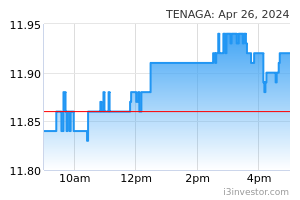

Tenaga Nasional Bhd (TNB) plans to invest around RM20 billion annually over the next 28 years to fast track its energy transition plan to reduce its emissions intensity to net zero by 2050. President and chief executive officer Datuk Indera Baharin Din said the investment would pave the way for TNB's journey towards its net zero aspiration and open opportunities in more than doubling its earnings. (NST)

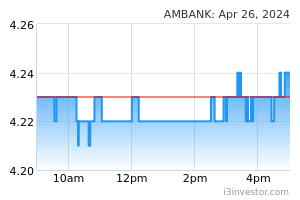

AMMB Holdings Bhd's (AmBank) net profit increased 8.4 per cent to RM419.19 million in the first quarter (Q1) ended June 30, 2022, from the RM386.6 million recorded in the same quarter last year. Its revenue in Q1 eased 6.2 per cent to RM1.16 billion from RM1.24 billion. (NST)

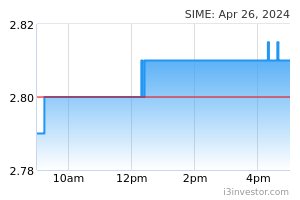

Sime Darby Bhd's net profit jumped 31.8 per cent to RM278 million in the fourth quarter ended June 30, 2022 from RM211 million a year ago. Group revenue for the quarter eased 3.9 per cent to RM10.85 billion from RM11.3 billion. The net profit for the full year, however, fell 22.6 per cent to RM1.1 billion in from the RM1.43 billion recorded in FY21, on the back of a 4.1 per cent drop in revenue to RM42.5 billion from RM44.3 billion. (NST)

Malaysia Marine and Heavy Engineering Holdings Bhd (MMHE) has returned to the black in the second quarter (Q2) ended June 30, 2022, chalking up a net profit of RM21.97 million from the net loss of RM34.38 million recorded in the same quarter a year ago. Revenue in Q2 increased 32.5 per cent to RM400.63 million from RM302.45 million. For the six months, MMHE registered a net profit of RM24.69 million from a net loss of RM138.73 million, while revenue grew 26.7 per cent to RM818.41 million from RM646.02 million. (NST)

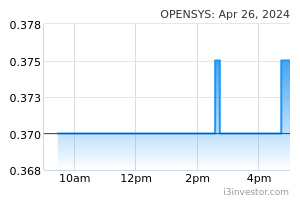

OpenSys (M) Bhd recorded a net profit of RM2.95 million in the second quarter (Q2) ended June 30, 2022, up 6.7 per cent year-on-year (YoY) from RM2.77 million in the same period last year, driven by all-round growth across segments. Revenue for the quarter rose 24.3 per cent YoY to RM18.24 million from RM14.67 million. (NST)

AME Real Estate Investment Trust (REIT), which is en route to list on Bursa Malaysia's Main Market on Sept 20, plans to acquire industrial properties from third-party vendors in the central and northern regions of Peninsular Malaysia. It said the mandate to acquire assets beyond Johor provides AME REIT the flexibility and opportunity to expand the reach of its property trust to generate stable cash flows and potential long-term income and capital growth. (TheEdge)

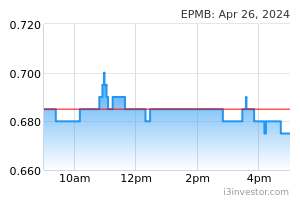

EP Manufacturing Bhd (EPMB) has inked a memorandum of understanding (MOU) to collaborate and venture into the business of new and used imported car distribution, in particular electric vehicles (EVs) and its localisation activity. In a Bursa Malaysia filing on Wednesday (Aug 17), EPMB said its unit EP 4Wheeler Sdn Bhd (EP4W) signed the deal with Cahaya Bumi Sdn Bhd. (TheEdge)

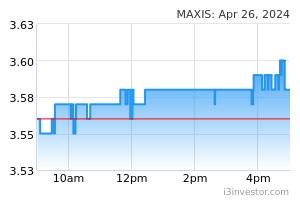

Maxis Bhd's subsidiary Maxis Broadband Sdn Bhd (MBSB) has issued two new series of sukuk amounting to RM400 million in nominal value under its unrated sukuk murabahah programme of up to RM10 billion. In a filing on Wednesday (Aug 17), the telecommunications company said the size of both issued series stood at RM200 million each. They carry a maturity date of Aug 17, 2029, and Aug 17, 2032, respectively. (TheEdge)

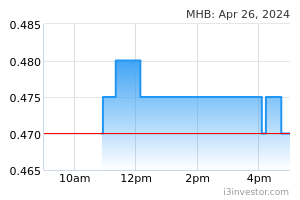

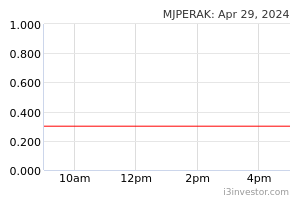

Majuperak Holdings Bhd (MHB), through its subsidiary Nexusbase Development Sdn Bhd (NDSB), is breaking ground with its maiden Klang Valley residential development, which is also its first property development outside Perak, with a total gross development value (GDV) of RM122mil. The property, situated on 2.2 acres of land, is slated to begin construction in the last quarter of this year, and it is expected to be completed in 2026. (TheStar)

