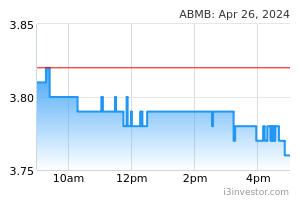

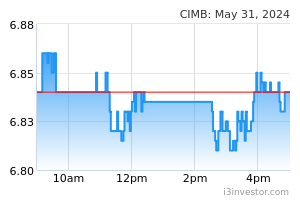

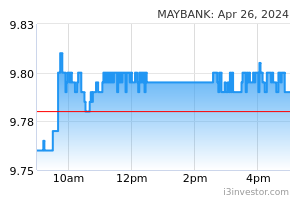

December 2022 system loans growth closed at 5.7% YoY, within our revised expectation of 5.5- 6.0% as both household and businesses remain supportive. We believe CY23 could deliver a slower growth trajectory at 4.0-4.5% as demand for financing could be set back by inflationary pressures and possibly slowing economic activity. That said, gross impaired loans (GIL) marked sequential improvements at 1.72%, possibly thanks to stronger recoveries which may in turn deflect persisting asset quality concerns. Deposits growth closed at 5.9%, below our 6.5-7.0% target but did demonstrate the predicted signs of migration from CASA to termed products as consumers seek to capitalise on higher rates. In the face of BNM’s recent decision to maintain the OPR at 2.75%, which was a surprise on our part, we believe it would keep rates flattish in favour of further observation on market conditions as inflationary pressures still persist. We maintain our OVERWEIGHT call on the sector, with top picks favouring stocks which we believe have a solid mix of resilience and earnings growth prospects. Our stock picks are MAYBANK (OP; TP: RM10.40), CIMB (OP; TP: RM6.40) and ABMB (OP; TP: RM4.20).

Busier month to spur gains. In Dec 2022, system loans increased by 5.7% YoY on better performances in household (+5.9%) and business accounts (+5.3%). This is within our expectation that industry loans growth would close at 5.5-6.0% at CY22, after having toned down expectation on a weaker Nov 2022 delivery. On a MoM basis, business loans led (+0.8%), likely driven by more borrowing needs ahead of the upcoming New Year seasonality. In lieu of recessionary pressures possibly stifling overall economic output, toppish interest rates are due to translate to some tightness in credit demand. We were also surprised by BNM’s stance to withhold a further 25 bps rate hike during the Jan 2023 MPC meeting, which could be an indication that inflationary signals could have been worse than expected. With that, we believe that CY23 industry loans growth could see some moderation, which we earmark to be 4.0-4.5%. This is also in line with our inhouse GDP growth expectations for CY23. (Refer to Table 1-3 for breakdown of system loans).

This could also be supported by the easing applications in Dec 2022 (-16% YoY, -12% MoM) as the cost of borrowing becomes more expensive. The biggest drag comes from household loans (-19% YoY) on significantly fewer property-related applications. Loan approvals also declined in tandem (-16% YoY, -18% MoM) with the lower applications during the period and may not pick up until closer to Hari Raya festivities (Refer to Table 4-5 for breakdown of system loan applications).

GIL readings show better health. Total impaired loans rose by 9% YoY due to the higher overall loans base but came off 5% MoM. This could be possibly due to better-than-expected recoveries from otherwise written-off accounts, leading to a GIL of 1.72% in Dec 2022 (Nov 2022: 1.83%, Dec 2021: 1.68%). Overall, we had expected for GIL levels to stay flattish as we do not anticipate a major flushing out of non-B40 accounts in the coming months. Recall that industry readings tend to hover between 1.6% and 1.9%, and we do not expect much deviation from here. Meanwhile, industry loan loss coverage was stable at 98.2% (Nov 2022: 98.1%, Dec 2021: 109.3%) as banks retain provisions in anticipation of uncertainties in 2023 (refer to Table 6-7 for breakdown of system impaired loans).

CASA continues to correct. System deposits closed with a 5.9% YoY increase, which missed our CY22 industry growth expectation of 6.5-7.0%. Though CASA readings did erode to 29.0% (Nov 2022: 29.5%, Dec 2021: 30.1%), we had anticipated a larger influx towards fixed deposit products, suggesting spending outflows could have prevailed during the year-end. Going forward, we anticipate deposits growth to outpace loans growth with consumers seeking to benefit from more attractive fixed deposit product rates, possibly fuelled by a migration of CASA portfolios. We anticipate 5.0-5.5% growth for CY23.

Maintain OVERWEIGHT on the banking sector. Though a healthy closing may alleviate concerns in the banking sector, we believe present recessionary uncertainties could still weigh on the long-term prospects. That said, it is likely that the banks would not be affected as drastically as other sectors given their widely diversified exposure with constant stress testing being conducted to strengthen preparedness. In the medium term, should macros not pan out to be worse-than-expected, we should see strong earnings uplift sector-wide (>20% EPS growth) coming from the relaxation of provisioning requirements with possible writebacks to bolster earnings further. With regards to the OPR, we believe it is unlikely BNM may revisit another hike as further observation may be needed to meaningfully determine the tolerance of the financial system to accept another 25 bps increase.

For 1QCY23, we maintain our prior preferences to continue highlighting names with stronger backing to share price and earnings support, being: (i) MAYBANK (OP; TP: RM10.40) for its persistently high dividend cushions (7-8% yield) and leading market share, (ii) CIMB (OP; TP: RM6.40) for resilient non-interest income stream performance led by regional operations, and (iii) ABMB (OP; TP: RM4.20) for its strength in the SME space which is expected to deliver high growth in a recovery environment. It also commands solid ROE (10%) and dividend potential (6%) despite its significantly smaller market cap.

Source: Kenanga Research - 2 Feb 2023