- Stay NEUTRAL, new MYR0.20 TP from MYR0.29, 5% upside. Results missed expectations, as GDEX booked its first loss-making quarter – succumbing to a competitive landscape within the courier segment. Moving forward, we believe the headwinds prevalent within the last-mile delivery space will only be partly mitigated by volume growth from its new automated sorting hub – margins would continue to be under pressure due to the stiff price war in the last-mile delivery space and prolonged cost pressures.

- Results missed expectations. GDEX turned loss-making in 1Q22, reporting a MYR1.2m core loss vs a core profit of MYR5.5m in 3QFY21 and MYR8m in 6QFY21. Note: The FYE was changed to 31 Dec from 30 Jun last year. Generally, the negative deviation was on a weaker-than-expected performance of the courier services segment, which turned loss-making due to the competitive landscape. On a YoY basis, 1Q22 revenue declined by 13.2%, primarily due to the stiff competitive pricing within the courier services segment – attributable to new market entrants – which also likely led to subdued volumes of parcels handled. A 1Q22 core loss was reported on higher operating costs and effective tax rate. Similarly, in QoQ terms, 1Q22 revenue was down 12.2% due to the aforementioned reasons.

- Outlook. We expect demand for online activities to slow in tandem with the broader reopening of the economy and resumption of physical retail businesses. Additionally, challenges within the courier landscape – due to the stiff price competition among players and new entrants – are likely to persist. We also remain cognisant of cost pressures on the diesel and labour fronts exerting pressure on margins. Nevertheless, on the topic of expansion, the establishment of an automated sorting hub will see a significant increase in daily existing capacity to 350,000 parcels from 150,000 (target to go operational: 2H22). Despite the expected increase in volume of parcels handled, the competitive business environment could see lower ASPs needed to attract more customers and support utilisation rates. This will lead to lower margins, partially capping volume growth in our view.

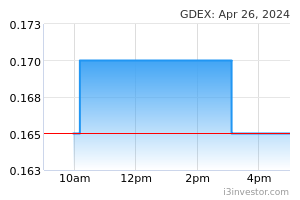

- We maintain our NEUTRAL call pending further clarity on strategies and cost controls during the results briefing on 26 May. We slash our FY22F- 24F earnings by 50-44%, expecting challenges within the last-mile delivery space to pose a risk to earnings growth moving forward. Despite the additional capacity that is expected to go operational by 2H22, we expect utilisation rates and ASPs to continue being under pressure and tweak our assumptions accordingly. Our TP drops to MYR0.20 – it includes a 4% ESG premium. The stock is currently trading at 41x FY23F P/E, which is around -0.5SD from the 5-year mean.

- Key risks include changes in parcel delivery demand and ASPs, and higher-/lower-than-expected operating costs.

Source: RHB Research - 25 May 2022