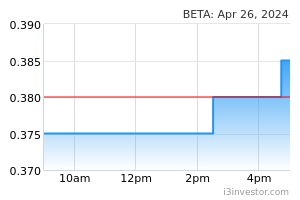

Electronics manufacturing services (EMS) provider Betamek Bhd has secured a RM123.5 million contract to supply various electronics parts for a new Perodua model. On February 13, the company's wholly-owned subsidiary Betamek Electronics (M) Sdn Bhd (BESB) received a letter of appointment (LOA) from Perusahaan Otomobil Kedua Sdn Bhd (Perodua). (NST)

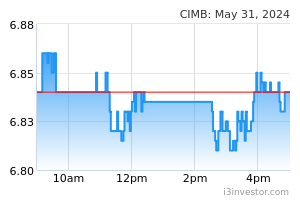

CIMB Bank Bhd has onboarded Intercontinental Specialty Fats Sdn Bhd (ISF) as the latest client in the bank's sustainability-linked treasury programme. ISF's participation in the programme is the first by a Japanese and foreign multinational corporation (MNC) in Malaysia. (NST)

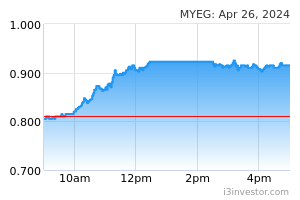

MY E.G. Services Bhd (MYEG) has announced that vehicle owners and drivers can continue renewing road taxes and driving licenses as usual through its existing channels. MyEG said the services now came with the added flexibility for users to forgo receiving physical copies of their documents. (NST)

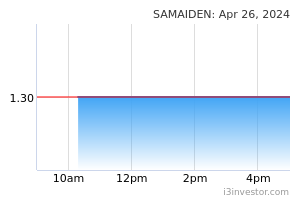

Samaiden Group Bhd's wholly owned subsidiary Samaiden Sdn Bhd (SSB) has received two notices of arbitration from Ditrolic Sdn Bhd concerning claims for two work packages worth a combined RM12.21 million. In a filing to Bursa Malaysia, the Ace Market-listed company said SSB had been appointed as a subcontractor for the work packages, which were part of a 100 megawatt alternating current large scale solar photovoltaic plant project in Kerian, Perak. (TheEdge)

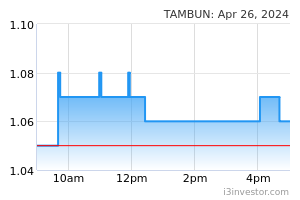

Tambun Indah Land Bhd was the second biggest loser on Bursa Malaysia in Tuesday (Feb 14) morning trade, shedding as much as 11 sen or 11.58%, after it announced that its net profit for the fourth quarter ended Dec 31, 2022 (4QFY2022) fell by 57.44% from a year ago. At 9.50am, the counter had pared some losses to settle 10 sen or 10.53% lower at 85 sen a share, from 95 sen on Monday. (TheEdge)

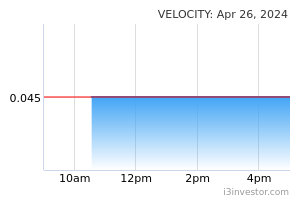

CSH Alliance Bhd’s share price dipped 30% to 4.5 sen on Tuesday morning (Feb 14), from the last closing price of 6.5 sen, after the company announced the disposal of its electric vehicle (EV) distributor Alliance EV Sdn Bhd for RM20 million cash to glove maker Hong Seng Consolidated Bhd. CSH Alliance opened at 5.5 sen a share on Tuesday, before dipping to 4.5 sen as at 9.11am. At the time of writing, its trading volume stood at 41.64 million shares. (TheEdge)

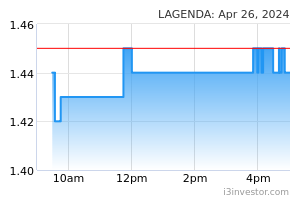

Lagenda Properties Bhd, via its 70%-owned indirect subsidiary Lagenda Mersing Sdn Bhd, has purchased a piece of land worth RM398.2mil in Kulai, Johor. In a filing with Bursa Malaysia, the company said it acquired the 1,075-acre land from Seriemas Development Sdn Bhd, a wholly-owned subsidiary of Permodalan Nasional Bhd. (TheStar)

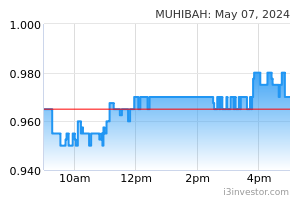

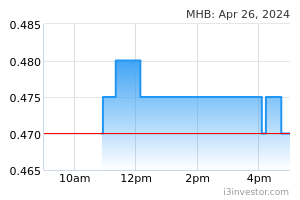

Muhibbah Engineering (M) Bhd (MEB) has won a construction job in Penang worth RM172.6mil from the Penang Development Corp. In a filing with Bursa Malaysia, MEB said the job will entail the development of a nine-storey office building and factory; a six-storey parking building with a TNB sub-station (and its mechanical requirements); as well as a normal waste depot, office waste depot and recycling room. (TheStar)

