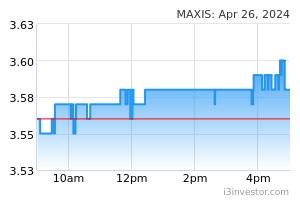

Maxis Bhd's net profit for the third quarter ended Sept 30, 2022 (3QFY22) dropped 3.1% to RM315 million from RM325 million a year ago, due to a one-off increase in corporate tax rate to 33% as a result of prosperity tax. Quarterly revenue grew 5.9% to RM2.41 billion from RM2.27 billion in 3QFY21, driven by a 3.7% higher contribution from its service revenue. Its earnings per share (EPS) dropped to four sen from 4.2 sen previously, according to a Bursa Malaysia filing. (TheEdge)

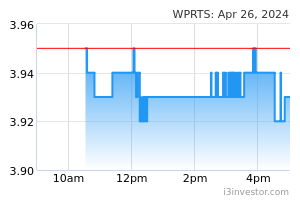

Westports Holdings Bhd's net profit for the third quarter ended Sept 30, 2022 fell 24% year-on-year (y-o-y) to RM150.39 million from RM199.06 million, mainly due to higher fuel cost and a one-off sundry income in last year's third quarter. In a Bursa Malaysia filing on Friday (Nov 4), the port operator said revenue for the quarter rose to RM520.54 million from RM504.89 million a year ago, on the back of the growth in conventional revenue. (TheEdge)

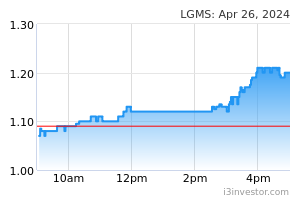

LGMS Bhd has won another award, this time the Asian Oceanian Computing Industry Organisation (ASOCIO) Tech Excellence Award for Cybersecurity. According to a statement by the National Tech Association of Malaysia (PIKOM), the awards are given to deserving individuals and organisations that have contributed outstanding technology solutions and services. (NST)

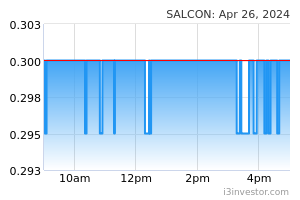

Water and wastewater engineering firm Salcon Bhd has inked an agreement with Appraisal Property Management Sdn Bhd (APM) to provide transportation services for the employees of APM to its clients' sites. In a Bursa Malaysia filing, Salcon said its wholly owned subsidiary Eco-Coach & Tours (M) Sdn Bhd has entered the agreement with APM, with the job commencing on March 1, 2023 until Dec 31, 2026. APM's principal activity is to carry out property or facilities management services. (TheEdge)

Automated manufacturing solutions provider ECA Integrated Solution Bhd, en route for a listing on Bursa Malaysia’s ACE Market on Nov 23, 2022, expects to raise RM25.5 million from its initial public offering (IPO). Executive director cum chief executive officer Ooi Chin Siew said of the IPO proceeds, RM7.7 million (30.2 per cent) would be used for the acquisition of machinery to augment its technical capabilities and to cater for higher production output. (TheStar)

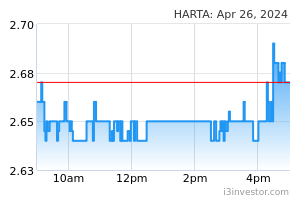

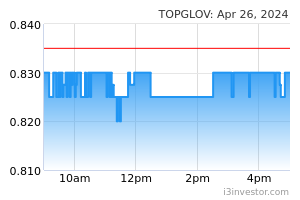

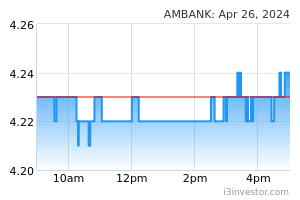

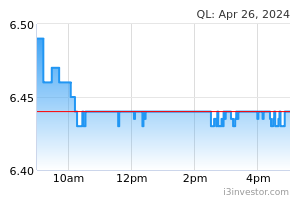

Hartalega Holdings Bhd and Top Glove Corp Bhd could be replaced by AMMB Holdings Bhd and QL Resources Bhd in the upcoming KLCI constituents review for December, said CGS-CIMB Securities Sdn Bhd. In a note today, the research firm said that based on Refinitiv market data at the close of trading on Nov 1, 2022, Hartalega ranked 39th in market capitalisation, while Top Glove ranked 42nd. (TheStar)

