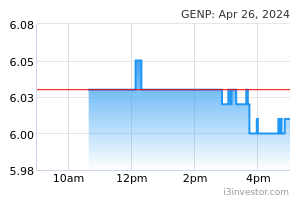

Kelington Group Bhd's latest RM330 million job win is one the company's largest non-turnkey awards which typically yield better margins, Kenanga Research said. The firm said including the recent job win, Kelington had surpassed its replenishment forecast to mark a new record of RM1.28 billion against FY21 of RM1.19 billion which included a large turnkey project. (NST)

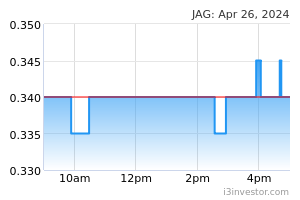

JAG Bhd’s wholly-owned subsidiary, JAG Land Sdn Bhd, has entered into a sale and purchase agreement to acquire a 12½-storey office building with two levels of basement car park located in Taman Desa, Kuala Lumpur from Menara ABS Bhd for a total purchase price of RM35.28mil. In a filing with Bursa Malaysia yesterday, JAG said the acquisition is meant for investment purposes with the aim to create a new stream of recurring income contribution for the group. (TheStar)

Genting Plantations Bhd has invested in a joint control stake in Green World Genetics Sdn Bhd (GWG). In a statement on Tuesday (Sept 6), Genting Plantations said the investment underpins a joint collaboration between it and GWG to establish Malaysia as an important regional seed hub and beyond that, to address the issue of national food security through the development of new crop varieties. (TheEdge)

Cycle & Carriage Bintang Bhd (CCB) has submitted an application to Bursa Malaysia Securities Bhd for the proposed withdrawal of its listing on Bursa Malaysia Securities. In a filing with Bursa Malaysia today, the Mercedes-Benz dealer said the submission was made following the closing of the unconditional voluntary take-over offer by Jardine Cycle & Carriage Ltd (Jardine CCL), which owns an 89.99 stake (90.66 million shares) in CCB on Aug 25. (TheStar)

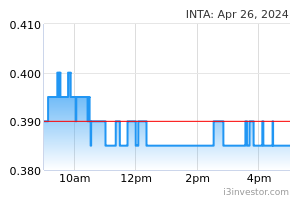

Inta Bina Group Bhd’s unit, Inta Bina Sdn Bhd, has received a RM146mil contract from Eco Ardence Sdn Bhd to undertake construction works on its project. The contract requires Inta Bina to design and construct the main building works for the Hana Service Apartment, it said in a filing with Bursa Malaysia yesterday. (TheStar)

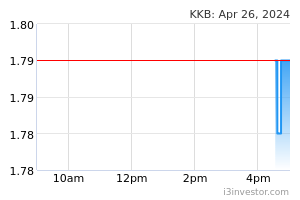

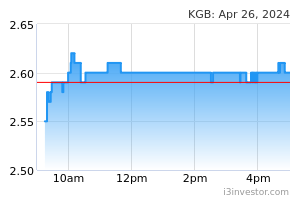

KKB Engineering Bhd has received a work order for structural steel works at a proposed glove factory in Petchem Industrial Park in Tanjung Kidurong, Bintulu. In addition, it said it had received a purchase order for C14 RQ cylinders and a C14 compact valve from MyGaz Sdn Bhd. In a filing with Bursa Malaysia, the group said the contracts have a total value of RM17mil, are are expected to be completed by the second quarter of 2023. (TheStar)

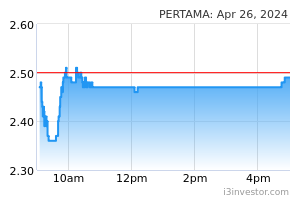

Pertama Digital Bhd, via subsidiary Dapat Vista (M) Sdn Bhd, is targeting to recirculate up to 18.2 million pieces of unused coins yearly to complement the nation's shift to a cashless society. Uncirculated coins have led Bank Negara Malaysia to spend additional funds to mint new coins for circulation into the economy every year. (NST)

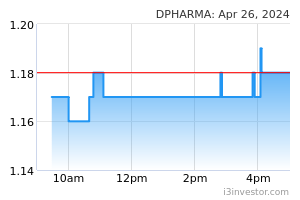

Duopharma Biotech Bhd's consumer healthcare (CHC) will be a more meaningful revenue and earnings driver over the medium term, given the structural demand growth and the company's strong brand recognition, CGS-CIMB Research said. According to Duopharma's results briefing yesterday, the firm said CHC's revenue had risen marginally year-on-year (YoY) to RM81 million (22 per cent of total) in the first half (1H) FY22, with flattish sales month-on-month (MoM) into July-August 2022. (NST)