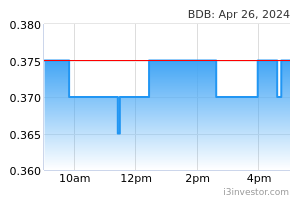

The Malaysian Rating Corporation Bhd (MARC) has affirmed its MARC-2IS rating on Bina Darulaman Bhd's (BDB) RM100 million Islamic Commercial Papers (ICP) programme for the fifth consecutive year. BDB acting president and group chief executive officer Mohd Iskandar Dzulkarnain Ramli said MARC's review validated BDB's management strategy and execution in creating a sustainable business model for the company and generating long-term value to shareholders. (NST)

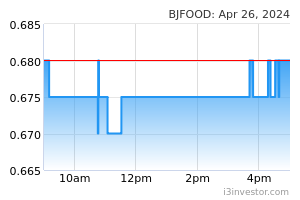

Berjaya Food Bhd's efforts to improve its business fundamentals have taken flight given its commendable earnings growth over the last two years. In its recent fourth quarter results, the food and beverage chain operator posted earnings of RM40.8mil, which was a significant increase from RM4mil in the fourth quarter of 2019. (TheStar)

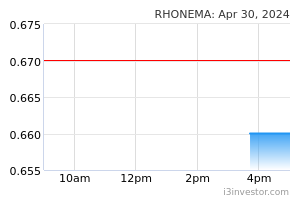

Rhone Ma Holdings Bhd expects to continue sustaining an increase in earnings by leveraging on the demand for meat, in tandem with the growing population of Malaysia. In a filing with Bursa Malaysia, the group said net profit in the second quarter ended June 30, 2022 rose to RM3.02mil from RM1.95mil previously, on the back of higher revenue from the company’s animal health products and equipment division, as well as its food ingredients segment. (TheStar)

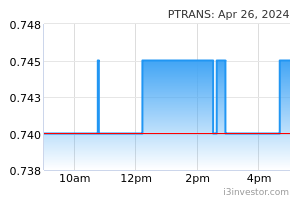

Perak Transit Bhd is looking to provide electrical buses and electric vehicle charging stations, in line with its environmental, social and governance (ESG) initiatives to reduce the carbon footprint of its operations. In a filing with Bursa Malaysia yesterday, the group said it is optimistic that the proactive business transformations and efforts to drive more innovative leasing solutions will continue to drive the growth in the near future. (TheStar)

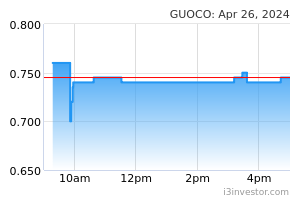

Guocoland (M) Bhd hinted at acquiring more land and launching new property projects, after its property development business consistently delivered stronger revenue over the past three consecutive quarters. Guocoland, which is the property arm of Hong Leong group, said new product launches would be phased according to prevailing market conditions. (TheStar)

Boustead Holdings Bhd is unlikely be able to take on more debt to support its 82%-owned Boustead Naval Shipyard Sdn Bhd (BNS) in completing the Littoral Combat Ship (LCS) project, according to an investment analyst. Boustead Holdings is a diversified conglomerate with core businesses in plantation, property and industrial, pharmaceutical, heavy industries as well as trading, finance and investment. (TheStar)

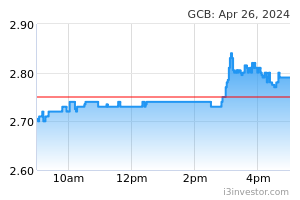

RHB Research expects Guan Chong Bhd to record similar performance in the second half (2H) of the year, backed by stronger numbers from its Schokinag operations on lower energy costs, sustained robust demand globally, and higher production capacity. The company recorded revenue and net profit of RM2.19 billion and RM97.9 million, respectively, for H1, while earnings margin inched higher year-on-year (YoY) with a higher cocoa powder ratio and cheaper cocoa bean prices cushioning the lower cocoa butter ratio. (NST)

Mercury Securities Sdn Bhd is upbeat on Aurelius Technologies Bhd's (ATB) attractive expansion plans, customer portfolio diversification from a high-mix-low-volume to a medium-mix-medium-volume business, and solid track record. The research firm said ATB commenced production for its newly acquired Customer F in March, involved in the multicomponent IC (MCIC) business, after installing four fully automated surface-mount technology (SMT) lines in its existing Plant 2. (NST)

PublicInvest Research has valued SNS Network Technology Bhd at 33 sen, and said over the years, SNS had continued to expand its presence by setting up other brand specialty stores. This includes Acer, AMD, Asus, Dell, HP, Huawei, Lenovo, Mi, MSI and Omen, following the launch of its first Apple Store, branded under the brand name “iTworld” in Ipoh. (TheEdge)

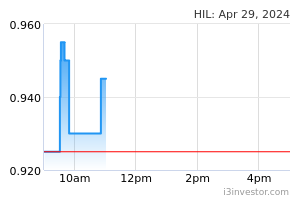

Kenanga Research has initiated coverage of HIL Industries Bhd with an "outperform" rating at 98.5 sen and a target price (TP) of RM1.08, and said that moving ahead, it expects property earnings to moderate while plastic manufacturing earnings to pick up. (TheEdge)

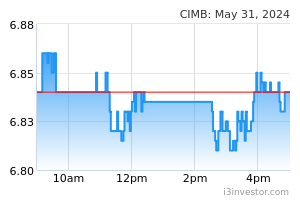

RHB Retail Research said CIMB Group Holdings Bhd is poised to extend its upside movement after crossing above the immediate resistance. In a trading stocks note on Wednesday (Aug 17), the research house said that the share price had been rising in tandem with the volume, showing that bullish momentum is gaining traction. (TheEdge)

Source: New Straits Times, The Edge Markets, The Star 17 Aug 2022

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.