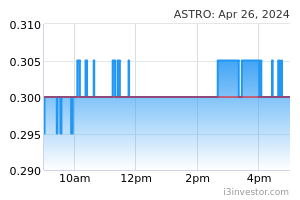

Astro Malaysia Holdings Bhd (Technical Buy)

• Following a strong lift-off from the trough of RM0.60 on 8 March 2023, ASTRO has appreciated 26% to reach a peak ofRM0.755 before it retraced to form a symmetrical triangle chart pattern. It closed at RM0.705 yesterday.

• An ensuing trajectory momentum could pave the way for ASTRO to trend higher on the back of the following bullish signals:(i) upward bias continuation as suggested by Parabolic SAR uptrend coupled with ADX indicators, and (ii) the share pricecrossing above the Ichimoku Cloud’s short-term resistance.

• That said, we anticipate the stock to climb towards our resistance thresholds of RM0.80 (R1; 13% upside potential) andRM0.89 (R2; 26% upside potential).

• Conversely, we have placed our stop loss price level at RM0.62, representing a downside risk of 12%.

• A leading content and entertainment group across the TV, radio, digital and commerce platforms, ASTRO reported a netprofit of RM5.8m (-95% YoY) in 3QFY23, which brought its 9MFY23 net profit to RM204.3m (-39% YoY).

• Based on the consensus projections, the group is expected to make net profit of RM396.1m for FY Jan 2023 andRM440.7m for FY Jan 2024, translating to forward PERs of 9.3x and 8.3x, respectively.

• Furthermore, the stock offers an attractive forward dividend yield of 8.7% based on consensus DPS estimate of 6.1 sen forFY Jan 2024.

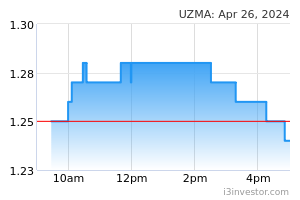

Uzma Bhd (Technical Buy)

• Since a breakout from the immediate resistance of RM0.42 in end-November last year, UZMA has been trading in anupward channel to hit a peak of RM0.75 on 27 February 2023 which subsequently retraced to the lower regression channel(which coincided with 38.2% Fibonacci retracement level) – presenting a timely buying opportunity for investors.

• From a technical standpoint, a technical rebound could be on the horizon given that the share price is on the verge ofcrossing above the 21-day EMA line while the stochastic indicator has climbed up from the oversold zone.

• That said, the stock could rise towards our target resistances of RM0.70 (R1; 12% upside potential) and RM0.75 (R2; 20%upside potential).

• Our stop loss price is pegged at RM0.56 (representing a downside risk of 10% from the closing price of RM0.625yesterday).

• An oil & gas service provider, UZMA is engaged in the provision of integrated well solutions, production solutions,subsurface solutions, and other upstream services (including the provision of geoscience and reservoir engineering, drilling,project and operation services) as well as other specialized services.

• The group posted a net profit of RM10.3m (+17% QoQ) in 2QFY23, which lifted its 1HFY23 cumulative net profit toRM19.1m (compared to a net profit of RM0.4m in 1HFY22).

• Going forward, consensus is projecting UZMA to register higher net profit of RM28.6m for FY June 2023 and RM32.2m forFY June 2024, which translate to forward PERs of 7.7x and 6.8x, respectively.

Source: Kenanga Research - 24 Mar 2023