Malaysia Marine and Heavy Engineering Holdings Bhd (MHB) has returned to the black in the third quarter (Q3) ended Sept 30, 2022 with a net profit of RM15.95 million from a net loss of RM23.88 million a year ago. MHB's revenue increased 5.1 per cent to RM409.23 million from RM389.29 million previously. For the nine-month period, the company registered a net profit of RM40.63 million from a net loss of RM162.61 million, while revenue increased 18.6 per cent to RM1.23 billion from RM1.04 billion. (NST)

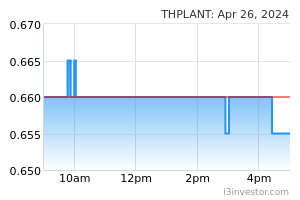

TH Plantations Bhd’s net profit dropped 46.4% to RM14.37 million for the third quarter ended Sept 30, 2022 (3QFY2022), from RM28.81 million last year, as a result of a fair value loss on biological assets. According to TH Plantations’ filing on Thursday (Nov 10), the oil palm planter logged a fair value loss on biological assets of RM7.24 million, as compared to a fair value gain of RM16.55 million in 3QFY2021. Earnings per share dropped to 1.13 sen from 3.03 sen. (TheEdge)

ITMAX System Bhd has inked an underwriting agreement wtih Maybank Investment Bank Bhd, CIMB Investmet Bank Bhd and AmInvestment Bank Bhd en route to its listing on the Main Market of Bursa Malaysia. The group, which is principally involved in the supply and installation and provision of public space networked systems, said the initial public offinerg (IPO) involves an offer for sale of 129.45 million shares and a public issue of 190.55 million shares. (TheStar)

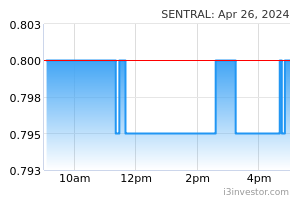

Sentral REIT's net property income for the third quarter ended Sept 30, 2022 (3QFY22) declined 12.5% to RM28.4 million, from RM32.47 million a year earlier. Earnings per unit decreased to 1.7 sen in 3QFY22, from 2.06 sen in 3QFY21, the real estate investment trust (REIT) said in a filing with Bursa Malaysia. (TheEdge)

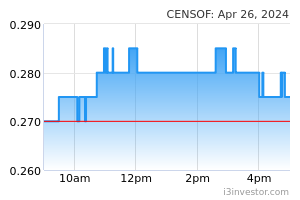

Censof Holdings Bhd's wholly-subsidiary Century Software (M) Sdn Bhd has secured a RM7.93mil contract from the Ministry of Entrepreneur Development and Cooperatives for the maintenance of hardware and software for the Business Licensing Electronic Support System. It said in a filing with Bursa Malaysia the project is for a duration of 36 months from Nov 15, 2022, to Nov 14, 2025 with no option for extension or renewal upon expiry. (TheStar)

Open a trading account (free) to trade local and SG Market: Click here

Discover how to get RM100 cashback: Chat with us

ATTA Global Group Bhd's wholly-owned subsidiary Park Avenue Construction Sdn Bhd has entered into three separate sales and purchase agreement to acquire three adjoining lots of land amounting to 260,988 sq ft in Barat Daya, Pulau Pinang, for RM28mil. it said in a filing with Bursa Malaysia the purchase consideration will be satisfied via the issuance of 114.29 million new shares in Atta at an issue price of 24.5 sen apiece. (TheStar)

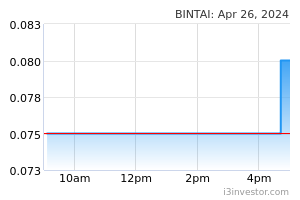

Bintai Kinden Corp Bhd's sub-subsidiary Johnson Medical International Sdn Bhd (JMI) has made its foray into the telco business via a venture with MN Permai Netcom. In a statement, the engineering services specialist said JMI will market telecommunications services to the Ministry of Health or any private hospital provided by MN Permai, which will be involved in sales as well as the installation of the services. (TheStar)

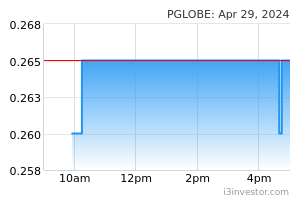

Paragon Globe Bhd’s wholly-owned subsidiary Paragon Business Hub Sdn Bhd has proposed to acquire a tract of freehold land in Plentong, Johor, measuring about 42ha, for RM71.5mil. In a filing with Bursa Malaysia yesterday, Paragon Globe noted the land deal will be funded with a combination of internally generated funds, bank borrowings and equity fundraising. (TheStar)

