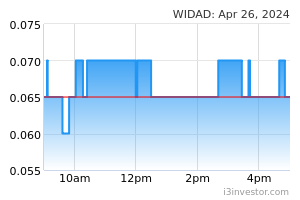

Widad Group Bhd is expected to continue to regain a firm footing for the financial year of 2022 (FY22), supported by its current total orderbook of RM1.6 billion. Managing director Datuk Dr Mohd Rizal Mohd Jaafar said out of the RM1.6 billion total orderbook, 52 per cent or RM832 million was contributed by integrated facilities management (IFM) business and concession. The construction sector contributes the remaining RM768 million. (NST)

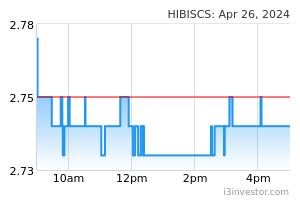

The heightened risk premiums from tax issues with the Sabah authorities will continue to weigh on Hibiscus Petroleum Bhd's sentiment for the time being, said Hong Leong Investment Bank Bhd (HLIB). The Sabah state government recently demanded Hibiscus to pay a total sum of RM97.3 million, comprising RM66.0 million in sales and service tax (SST) and RM31.3 million in penalty incurred for late payment. (NST)

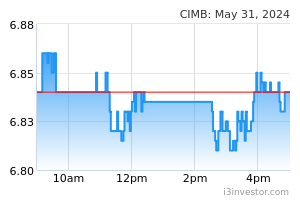

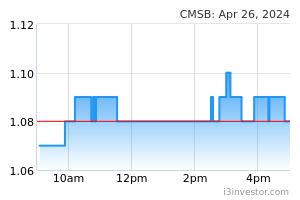

CIMB Group Holdings Bhd's 94.83%-owned subsidiary CIMB Thai Bank PCL's net profit for the cumulative six months ended June 30, 2022 (6MFY22) jumped 122% year-on-year (y-o-y) to 2.12 billion baht from 1.16 billion baht. The improvement was mainly attributed to better cost control with a 7.4% decrease in operating expenses and a 63.7% decrease in expected credit losses, according to a statement to the local bourse on Thursday (July 21). (TheEdge)

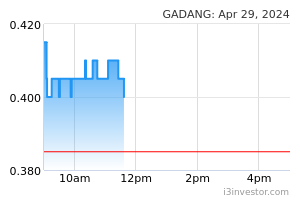

Gadang Holdings Bhd’s RM680mil contract win is set to boost the construction engineering firm’s outstanding order book and spur earnings for the current financial year ending May 31, 2023 (FY23). TA Research in a report yesterday said it is raising Gadang’s earnings forecasts for FY23 and FY24 by 2.8% and 4.4%, respectively. (TheStar)

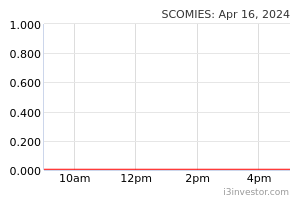

Scomi Energy Services Bhd (SESB) is proposing to dispose of its 48 per cent stake in Scomi KMC Sdn Bhd and 100 per cent equity interest in Scomi Oilfield Ltd (SOL) to Cahya Mata Oiltools Sdn Bhd, a 75 per cent-owned subsidiary of Cahya Mata Sarawak Bhd. Meanwhile, Scomi Oiltools Sdn Bhd (SOSB) has proposed to dispose of its 4.0 per cent stake in Scomi KMC Sdn Bhd (together with 25 million redeemable preference shares in the company) to Oiltools International Sdn Bhd, a wholly-owned subsidiary of Cahya Mata Oiltools. (TheStar)

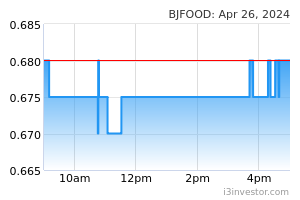

Berjaya Food Bhd’s board of directors has recommended shareholders to approve the group’s proposed bonus issue of up to 1.56 billion shares on the basis of four bonus shares for every one share held, saying it is in the best interest of the group. Shareholders are scheduled to vote on the proposal at an extraordinary general meeting (EGM) on Aug 19, according to the group’s circular to shareholders on Bursa Malaysia on Thursday (July 21). (TheEdge)