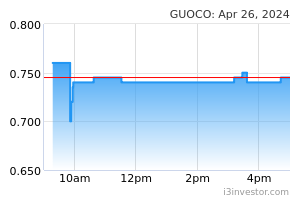

Guocoland (M) Bhd will continue to focus on monetising its inventories and progressing its development projects for timely completion. In a filing with Bursa Malaysia, the property developer said new product launches will be phased according to prevailing market conditions. (TheStar)

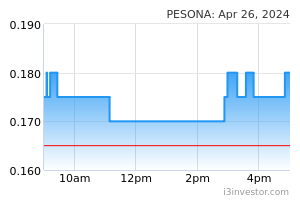

Construction firm Pesona Metro Holdings Bhd’s (PMHB) wholly-owned subsidiary Lumayan Metro Sdn Bhd (LMSB) has inked a turnkey agreement with developer Danau Lumayan Sdn Bhd (DLSB) to plan, design and build 3,438 units of Residensi Wilayah over two phases, in a deal worth RM948.1mil. The Residensi Wilayah, used to be known as Rumawip, is a government initiative to provide affordable housing for first-time buyers in the Federal Territory. (TheStar)

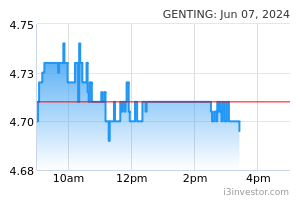

Local gaming titan Genting Bhd’s rating of Baa2 has been affirmed by Moody’s Investors Service, which has also posted the same rating for Genting’s associate company Genting Overseas Holdings Ltd (GOHL). Subsidiary Genting Singapore (Ltd), meanwhile, has received the A3 issuer rating, which is two notches higher than the Baa2, itself being the ninth highest in Moody’s Long-term Corporate Obligation ranking. (TheStar)

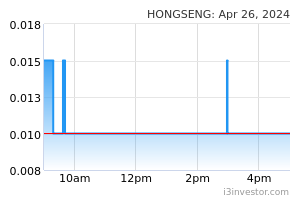

Hong Seng Consolidated Bhd has proposed to acquire Alliance EV Sdn Bhd (AEV), the electric vehicle (EV) business arm of CSH Alliance Bhd for RM20mil. In a filing with Bursa Malaysia, Hong Seng said it entered into a shares sale agreement (SSA) with CSH to undertake the proposed acquisition of five million ordinary shares in AEV, representing the entire issued share capital in AEV. (TheStar)

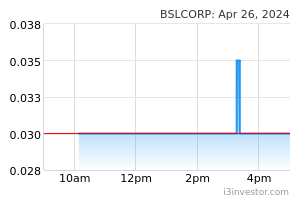

BSL Corp Bhd's latest renounceable rights issue may yield returns that are more than double than its issued price, an industry observer said. BSLCorp is undertaking a renounceable right issue of 12 rights shares with five free warrants for every two existing shares at the issue price of 5.5 sen each. (NST)

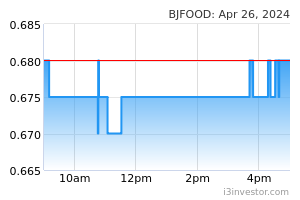

Berjaya Food Holdings Bhd's (BFood) outlook remains robust backed by the renowned Starbucks brand equity and opportunity from the expected Chinese tourists with the reopening of its border. Hong Leong Investment Bank Bhd (HLIB) said it lauded BFood's stable performance despite the headwinds faced. (NST)

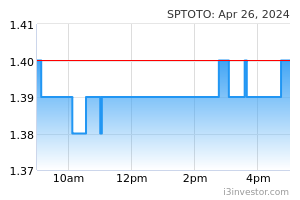

Sports Toto Bhd is expected to register a slight improvement in its lotto operations for the upcoming second quarter (Q2) financial year 2023, said Affin Hwang Capital. This is on the back of a higher number of draw days quarter-on-quarter (qoq) (i.e 46 draws from 42 draws in Q1 FY23) despite sales per draw likely to be flattish and lag 15 per cent below pre-pandemic levels. (NST)

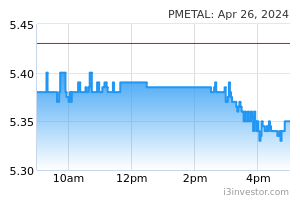

Kenanga Research has maintained its “outperform” rating on Press Metal Aluminium Holdings Bhd at RM5.15 with a higher target price of RM6.30 (from RM5.50) and said that year-to-date, aluminium prices have risen 6% to above US$2,500/MT, buoyed by the reopening of China which is the largest global aluminium consumer. (TheEdge)

Analysts are generally more positive on Malaysia Marine & Heavy Engineering Bhd’s (MMHE) outlook after it turned the corner in financial year 2022 (FY22). The oil and gas (O&G) services group had posted a net profit of RM9.8mil in FY22 as compared to a RM263.2mil net loss in FY21. (TheStar)

Source: New Straits Times, The Edge Markets, The Star 14 Feb 2023

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077