Valuation / Recommendation

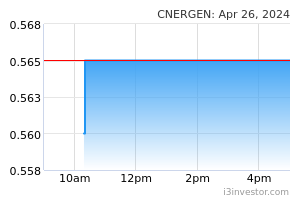

We initiate coverage on Cnergenz Berhad with a BUY recommendation with a TP of RM0.66 based on FY23F EPS of 3.8 sen and a peers average PE of 17.3x.

We like the stock for its attractive expansion plans and cheap valuations, well- positioned to leverage on the growing SMT manufacturing solutions industry in Southeast Asia which is forecasted by Providence to grow at a 2-year CAGR of 8% from 2022 to 2024. The target price represents a potential return of 40.0% from the current price.

Investment Highlights

Proxy to fast growing E&S industry. Cnergenz is one of the leading SMT solution providers in Malaysia, Thailand, and Vietnam, with the expertise to design, develop, assemble, configure, integrate, test and commission integrated production line systems. The company also maintains a healthy relationship of more than 12 years with its top 5 customers which contributes approximately 61% to revenue in FY21. The company commands a market share of 17.4% in 2021 for the 3 key markets and serves more than 113 customers worldwide.

Capacity expansion. Cnergenz is currently operating from its 22.8k sq ft existing facility in Bukit Tengah, Penang. The company plans to scale up its operations via the construction of a new 3-storey plant with a built-up area of 130k sq ft, which is approximately 6x larger than its existing production floor space, expected to complete within 4Q23. Approximately RM37.8m worth of capex will be allocated for this plant, funded via IPO proceeds.

Approximately 66k sq ft of floor space will be allocated for workshop and assembly area which will enable Cnergenz to perform modifications, customisations and refurbishment works on machinery and equipment in-house.

With the completion of the new plant, we think that Cnergenz is well-positioned to benefit from the growing SMT manufacturing solutions industry in Southeast Asia which is forecasted by Providence to grow at a 2-year CAGR of 8% from 2022 to 2024, and uptake potential demand for the smart factory solutions in the E&S industry.

Strong order book and track record. The company has an order book of RM147m as of 31st May 2022, expected to be fully recognised within 2H22. Under the leadership of Group CEO Lye Yhin Choy who is responsible for the overall management and business operations of Cnergenz, the company was able to achieve a 3-year revenue CAGR of 9.0% from FY18 to FY21 (excluded customer K & H for FY18 and FY19), despite the COVID-19 pandemic in FY20.

Risk factor. (1.) Slower than expected contract flows (2.) Shortages of skilled engineers and technicians.

Source: Mercury Securities Research - 18 Jul 2022