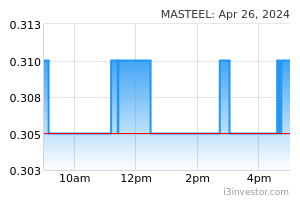

Malaysia Steel Works (KL) Bhd (Technical Buy)

• A breakout from an immediate resistance hurdle might be on the horizon for MASTEEL shares after rising from the trough ofRM0.235 on 7 November 2022 to as high as RM0.45 in late-November 2022 before closing at RM0.42 yesterday.

• With the appearance of a bullish dragonfly doji candlestick and the share price hovering above the Ichimoku Cloud’s shortterm support line, the stock is set to extend its upward shift as the MACD pulls away from the signal line amid an emergingParabolic SAR uptrend.

• Hence, the stock is expected to advance towards our resistance targets of RM0.465 (R1; 11% upside potential) and RM0.50(R2; 19% upside potential).

• Our stop loss level is set at RM0.375, which translates to a downside risk of 11%.

• An integrated steel manufacturer focusing on the production of high-tensile deformed steel bars, mild steel round bars andsteel billets, MASTEEL registered a net profit of RM3m (+150% QoQ) in 3QFY22, bringing its 9MFY22 earnings toRM17.4m (-15%YoY).

• Valuation-wise, the stock is currently trading at a Price/Book Value multiple of 0.33x based on a book value per share ofRM1.27 as of end-September 2022.

• In terms of recent corporate development, MASTEEL – being the first ‘ultra-low carbon emission’ integrated steel mill inMalaysia – has been included in the FTSE4GOOD Bursa Malaysia Index in December 2022.

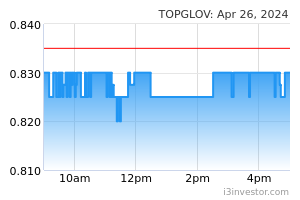

Top Glove Corporation Bhd (Technical Buy)

• TOPGLOV’s share price is anticipated to bounce off from an immediate support level to resume the upward momentumfollowing its rise from the low of RM0.705 on 21 December 2022 to the peak of RM0.95 in late-December 2022 beforeclosing at RM0.835 yesterday.

• On the chart, the stock is poised to advance further driven by the following positive technical signals: (i) the appearance of abullish long-legged doji candlestick, (ii) the stochastic indicator is on the verge of climbing out from the oversold zone, and(iii) the share price is still hovering above the Ichimoku Cloud’s support line.

• With that said, an anticipated upward shift will likely lift the stock price towards our resistance thresholds of RM0.93 (R1;11% upside potential) and RM0.99 (R2; 19% upside potential).

• We have pegged our stop loss level at RM0.75, representing a downside risk of 10%.

• A global healthcare nitrile and latex gloves manufacturer that serves multinational clients across the world, TOPGLOVlogged a net loss of RM168.2m in 1QFY23 (compared to a net loss of RM52.6m in 4QFY22) after reporting a full-year netprofit of RM236m in FY22.

• Moving forward, consensus is projecting that TOPGLOV would register a net loss of RM196m in FY August 2023 beforeturning around with a net profit of RM166m in FY August 2024, which translates to a forward FY24 PER of 40x.

Source: Kenanga Research - 3 Feb 2023