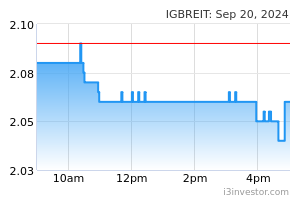

IGB Real Estate Investment Trust (IGB REIT), which has put in a strong earnings performance so far this year, could see profits begin to normalise from the coming quarter as the low base effect dissipates. The REIT, which posted a 9MFY22 net profit of RM252.2mil or nearly double the amount of the previous corresponding period, attributes its strong year-on-year growth figures to an earnings rebound following the Covid-19 transition to Phase 4 of the national recovery plan on Oct 18, 2021. (TheStar)

Kitchen cabinet manufacturer Signature International Bhd (SIB) is proposing to acquire Singapore’s Corten Interior Solutions Pte Ltd and Areal Interior Solutions Pte Ltd (Areal) for S$47.8mil (RM160.48mil). In a filing with Bursa Malaysia yesterday, SIB said it had entered into a conditional share sale agreement (SSA) with Lim Leng Foo to acquire 1.5 million ordinary shares or 75% equity interest in Corten for S$45mil (RM151.08mil). (TheStar)

Plantation giant Kuala Lumpur Kepong Bhd is considering raising its stake in British chemicals company Synthomer Plc as it looks to further expand its specialty chemicals business globally, two sources told Reuters. Kuala Lumpur Kepong is talking with at least one financial adviser to explore potentially boosting its 26.3% stake in Synthomer, said the sources with knowledge of the matter. (TheEdge)

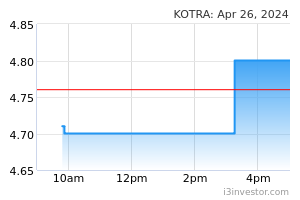

HB Research expects Kotra Industries Bhd to book a revenue compounded annual growth rate (CAGR) of nine per cent over the financial years 2023 (FY23) to FY25, premised on resilient demand for its nutraceutical products and a gradual pick-up in export sales. The research firm said that as export sales are denominated in US Dollar (USD) terms, this enables Kotra to capitalise on the strengthening USD. (NST)

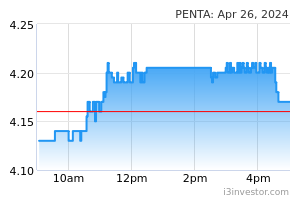

Pentamaster Corp Bhd latest nine months of 2022 (9M22) net profit of RM59.7 million has come below CGS-CIMB Research expectations. The research house said Pentamaster's 9M22 revenue rose 17 per cent year-on-year (YoY) to RM453 million, mainly driven by higher automated test equipment (ATE) sales from the automotive segment, which jumped 2.8 times YoY to RM185 million. (NST)

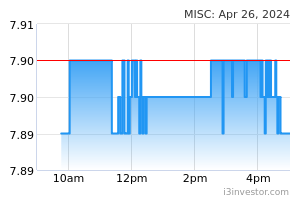

RHB Investment Bank Research has maintained its “buy” rating on MISC Bhd at RM7.12 with a higher target price (TP) of RM8.04 (from RM7.79) and said it was positive on the additional five LNG carrier charter contracts secured by MISC’s four-party consortium with other established Asian shipping companies, which should increase its recurring income base. (TheEdge)

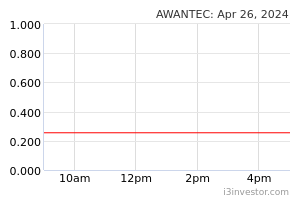

RHB Retail Research said AwanBiru Technology Bhd is poised to resume its uptrend as it bounced off the 21-day average line while attempting to surpass the 50 sen level on Thursday (Nov 3). In a trading stocks note on Friday, the research house said that if a breakout happens above that level, the stock may propel higher towards the recent high of 53.5 sen, or Oct 25’s high, followed by the 60 sen threshold. (TheEdge)

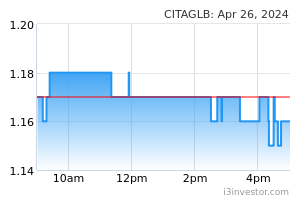

RHB Retail Research said Citaglobal Bhd is set to propel towards its four-year high as it surpassed the 28.5 sen immediate resistance on Thursday (Nov 3), forming a “higher high” bullish structure. In a trading stocks note on Friday, the research house said that coupled with the long bullish candlestick printed on Thursday, the stock will likely see buying interest persisting towards the 30.5 sen resistance, or the highest level since May 2018, followed by the next resistance level at the 35 sen threshold. (TheEdge)

Source: New Straits Times, The Edge Markets, The Star 4 Nov 2022

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.