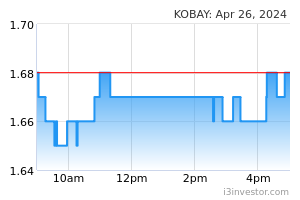

Kobay Technology Bhd (Technical Buy)

• After breaking out from the resistance line of RM2.89 on 25 Jan 2023, KOBAY’s share price subsequently staged a strong rally to hit the peak of RM3.38 on 3 Feb 2023 before retracing sharply to close at its intermediate support level of RM2.58 yesterday.

• We believe a technical rebound could be on the horizon as the selling pressure has eased as suggested by the Chaikin Oscillator while the stochastic indicator (with its %K line on the verge of crossing above the %D line) set to climb out from the oversold zone amid the appearance of a doji candlestick.

• Ergo, we anticipate the stock price could rise to challenge our resistance thresholds of RM2.90 (R1; 12% upside potential) and RM3.10 (R2; 20% upside potential).

• We have set our stop loss price level at RM2.30 (representing a downside risk of 11% from the last traded price of RM2.58).

• Fundamentally speaking, KOBAY – which is principally involved in the manufacturing of precision metal components – reported a net profit of RM9m in 2QFY23 (-14% QoQ), taking its cumulative bottomline to RM19.5m in 1HFY23 (-18% YoY).

• Following which, consensus is currently projecting the group to register net profit of RM50.7m for FY June 2023 and RM61.7m for FY June 2024, translating to forward PERs of 16.5x and 13.6x, respectively.

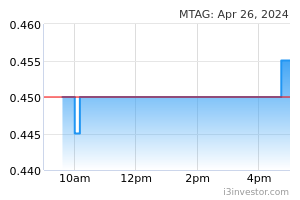

MTAG Group Bhd (Technical Buy)

• MTAG’s share price gapped down from the prior day’s closing of RM0.605 to as low as RM0.39 on 24 Feb 2023 (following the announcement of a weaker set of quarterly financial results amid concerns of a possible loss of key clients) before inching up to close at RM0.44 yesterday.

• We believe the stock could stage a technical rebound ahead to fill the price gap as the share price has crossed back above the lower Bollinger Band while the RSI indicator is on the verge of climbing out from the oversold zone.

• Hence, the stock could rise to challenge our resistance targets of RM0.50 (R1; 14% upside potential) and RM0.57 (R2; 30% upside potential).

• Our stop loss price level is placed at RM0.39 (representing a downside risk of 11%).

• As a leading labels and stickers printing and materials converting specialist, MTAG is an indirect proxy to the fast-growing electronics manufacturing services (EMS) industry in Malaysia.

• Earnings-wise, the group reported net profit of RM6.7m (-46% QoQ) in 2QFY23, which took its 1HFY23’s net earnings to RM19.2m (+36% YoY).

• Going forward, consensus is estimating MTAG would make net profit of RM38.5m in FY June 2023 and RM39.4m in FY June 2024, which translate to forward PERs of 7.8x and 7.6x, respectively.

Source: Kenanga Research - 2 Mar 2023