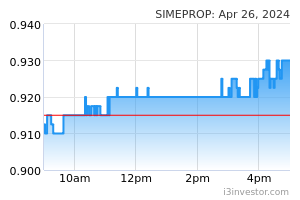

Sime Darby Property Bhd celebrated its Auxiliary Police (AP) unit's 6th anniversary recently with a history-making event at the Pusat Latihan Polis (Pulapol) here. SD Property is the nation's first company to conduct its AP unit's anniversary parade at Pulapol, Malaysia's oldest police academy and training institute. (NST)

Malaysia Airports Holdings Bhd (MAHB) may need to raise more borrowings to repay debts due this year, according to CGS-CIMB Research. (TheEdge)

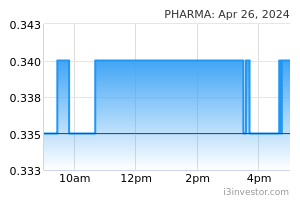

Kenanga Research does not expect Pharmaniaga Bhd's financial year 2022 (FY22) to chalk up positive earnings growth since most of its vaccine delivery has been completed. The firm said Pharmaniaga now held 10 million doses of Sinovac Covid-19 vaccines in its inventory, having sold two million doses in the first quarter (Q1) of calendar year 2022. (NST)

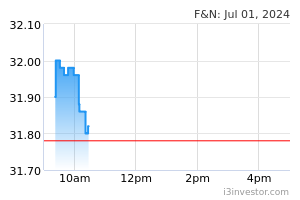

Cocoaland Holdings Bhd’s independent adviser, Malacca Securities Sdn Bhd, says the RM1.50 a share cash offer tabled by Fraser & Neave Holdings Bhd (F&N) to privatise Cocoaland is “fair and reasonable” and advised shareholders to vote in favour of resolutions to privatise the company. In a filing with Bursa Malaysia yesterday, Cocoaland’s board concurred with the findings and also recommended shareholders vote for the privatisation. (TheStar)

Hong Leong IB (HLIB) Research has maintained its "buy" rating on Hibiscus Petroleum Bhd at 82.5 sen with a lower target price (TP) of RM1.54 (from RM1.73) after the Sabah state government recently demanded Hibiscus to pay a total sum of RM97.3 million, comprising RM66 million in state sales tax and RM31.3 million in penalty incurred for late payment. (TheEdge)

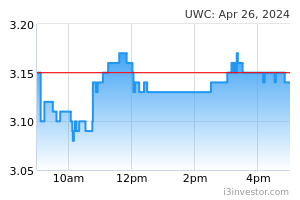

RHB Retail Research said UWC Bhd is set for an upward rebound as it broke above the RM3.42 resistance on stronger volume on Wednesday (July 20) – printing a “White Marubozu” bullish candlestick. In a trading stocks note on Thursday, the research house said if the bullish momentum persists, the stock may climb further towards the immediate resistance at RM3.80 – or the high of April 7 – before heading towards RM4.08, or the high of April 5. (TheEdge)

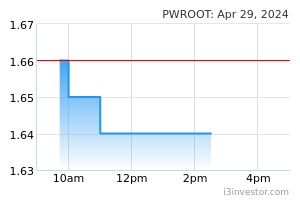

RHB Retail Research said Power Root Bhd is poised to resume its uptrend as it rebounded on Wednesday (July 20) from the immediate support on the back of stronger trading volume – eyeing the immediate resistance of RM1.85. (TheEdge)

Source: New Straits Times, The Edge Markets, The Star 21 Jul 2022

Need a Trading Account?

Open a trading account now for FREE with our selected advertiser to enjoy Free Subscription to MQ Trader!

Contact Us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Contact Number: +60128058077

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.