The Brent Crack Spread margin chart is showing that it is dropping sharply from 32% to 18% in the last few days.

What is Crack Spread?

Crack spread refers to the pricing difference between a barrel of crude oil and its by-products such as gasoline, heating oil, kerosene, and fuel oil. The business of refining crude oil into various components requires careful attention to market prices for the various by-products. The spread estimates the profit margin that a refinery can expect to generate from cracking the long-chain hydrocarbons of crude oil into useful petroleum by-products. Depending on various factors such as weather seasonality, global supplies, and time of year, the demand and supply equation for different petroleum components changes. This affects the profit margins for refiners.

The spreads are used by refiners to hedge their Profit and Loss (P&L), while speculators use cracks spreads in futures trading. For example, if a refiner relies on selling gasoline and the price of gasoline drops below the price of crude oil, this is likely to result in a loss to the refiner. Speculators aim to profit from the price difference between crude oil and its by-product components.

Factors Affecting Crack Spread

One of the factors that affect the spread is geopolitical issues. Generally, during periods of political uncertainty and instability, there will be a reduction in oil supply. The result is a rise in crude oil prices relative to refined products. This weakens, or narrows, the crack spread initially. However, as refineries respond to the reduced crude oil supply and by-product output reduction, the crack spread widens. Foreign policy changes also affect crude oil producers and the prices of crude by-products.

Prevailing weather conditions, mainly summer and winter seasonality, affect the spreads as well. During the summer season, there is a higher demand for specific by-products such as gasoline and diesel, which significantly strengthens the crack spread. The winter season increases the demand for distillates like diesel fuel and motor gasoline and also results in a wider crack spread.

There exists an inverse relationship between crude oil and currency strength, and any changes in the strength of a currency may affect crude oil prices and ultimately the crack spread. When the value of a currency declines, crude oil prices increase, and this weakens the crack spread. An increase in the value of crude oil means that the profit margins from crude oil components are reduced. For refiners to get a strong positive crack spread, the price of crude oil must be significantly lower than the price of refined products.

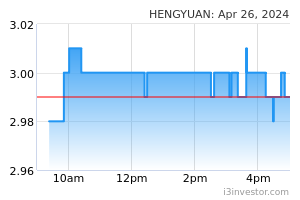

The above Hengyuan price chart shows that it has started to drop from Rm 7.50 to the current price of Rm 4.30 in the last 2 months. Due to rapid dropping of Brent Crack Spread margin, Hengyuan share price will continue to drop. Investors must follow the price chart which cannot lie.