- Top Picks: Kuala Lumpur Kepong (KLK), IOI Corp (IOI) and Wilmar International (Wilmar). Malaysia’s palm oil (PO) inventory dropped 6.6% MoM in February due to the low output season, coupled with floods experienced in the key states. We expect PO stock levels to continue to decline in March as a result of low production as well as rising festive demand. As for sector earnings, we expect a QoQ decline in 1Q23, on the back of lower CPO ASPs and lower production in the off-peak season.

- The 4Q22 reporting season saw mixed earnings, with six planters booking above-expectation earnings, while five were in line, and two came in below. We make no changes to our CPO price assumptions of MYR3,900 and MYR3,500 for 2023 and 2024. The pure Indonesian planters saw earnings which were mostly above expectations due to the benefit of the tax-free levy period which distorted ASPs during the period.

- Output grew YoY in 4Q22. In Malaysia, we saw an average 4.1% YoY output growth for the companies we cover in 4Q22. Most planters expect a recovery in output in 2023 – ranging from mid-single digit to low double digits, on the back of an improved labour workforce. Labour shortages are expected to be fully resolved by 1H23. In Indonesia, we saw an average +12% YoY and -14% QoQ output growth for the companies we cover in 4Q22. The Association of Indonesian Palm Oil Producers’ (GAPKI) official 4Q22 numbers differed slightly – with an +11.4% YoY and +2.5% QoQ increase, bringing FY22 CPO growth to -0.1% YoY. For 2023, Indonesian planters are expecting a small single-digit recovery in production output.

- Downstream margins patterns differ. We continued to see decently high margins for Malaysian players in 4Q22, albeit, lower QoQ – given the tax advantage during the Indonesian tax levy holiday. However, margin for Indonesian downstream players remained weak in 4Q22 – albeit, better QoQ, again as a result of the tax levy. Going forward, with the reinstatement of the tax levy in mid-Nov 2022, we should see the reverse happening in 1Q23, where Malaysian counterparts would see lower downstream margin while Indonesian players enjoy greater profitability.

- Malaysia’s February output fell 9.4% MoM while exports slipped 2.0%, resulting in stocks falling to 2.12m tonnes (-6.6% MoM). While output normally picks up in March after two months of weak production, things may turn out differently this year as a lot of key states such as Sabah, Johor and Pahang have been experiencing floods for the past few weeks. Therefore, we may still see Malaysian PO stocks at lower levels at end- March, taking into account slightly stronger demand from Ramadan and Aidil Fitri as well as the impact of Indonesia’s domestic market obligation (DMO) policy and export quota suspension. Still, given the time it takes for major importing countries to run down their inventory before restocking again, we believe a larger pickup in demand is only likely to come in 2H23.

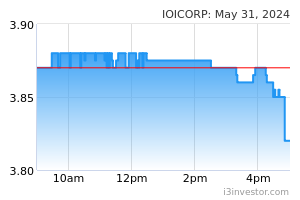

- Maintain NEUTRAL. We continue to advocate buying integrated players like KLK, IOI, Wilmar and Golden Agri, as they perform better in a lower CPO price environment.

Source: RHB Research - 13 Mar 2023