Alliance Bank Malaysia Bhd's net profit for the first quarter ended June 30, 2022 (1QFY23) climbed 45% to RM212.16 million from RM146.01 million a year earlier, driven by higher net interest income and lower allowance for expected credit losses. Earnings per share rose to 13.7 sen from 9.43 sen, its Bursa Malaysia filing on Tuesday (Aug 30) showed. No dividend was declared for the quarter under review. (TheEdge)

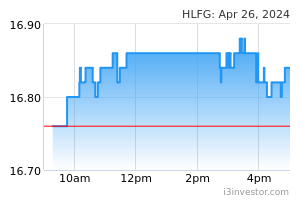

Hong Leong Financial Group Bhd's (HLFG) net profit rose 8.3 per cent to RM2.5 billion for the financial year ended June 30, 2022 (FY22) from RM2.3 billion last year due to a higher contribution from the commercial banking division. The group's revenue rose to RM6.3 billion in FY22 from RM6.2 billion last year. Net income from its Islamic banking and Takaful businesses for the period was RM991 million, slightly lower by 0.4 per cent year-on-year (YoY). (NST)

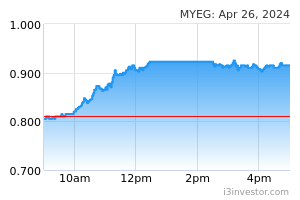

MyEG Services Bhd’s net profit rose 10.38% to RM88.64 million or 1.2 sen per share in the second quarter ended June 30 (2QFY22) from RM80.68 million or 1.1 sen per share a year earlier. This was due to the resumption of full operations of its e-service centres nationwide, said the electronic government solutions and services provider. (TheEdge)

Malaysia Smelting Corp Bhd's (MSC) net profit jumped 13.5 times to RM39.5 million in the second quarter (Q2) ended June 30, 2022, from RM2.9 million a year ago. The tin miner and metal producer said revenue also rose 25 per cent to RM408.8 million in Q2 2022 from RM327.1 million last year. (NST)

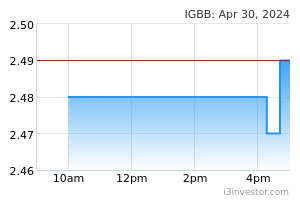

Property firm IGB Bhd posted a net profit of RM49.79 million for the second quarter ended June 30, 2022 (2QFY22) versus a net loss of RM5.28 million a year before, bolstered by higher contribution from all operating divisions after the country transitioned into the endemic phase of Covid-19 with all restrictions on business operating hours removed and standard operating procedures relaxed. (TheEdge)

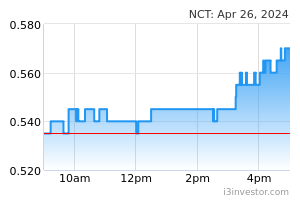

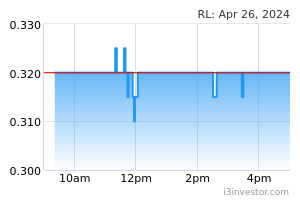

NCT Alliance Bhd's net profit for the second quarter ended June 30, 2022 (2QFY22) rose 17% to RM11.1 million from RM9.48 million a year earlier, mainly contributed by its ongoing Grand Ion Majestic (GIM) project. Revenue for the quarter dipped to RM48.82 million, from RM49.23 million previously. Earnings per share slipped to 1.26 sen, from 1.78 sen earlier. The company did not declare any dividend. (TheEdge)

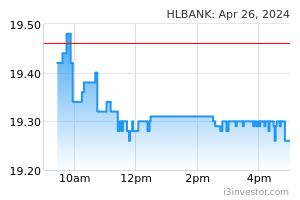

Hong Leong Bank Bhd's net profit grew 32% to RM907.64 million for the fourth quarter ended June 30, 2022 (4QFY22) from RM689.48 million a year ago, driven mainly by higher net income, lower provisions coupled with some writebacks of previously impaired losses from financial investments and other assets. The group also recorded an RM89.5 million increase in share of profit from associated company, its Bursa Malaysia filing showed. (TheEdge)