Southern Score Builders Bhd has completed its regularisation plan which involves, among others, the acquisition of Southern Score Sdn Bhd (SSSB), a G7 contractor. Southern Score was formerly a Guidance Note 3 (GN3) company. In a statement today, the company said following the acquisition, it would be involved in the provision of construction management services mainly for high-rise residential buildings. (NST)

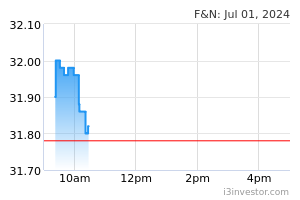

Fraser & Neave Holdings Bhd's (F&N) earnings for financial years 2023 and 2024 have been revised downward. Kenanga Research revised down F&N's earnings forecasts for FY23 and FY24 by three per cent and five per cent respectively. The revision was on account of higher depreciation cost due to FY23 capital expenditure of RM700 million., the firm said. (NST)

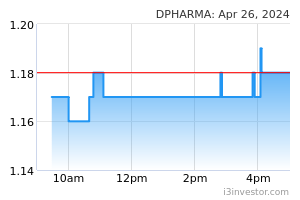

Duopharma Biotech Bhd's nine-month 2022 (9M22) results have exceeded expectations on robust performance from the ethical classic segment, said RHB Research. The firm said Duopharma Biotech had delivered core earnings growth of 67 per cent year on year (yoy) in the third quarter (Q3) 2022 at RM27.5 million, bringing 9M22 core earnings to RM103.7 million, exceeding the firm's and consensus' full-year estimates by 34 per cent and 20 per cent. (NST)

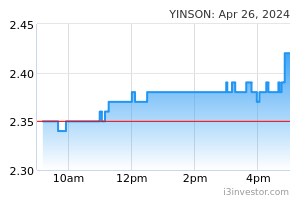

CGS-CIMB Securities has maintained its “add” rating of Yinson Holdings Bhd at RM2.11, with a higher target price (TP) of RM3.34, and said it sees the energy infrastructure and technology company bagging Eni SpA’s Agogo floating production, storage and offloading (FPSO) charter contract. In a note on Wednesday (Nov 9), the research house said the award of the Agogo charter contract, likely in December, is a key potential rerating catalyst for Yinson. (TheEdge)

PublicInvest Research has initiated coverage of ECA Integrated Solution Bhd (ECA) at 17 sen with an “outperform" rating and target price of 32 sen based on 16x FY23 EPS. In a note on Thursday (Nov 10), the research house said ECA is riding on the positive spillover effects in terms of the relocation of industries from China and the US to this region in order to minimise future risks arising from increased US-China tensions. (TheEdge)

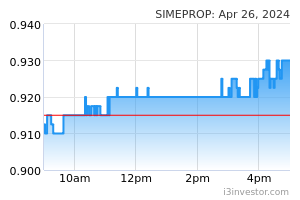

RHB Retail Research said Sime Darby Property Bhd is likely to resume its recent bullish reversal since it inched upwards to reclaim the area above the previous breakout level of 45.5 sen on Wednesday (Nov 9), firming up the “higher low” bullish pattern above the 21-day average line. In a trading stocks note on Thursday, the research house said it expects renewed buying interest to emerge above that level in the coming sessions, propelling it towards the recent high of 48.5 sen, followed by the next resistance point of 52 sen or the high of June 1. (TheEdge)

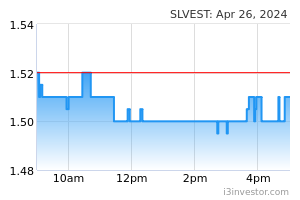

RHB Retail Research said Solarvest Holdings Bhd is set for an uptrend reversal after it bounced off strongly from the 21-day average line on Wednesday, surpassing the previous resistance of 73 sen. In a trading stocks note on Thursday (Nov 10), the research house said that coupled with a “higher high” bullish structure (due to the pickup in trading volume), it expects the bulls to propel the stock towards Sept 28’s high of 76 sen, followed by the 80 sen threshold. (TheEdge)

Source: New Straits Times, The Edge Markets, The Star 10 Nov 2022

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.