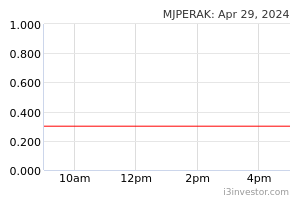

Majuperak Holdings Bhd has clarified that the garden leave accorded to its outgoing group chief executive officer (CEO)-cum-executive director, Nizran Noordin is based on a mutual agreement between its board and Nizran himself. Majuperak said Nizran’s leave would commence on Sept 2, 2022 to clear his leave balance before his contract ends on Oct 31, 2022. (TheStar)

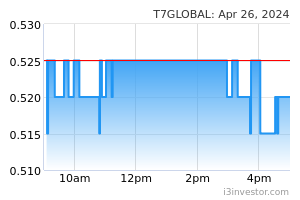

T7 Global Bhd has set an annual revenue target of RM500mil to be achieved in the coming years, said newly appointed group CEO Tan Kay Zhuin. "Since the inception of T7 Global, we have invested in building on a successful working model and in-house capabilities to support our businesses. (TheStar)

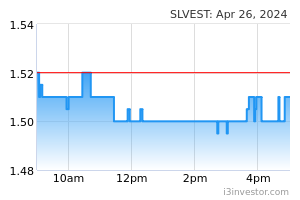

Solarvest Holdings Bhd has established a subsidiary, Vestech Energy Sdn Bhd, to focus on providing solar solutions to the residential segment in an effort to enhance solar adoption rate among homeowners. In a statement on Tuesday (Sept 6), Solarvest said through Vestech, it has launched six EcoHome solar plans tailored for landed house homeowners with average monthly electricity bills starting from RM300 and above. (TheEdge)

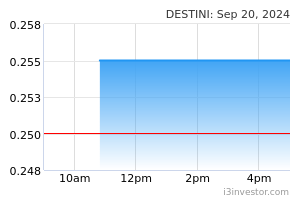

Shares in Destini Bhd fell 21.05% in morning trade on Tuesday (Sept 6), despite the company having denied that it has been classified as a Practice Note 17 (PN17) company or that it was set to be delisted on Monday. At 9.40am, Destini had fallen two sen to 7.5 sen, with 8.92 million shares traded. (TheEdge)

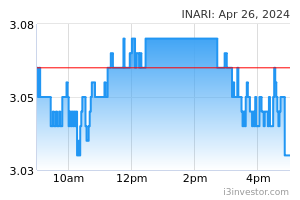

PublicInvest Research has maintained its “outperform” rating of Inari Amertron Bhd at RM2.66, with a target price (TP) of RM4.13, and said despite seeing flattish growth in radio frequency (RF) components, the group is expecting to see FY23 sales growth coming from: i) fibre transceiver modules; ii) high-power LED packages for the optical communications, automotive and industrial segments; and iii) system-on-modules (SOMs). (TheEdge)

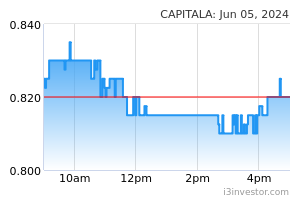

Hong Leong Investment Bank (HLIB) Research said while the recovery outlook for the aviation sector seems promising, the lingering concern over Capital A Bhd’s PN17 status remains a sentiment dampener. In a technical tracker on Tuesday (Sept 6), the research house said it gathered that the regularisation plan is currently being finalised and will be submitted to Bursa Malaysia soon (deadline: January 2023), and HLIB is hopeful about Capital A’s restructuring plan as the management has managed to convince auditor E&Y on the group’s cash flow ability for the next two years. (TheEdge)

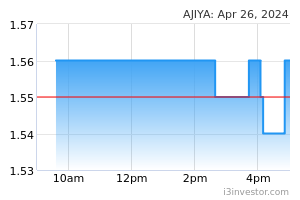

RHB Retail Research said Ajiya Bhd is set to resume its uptrend after surpassing the consolidation level of RM1.14 on Monday, on surging trading volume. In a trading stocks note on Tuesday (Sept 6), the research house said that as the stock also bounced off the 21-day average line to form a “higher high” bullish pattern, this would indicate that the initial strong buying momentum will push the stock towards the RM1.21 resistance, followed by RM1.26, its year-to-date high. (TheEdge)

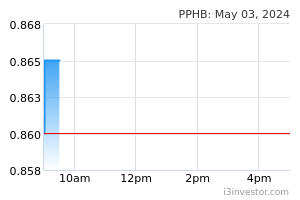

RHB Retail Research said Public Packages Holdings Bhd is set to print a new 52-week high after breaching the 61.5 sen immediate resistance on improved trading volume on Monday, forming a “higher high” bullish pattern above the 21-day average line. In a trading stocks note on Tuesday (Sept 6), the research house said if the breakout is sustained, the uptrend may take the stock to the next resistance level of 70.5 sen, which is also May 10, 2021’s high, followed by 73 sen (the high of May 5, 2021). (TheEdge)

Source: New Straits Times, The Edge Markets, The Star 6 Sep 2022

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.