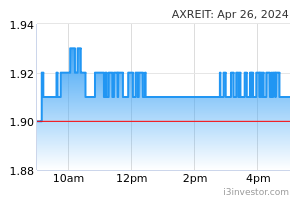

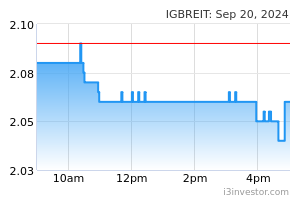

- Top Picks: Axis REIT and IGB REIT. M-REITs, being a defensive yield play, are becoming more attractive. The yield spread of the sector vs the Malaysian 10-year government bond (MGS 10YR) has recovered to +1SD from the historical mean. Retail REITs with assets that enjoy strong market positioning should remain stable next year. We remain cautious on the office segment as supply continues to grow, with limited catalysts for demand. Meanwhile, hospitality REITs should remain on a recovery path, as tourists increasingly return to the country. Maintain NEUTRAL on sector.

- Yield spread widened to 190bps. With the interest rate upcycle nearing an end, we think that the current 190bps yield spread between M-REITs vs MGS 10YR being at +1SD from the historical mean will be sustained. This is because the expectation of further rate hikes are already priced in, in our view. This makes the M-REIT sector a much more attractive yield play than it has been in the past year, as the bond yield has come off its peak of 4.6% at end-October to 4%, supported by encouraging improvements in earnings (FY23F EPU growth at 4% YoY).

- Retail to remain resilient. The retail segment remains considerably strong in 2H22 despite rising inflationary pressure and multiple rounds of interest rate hikes. Going into 2023, we think the momentum should be maintained, driven by festive seasons in 1Q23 and 2Q23. The prime retail assets held by the REITs under our coverage should remain hotspots for consumers generally. While rental reversion rates continued to range from flattish to low single digits in 2022 – partly to help tenants fully recover from the pandemic – we think that it could improve in 2023, following the strong retail sales growth in 2022.

- Hotel occupancy rates to continue improving. Similar to the retail indunstry, the increasing number of tourists since Malaysia reopened its borders has been a boost to the hotel segment. We are keeping an eye on China which recently loosened its zero-COVID policy, as a full reopening of its borders would be another catalyst to the segment’s recovery. According to Knight Frank, hotel occupancy rates were at 60% in August, although revenue per available room (RevPar) was still 28% lower from 2019 levels. An inhibiting factor will be the persistent labour shortage, which would prevent hotels from operating at optimum capacity.

- Lack of catalysts for offices. Overall vacancy rates for the segment should remain elevated, as supply continues to increase with limited reciprocation in demand. There is a strong interest in office buildings that are green-certified as companies put more emphasis on ESG issues. As such, we think that the downward pressure, particularly for older office assets, will remain as they struggle to compete with newer office buildings. Nevertheless, we prefer KLCCP Stapled (KLCCP) in this segment as its Grade-A office assets remain the exception to the rule, as its long-term lease structures should continue to be stable.

Source: RHB Research - 27 Dec 2022