- D/G SELL from Neutral, with MYR0.14 TP, 32% downside. FY22 results missed expectations, with GDEX reporting another loss-making quarter due to softer volume loadings in the underperforming courier segment. We still believe challenges within the last-mile delivery space are likely to persist, with margins to remain under pressure due to the ongoing price war and softer demand as a result of the resumption of physical retail businesses. This report marks the transfer of coverage to Alexander Chia.

- Results missed expectations yet again. GDEX reported another loss- making quarter in 4Q22 of MYR6m, bringing full-year core losses to MYR18m, ie 20% below our and Street’s estimates. The negative deviation was driven by the underperforming courier services segment, which saw another loss of MYR6m in 4Q22 (3Q22: -MYR6.6m) on tight competition within the last-mile delivery landscape, which caused a drop in overall parcel volumes. On a YoY basis, full-year revenue was down 8.5%, primarily due to the softer volumes handled in the courier segment from new alternatives in the market. This is especially so in the e-commerce space, where merchants are unable to choose their preferred courier providers, ie “masking”. The increase in opex, due to the implementation of higher wage rates and IT expenses, also led to the core losses reported for this period.

- Unlikely to see a turnaround in the courier segment. The softening of online activities – a result of the resumption of physical retail businesses – entailed a further drop in volumes handled by GDEX for 2022. Furthermore, the emergence of new players in the courier landscape – especially e- commerce players with their own in-house logistics providers – will continue to be an issue for the group, in our view. We believe that challenges from stiff price competition amongst players, weak market sentiment, and lower demand will still persist. As GDEX continues to explore potential business opportunities, we think it is unlikely to cover the losses from the courier service segment in the near term.

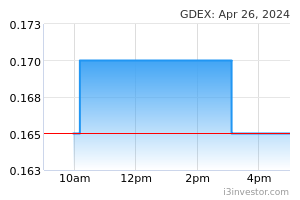

- We downgrade our call to SELL with an unchanged SOP-derived TP of MYR0.14. Our TP takes into account an ESG premium of 4%, given its ESG score of 3.2, which is above the country median.

- Key risks include changes in parcel delivery demand and ASPs, and lower- than-expected operating costs.

Source: RHB Research - 1 Mar 2023