Previous Day Highlights

FBM KLCI continued to trend lower for the fifth consecutive days due to a lack of clear direction among investors. The benchmark index lost 0.09% or 1.31 points to close at 1,454.19. Losers were led by PETDAG, TENAGA and KLK. Market breadth was negative with 739 losers against 255 gainers while 307 were remain unchanged. Total volume stood at 4.63bn shares valued at RM3.95bn.

Key regional indices closed mixed despite the slight gains from Wall Street overnight. Nikkei225 advanced 0.08% to end at 27,445.56 while STI closed flattish at 3,262.63. Nonetheless, HSI declined 0.79% to finish at 19,785.94 whereas SHCOMP jumped 0.66% to close at 3,279.61.

Wall Street ended in negative territory as concerns over interest rate hike and inflation weighed on market sentiment. The DJIA was down 0.71% to end at 32,656.70, the S&P 500 decreased 0.30% to end at 3,970.15 and the Nasdaq weakened 0.10% to end at 11,455.54.

News For The Day

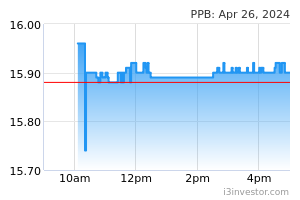

PPB Group FY22 net profit climbs to RM2.2bn

PPB Group Bhd’s FY22 net profit increased to RM2.20bn compared with RM1.50bn YoY. Revenue in FY22 rose to RM6.15bn versus RM4.65bn YoY, with all key segments recording improvement in revenue and profitability such as grains and agribusiness. -The Star

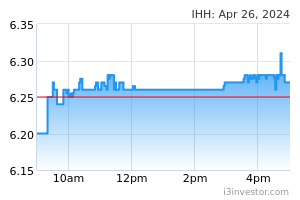

IHH FY22 net profit falls to RM1.55bn

IHH Healthcare’s FY22 net profit dropped 17% YoY to RM1.55bn compared with RM1.86bn, mainly attributed to impairment loss relating to the group’s asset and goodwill in China. Net operating income decreased 13% to RM1.4bn, while revenue rose to RM18.10bn from RM17.13bn YoY due to the strong recovery from core non-Covid-19 revenues. – The Star

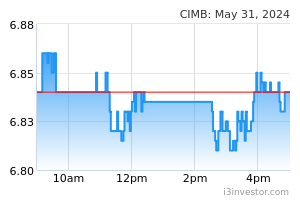

CIMB’s FY22 earnings jumps 27% on loan growth

CIMB Group Holdings’ FY22 net profit jumped 26.6% YoY to RM5.44bn versus RM4.29bn, on the back of stronger operating income from robust loan growth and net interest margin expansion. The stronger net profit was also attributed to stringent cost management, lower provisions from prudent risk management.. – The Edge Markets

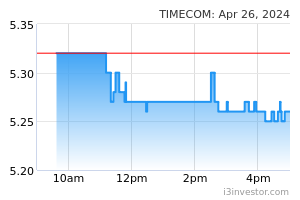

TIME's 4Q net profit up 12.6%, declares 14.69 sen dividend

TIME dotCom’s 4QFY22 net profit grew 12.57% YoY to RM122.24m from RM108.59m mainly due to higher recurring data revenue. Consolidated 4QFY22 revenue jumped 14.6% YoY to RM425.3m, compared with RM371.1m. TIME declared an ordinary interim of 12.33 sen and a special interim tax-exempt dividend of 2.36 sen per ordinary share, totalling FY22 dividend to 31.03 sen. -The Edge Markets

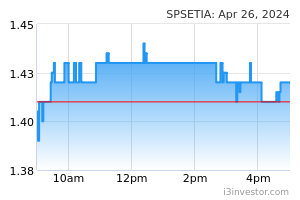

SP Setia's FY22 net profit rose 8.3% to RM308.09m

SP Setia Bhd's FY22 net profit rose 8.3% YoY to RM308.09m from RM284.37m on higher sales achieved in the year. The company exceeded its sales target for the year by RM110m to achieve RM4.11bn attributed to sustained demand for landed residential homes, the easing of foreign labour shortage for Malaysia and the reopening of international borders.-NST

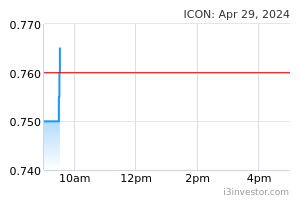

Hefty gain on rig sale lifts Icon Offshore 4Q net profit higher

Icon Offshore posted record 4Q and FY22 net profits after a hefty net gain of RM196.3m from the disposal of its sole jack-up rig. The oil and gas service provider’s 4QFY22 net profit was up by 32 times to RM153.6m from RM4.8m YoY. FY22 net profit rose by more than seven times to RM171.56m from RM22.7 m YoY. -The Edge Markets

Our Thoughts

Wall Street closed on a weak note as the latest economic data is showing weaker business confidence in the US. Following a volatile session, the DJI Average lost 232 points while the Nasdaq declined by 11 points with the US 10-year yield ended marginally higher at 3.93%. In Hong Kong, the HSI continued with its correction to end 157 points lower amid the heightened geopolitical tension that is curbing risk appetite. On the home front, the lack buying interests saw the FBM KLCI hovered within a tight range before closing slightly lower at just below the 1,455 level. Although there were some accumulations on banking stocks following the latest solid earnings reports, overall sentiment remained rather cold. We reckon the local bourse to remain stuck in a consolidation mode amid the uncertainties in the US hence expect the index to hover within the 1,450-1,460 range today. Amid the prevailing volatility, we would advocate investors to look at companies that offer solid dividend yields within the Banking, Gaming and Reits segment which are offering reasonable value proposition.

Source: Rakuten Research - 1 Mar 2023

To sign up for an account : http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity:http://bit.ly/3I5Jzxo