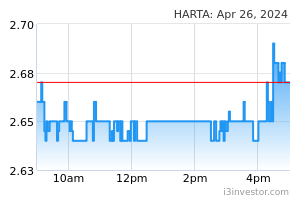

Hartalega Holdings Bhd (Technical Buy)

• HARTA’s share price is set to bounce off from its immediate support level after retracing from a recent high of RM1.84 in late December 2022 to as low as RM1.53 last Friday before pulling away to close at RM1.61 yesterday.

• From a technical standpoint, the stock is anticipated to show an upward bias as the stock price is poised to overcome the Parabolic SAR downtrend signal after crossing above the 9-day EMA line while the stochastic indicator is in the midst of climbing out from the oversold zone.

• Thus, the stock could advance towards our target thresholds of RM1.78 (R1; 11% upside potential) and RM1.90 (R2; 18% upside potential).

• Our stop loss is pegged at RM1.45, representing a downside risk of 10%.

• HARTA – a global healthcare nitrile and latex gloves producer with clientele across the world – reported net profit of RM28.3m (-68% QoQ) in 2QFY23 (which was impacted by lower average selling prices amid a competitive environment), lifting its cumulative net earnings to RM116.6m (-96% YoY) in 1HFY23.

• Moving forward, consensus is forecasting that HARTA would deliver a net profit of RM166.9m and RM220.9m in FY March 2023 and FY March 2024, which translate to forward PERs of 33x and 25x, respectively.

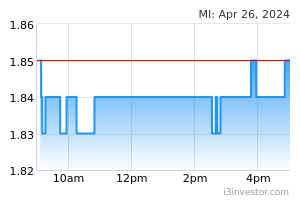

Mi Technovation Bhd (Technical Buy)

• Following a breakout from the descending trendline’s resistance at RM1.13 on 7 November 2022, MI’s share price has subsequently staged a trend reversal with the formation of higher highs and higher lows to plot an ascending channel before closing at RM1.42 yesterday.

• Chart-wise, the share price is on the verge of shifting higher in view of the following bullish technical indicators: (i) the Parabolic SAR is in an uptrend, (ii) the MACD is steering away from the signal line, (iii) the share price is hovering above the 21-day EMA line after crossing above the 21-day MA line.

• An extended run-up could then drive the stock towards our resistance projections of RM1.57 (R1; 11% upside potential) and RM1.70 (R2; 20% upside potential).

• Our stop loss price is set at RM1.27 (or a downside risk of 11%).

• MI – which is principally involved in the design, manufacture and distribution of wafer level chip scaling packaging (WLCSP) machines for the semiconductor industry – reported a net profit of RM20.3m (+8.6% QoQ). This brought its bottomline to RM51.8m (+6.6% YoY) in 9MFY22.

• Going forward, consensus is projecting MI to post net profit of RM54.5m in FY December 2022 and RM67.3m in FY December 2023, which translate to forward PERs of 24x and 19x, respectively.

Source: Kenanga Research - 20 Jan 2023