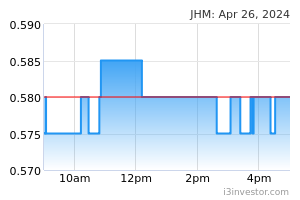

JHM Consolidation Bhd (Technical Buy)

• Following a pullback from the recent high of RM1.35 in August 2022, JHM’s share price has trended downwards to hit a low of RM0.70 twice, possibly paving the way for the formation of a double-bottom reversal pattern ahead.

• We believe that the share price – which ended at RM0.715 yesterday – will likely rebound backed by an anticipated reversal from the lower Bollinger Band and an unwinding of the stochastic indicator from the oversold area.

• Hence, the stock could rise to challenge our resistance levels of RM0.79 (R1; 10% upside potential) and RM0.89 (R2; 24% upside potential).

• We peg our stop loss at RM0.645, representing a downside risk of 10%.

• JHM is primarily engaged in 2 key segments: (i)) electronics business unit, which is involved in the manufacture and assembly of surface mount technology of automotive rear, interior and front headlamp lighting and motor controller, and (ii) mechanical business unit (which provides one-stop solutions from fabrication of tooling, design to final assembly and test of LED lighting modules/applications, microelectronic components as well as precision mechanical parts).

• Earnings-wise, the group recorded a net profit of RM0.9m (-71% QoQ) in 3QFY22, bringing its cumulative 9MFY22 net profit to RM20.4m (-5% YoY).

• Based on consensus estimates, JHM is expected to report a net profit of RM18.9m in FY December 2022 and RM41.4m in FY December 2023. This translates to forward PERs of 23.1x and 10.5x, respectively.

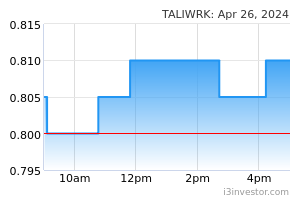

Taliworks Corporation Bhd (Technical Buy)

• After backing off from a resistance level of RM0.985 in February 2022 to a low of RM0.85 in December 2022, TALIWRK’s share price may reverse course ahead.

• Following which, the share price will likely shift higher backed by positive technical signals arising from: (i) the MACD crossing above the signal line, (ii) the stock price being on the verge of bouncing off from the lower Bollinger Band, and (iii) the appearance of the first uptick by the Parabolic SAR.

• Thus, we believe TALIWRK’s share price could advance towards our resistance thresholds of RM0.95 (R1) and RM0.985 (R2), representing upside potentials of 11% and 15%, respectively.

• Our stop loss price is set at RM0.775 (or a downside risk of 9%).

• TALIWRK’s core businesses are in: (i) the operation & maintenance of water treatment plants in Malaysia, (ii) construction & engineering, (iii) waste management, and (iv) renewable energy.

• The group reported a net profit of RM12.5m (-70% QoQ) in 3QFY22, bringing its 9MFY22 cumulative net profit to RM34.1m (-49% YoY).

• Consensus is projecting TALIWRK to report net profit of RM59.3m in FY December 2023 and RM75.9m in FY December 2024, which translate to forward PERs of 29.5x and 22.5x, respectively.

Source: Kenanga Research - 5 Jan 2023