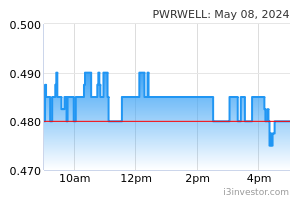

Powerwell Holdings Bhd posted a net profit of RM1.21 million for the first quarter ended June 30, 2022 (1QFY23), compared to a net loss of RM382,000 a year earlier, due to higher revenue. In a bourse filing on Monday (Aug 29), the power distribution management specialist said revenue for the quarter rose 60% to RM23.81 million from RM14.89 million previously, due to higher sales generated from project deliveries. (TheEdge)

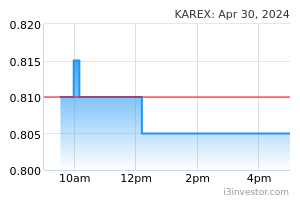

Karex Bhd remained in the red in its fourth quarter ended June 30, 2022 (4QFY22) due to higher raw material prices, the implementation of a higher minimum wage and continued disruptions to logistic networks. However, it managed to narrow its net loss to RM3.4 million or 0.32 sen per share, from RM5.1 million or 0.48 sen per share in 4QFY21. (TheEdge)

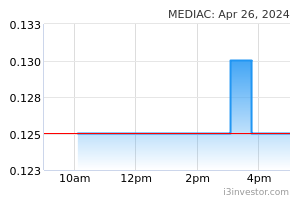

Media Chinese International Ltd narrowed its net loss to RM1.34 million or 0.09 sen per share for the first quarter ended June 30, 2022 (1QFY23), from RM8.39 million or 0.48 sen per share a year earlier. Quarterly revenue increased 5.43% to RM133.35 million from RM126.48 million, mainly attributed to the increase in turnover profit from the group’s travel segment. (TheEdge)

Lingkaran Trans Kota Holdings Bhd (Litrak) saw its net profit climb 50.11% to RM56.92 million in the first quarter ended June 30, 2022 (1QFY23) from RM37.92 million a year earlier, on the back of higher revenue and lower finance cost. Earnings per share rose to 10.58 sen from 7.12 sen, according to the group’s bourse filing. (TheEdge)

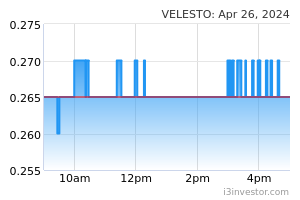

Velesto Energy Bhd registered a net loss of RM43.17 million for the second quarter ended June 30, 2022 (2QFY22), compared to a net profit of RM16.27 million in the same period last year. The group attributed the net loss recorded in 2QFY22 to lower contribution from its drilling segment, as well as higher corporate expenses after recognising higher net foreign exchange loss in the current quarter. (TheEdge)

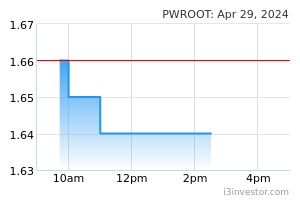

Power Root Bhd’s net profit jumped by more than seven times to RM15.26 million in the first quarter ended June 30, 2022 (1QFY23) from RM2 million a year ago, lifted by favourable product sales mix. Earnings per share rose to 3.7 sen from 0.5 sen. The better profit was also lifted by a gain on foreign exchange of RM744,000 compared with RM214,000 previously, said the beverage maker in a filing with Bursa Malaysia. (TheEdge)

Tiong Nam Logistics’s net profit for the first quarter ended June 30, 2022 (1QFY23) tumbled 75.34% to RM382,000 from RM1.55 million in the same quarter last year on higher tax expenses and losses sustained by associates. Earnings per share slipped to 0.07 sen from 0.3 sen, the group’s filing with the bourse on Monday showed. (TheEdge)

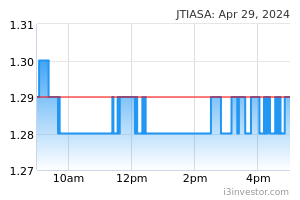

Jaya Tiasa Holdings Bhd reported a 115% jump in its fourth quarter net profit ended June 30, 2022 (4QFY22) to RM42.195 million from RM19.64 million a year earlier due to better profit margins from higher crude palm oil (CPO) and palm kernel average selling prices. Revenue for the quarter rose 7.99% to RM214.8 million from RM198.9 million, despite seeing a huge decline of revenue in its timber division, which was down 48% from RM32.42 million to RM16.84 million, according to the group's filing with Bursa Malaysia on Monday. (TheEdge)

