Previous Day Highlights

FBM KLCI ended marginally higher as investors stay sidelined while waiting for the 2nd tabling of Budget 2023. The benchmark index inched 0.04% or 0.55 points higher to close at 1,474.01 with gainer led by KLK, PCHEM and NESTLE. However, market breadth was negative with 620 losers against 316 gainers while 383 remained unchanged. Total volume stood at 3.38bn shares valued at RM1.85bn.

Key regional indices mostly ended on a weak note except SHCOMP which gained 0.49% to close at 3,306.52. Nikkei 225 and STI weakened 0.21% and 0.06% to close at 27,473.10 and 3,306.86 respectively. Meanwhile, HSI tumbled 1.71% to finish at 20,529.49.

Wall Street tumbled as broad-based selling amid more inflationary concerns. The DJIA slumped 2.06% to close at 33,129.59. Meanwhile, S&P500 and Nasdaq fell by 2.00% and 2.50% to end at 3,997.34 and 11,492.30 respectively.

News For The Day

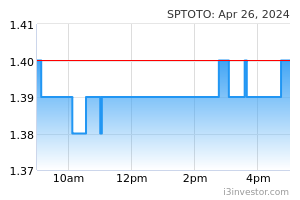

Sports Toto 2Q net profit jumps 21.8% to RM64.8m

The group’s 2QFY6/22 net profit jumped 21.8% YoY to RM64.8m against RM53.3m. Its recorded RM1.4bn revenue in 2QFY6/22, marking an increase of 13.1% YoY over the revenue of RM1.2bn. SToto said the improvement in its result was mainly due to the improved performance of its principal subsidiary-The Star

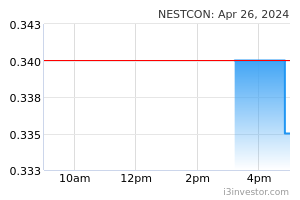

Nestcon wins RM154m construction contract

Nestcon’s wholly-owned subsidiary, Nestcon Builders has secured a RM154m construction contract from Solaris Ceria SB. Nestcon said the contract was for the construction of 1 block of 52-storey office suites and serviced apartments at Mont Kiara, Kuala Lumpur. The project is expected to be completed on or before Feb 28, 2026. -The Star

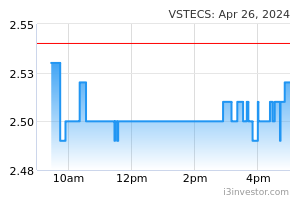

VSTEC's earnings down 9% in 4Q, declares 3.7 sen dividend

VSTECS posted its 4QFY22 net profit of RM18.25m, down 8.6% YoY from RM19.82m due to lower consumer information and communications technology (ICT) spending. VSTECS also declared a second interim dividend of 3.7 sen per share, payable on May 16, 2023. To-date, total dividends of 6.2 sen per share representing a payout ratio of 37% has been declared in FY22. -The Edge Markets

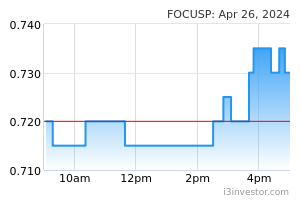

Focus Point achieves record earnings in FY22

Focus Point Holdings has proposed to undertake a bonus issue of up to 132m shares on the basis of two bonus shares for every five existing shares. Focus Point’s 4QFY22 net profit rose 12.5% YoY to RM10.45m from RM9.29m driven by higher revenue from its optical and related products segment, best full-year net profit and revenue since its listing in 2010.–The Edge Markets

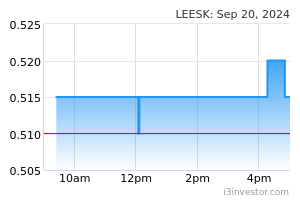

Lee Swee Kiat Group ends FY22 with record revenue, profit

Underpinned by stronger domestic sales, Lee Swee Kiat Group (LSK)’s 4QFY22 net profit more than doubled to RM3.8m from RM1.63m YoY. It declared an interim dividend of 3.5 sen per share, amounting to approximately RM5.65m. LSK warned of the current weak demand from overseas markets, as a result of high global inflation and interest rates. - The Edge Markets

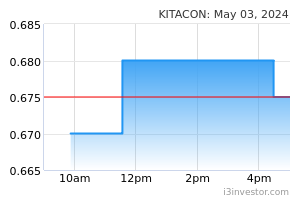

Kumpulan Kitacon posts RM41.9m FY22 net profit

KKB reported a FY22 net profit of RM6.65m on revenue of RM137.65m, while basic earnings per share stood at 1.33 sen. KKB’s total outstanding order book of approximately RM1.2bn is expected to sustain the group’s earnings and cash flow contribution for the next two years. -The Star

Our Thoughts

Wall Street tumbled as the ugly reality of inflation finally hit US equities instigating a broad-based selling with the US 10-year yield hitting above 3.95%, the highest level since November 2022. As a result, the DJI Average dived almost 700 points while the Nasdaq lost 295 points. Over in Hong Kong, the HSI closed almost 360 points lower as the market enters into a correction. Overall sentiment remains fragile as expectations of a strong recovery from China wanes. Corporate earnings are also in focus as intensifying competition amongst the Chinese companies may see erosion of margins. On the home front, the FBM KLCI ended flat amid some buying on Plantation stocks supported by recent recovery in CPO price. As sentiment had turned cautious as regional volatility heightens, we expect the index to trend within the 1,470-1,480 range today. In view of the spike in the US yields, we suspect tech stocks to face with strong headwinds today. Oil & Gas stocks may also see some selling pressure as the higher yields and stronger US$ had put pressure on crude prices with the Brent crude now hovering below the US$83/barrel.

Source: Rakuten Research - 22 Feb 2023