QL’s 9MFY23 results beat expectations. Most of its major segments showed improvement post the pandemic. Its marine division’s exports are normalising, boosted further by a strong USD vs. MYR. It is also expanding its convenience store business by adding new outlets. Hence, we raise our FY23F and FY24F earnings by 13% and 10%, respectively, lift our TP by 11% to RM6.66 (from RM6.00) and upgrade our call to OUTPERFORM from MARKET PERFORM.

9MFY23 core net profit beat expectations at 89% and 84% of our full year forecast and the full-year consensus estimates, respectively. The variance against our forecast came largely from higher-than-expected demand for its marine products and eggs (Indonesia and Vietnam). The absence of dividend is expected as it generally only declares dividend in the 4QFY.

Results’ highlights. Revenue grew 24% YoY driven largely by strong performance from its marine products division (+ 18% partly contributed by the resumption of exports to China) and poultry business (+14%). Its convenience store CVS operations jumped 19% on account of higher stores numbers. EBITDA improved by a stronger 49% thanks to: (i) improved selling price (for marine products), and (ii) improved egg prices in both Malaysia (partly due to government subsidies) and operational efficiency in both its Indonesia and Vietnam farming operations.

With the exception of oil palm plantation, all other operations showed improvement, with marine products driven by higher volume (as operations normalised) and a 10% increase in ASP (aided by stronger USD), while its convenience store division was boosted by the addition of 75 new stores (from 260 as at end of CY22). Its poultry business was underpinned by higher price for eggs and feed meals, higher volumes for feed meals and prices for feed meals sold as well as government subsidies.

Forecasts. We raise our FY23-24F earnings by 13% and 10% respectively on the above reasons.

We like QL for: (i) the sustained strong export demand for its marine products post pandemic, (ii) its strong Family Mart convenience store franchise given its appealing Japanese-themed products and continued outlet expansion including Family Mart Mini targeting petrol stations and highways, and (iii) the strong growth potential of its poultry business in Indonesia and Vietnam on increased protein diet content as living standards improve with prices looking stable (and likely to increase in Indonesia).

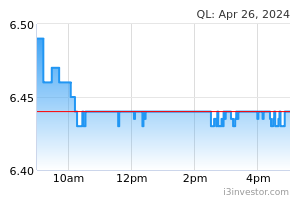

Correspondingly we lift our DCF-derived TP by 11% to RM6.66 (WACC: 5.2% and TG: 2%). There is no adjustment to our TP based on ESG given a 3-star rating as appraised by us (see Page 4). Upgrade to OUTPERFORM from MARKET PERFORM.

Risks to our call: (i) higher than expected inflationary pressure, ii) unreasonable monsoon season, (iii) change in fishing regulations, and (iv) a weaker USD.

Source: Kenanga Research - 1 Mar 2023