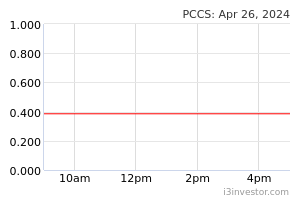

Athletics apparel manufacturer PCCS Group Bhd posted a net profits of RM15.31 million for its first quarter (Q1) ended June 30, 2022 (FY22), which was 14 times higher than the RM1.1 million it recorded a year ago. The company's net profit was partially contributed by the gain on disposal of subsidiaries, Mega Label (Malaysia) Sdn Bhd (MLM) and Mega Label (Penang) Sdn Bhd (MLP) amounting to RM8.3 million. (NST)

Techna-X Bhd registered a net profit of RM301.9 million for the second quarter (Q2) ended June 30, 2022 compared to a net loss of RM33.5 million for the same quarter last year. Techna-X's revenue rose 65.1 per cent to RM20.8 million in Q2 2022 from RM12.6 million last year. The company said the strong results was largely due to the divestment of its original metallurgical coke business. (NST)

Frozen seafood processor PT Resources Holdings Bhd aims to raise RM48.6 million from its initial public offering (IPO) en route to its listing on Bursa Malaysia’s ACE Market. Managing director Heng Chang Hooi said that from the proceeds, RM17.6 million would be allocated to finance the capital expenditure for a new cold storage warehouse. (TheStar)

RHB Bank Bhd expects further headwinds in the second half of the year (2H22) due to uncertainties surrounding global factors, leading to higher interest rates and a spillover to higher borrowing cost. Group managing director and group chief executive officer Mohd Rashid Mohamad said geopolitical factors that impacted the supply chain as well as China's strict Covid-19 policy would have an impact on the economy at large. (NST)

FGV Holdings Bhd has declared dividend of four sen after posting a 10.39% increase in its net profit for the second quarter ended June 30, 2022 (2QFY22) to RM374.02 million from RM338.82 million a year prior, largely due to higher palm products' margins as a result of firmer crude palm oil (CPO) prices. According to the plantation giant's Bursa Malaysia filing on Tuesday (Aug 30), quarterly revenue jumped 58.64% to RM7.43 billion from RM4.68 billion. Earnings per share came up to 10.25 sen compared with 9.29 sen in 2QFY21. (TheEdge)

LYC Healthcare Bhd has entered into a memorandum of understanding (MOU) with Lincoln University College and Evexia Education Group Sdn Bhd to jointly develop educational courses related to the provision of postpartum or confinement care services. In a statement to the local bourse on Tuesday (Aug 30), LYC said its unit LYC Mother & Child Centre Sdn Bhd (LYCMC) had inked the MOU. (TheEdge)

Reservoir Link Energy Bhd has bagged a letter of award (LOA) for a contract worth RM10.2 million. In a statement on Tuesday (Aug 30), the energy-related services provider said that its 51%-owned subsidiary Founder Energy Sdn Bhd had received the LOA from Atlantic Blue Sdn Bhd for the turnkey construction and commissioning of a large-scale solar photovoltaic plant with a capacity of 13MWac located in Selangor. (TheEdge)

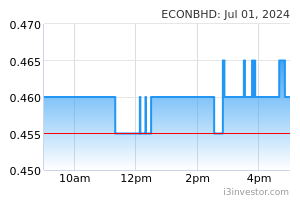

Econpile Bhd has bagged a RM40 million construction sub-contract related to the Rapid Transit System Link (RTS) project between Johor Bahru and Singapore. Econpile said its wholly owned subsidiary Econpile (M) Sdn Bhd was awarded the piling job — at the immigration, custom and quarantine complex for the RTS Link — by Ekovest Construction Sdn Bhd. (TheEdge)

Source: New Straits Times, The Edge Markets, The Star 30 Aug 2022

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.