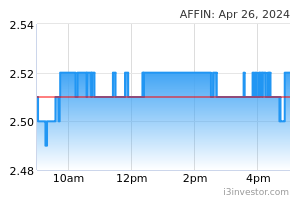

Affin Bank Bhd (Technical Buy)

• AFFIN’s share price gapped down on 30 November from the prior day’s closing of RM2.48 (after trading ex-entitlement for an interim-cum-special dividend of 4.5 sen per share) and subsequently hit a low of RM1.99 on 16 December.

• Chart-wise, we believe the share price (which closed at RM2.07 yesterday) will shift upwards ahead following the price crossing back above the lower Keltner Channel as the RSI indicator climbs out from the oversold area.

• Riding on positive technical signals, we expect the stock to rise and challenge our resistance thresholds of RM2.28 (R1; 10% upside potential) and RM2.40 (R2; 16% upside potential).

• Conversely, our stop loss price has been identified at RM1.86 (representing a 10% downside risk).

• AFFIN is a financial group that offers a suite of financial products and services to both retail and corporate customers.

• Earnings-wise, the group reported a net profit jump to RM872.4m in 3QFY22 (from RM133.2m in 3QFY21). This took 9MFY22 bottomline to RM1,162m (versus net profit of RM320.1m previously).

• Based on consensus forecasts, AFFIN’s net earnings are projected to come in at RM343m (after excluding a RM1b one-off gain from the disposal of its asset management arm AHAM) in FY December 2022 and RM548.9m in FY December 2023.

• In terms of Price/Book Value valuation, the stock is currently trading at a multiple of 0.4x based on its net book value of RM4.95 per share as of end-September 2022.

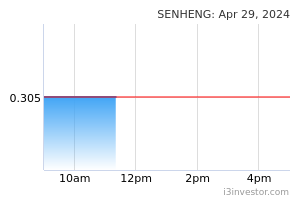

Senheng New Retail Bhd (Technical Buy)

• Listed on 25 January this year, SENHENG’s share price has been trending down since then (from an IPO offer price of RM1.07 before hitting as low as RM0.57 in July.

• On the chart, the share price (which closed at RM0.625 yesterday) is expected to stage a technical rebound as the RSI indicator is rising while the 12-day moving average is still hovering above the 26-day moving average following the MACD golden cross in late November.

• As such, we believe the stock could climb to challenge our resistance levels of RM0.70 (R1; 12% upside potential) and RM0.75 (R2; 20% upside potential).

• Our stop loss level is pegged at RM0.56 (representing a 10% downside risk).

• Fundamentally speaking, SENHENG is a leading retailer in consumer electronics with over 100 stores located across Malaysia.

• Earnings-wise, the group reported a net profit of RM14.5m in 3QFY22 (compared with a net profit of RM10.7m in 3QFY21), driven by strong demand for consumer electronics and improved retail sector activity amid an economic recovery. This took 9MFY22 bottomline to RM39.5m (versus net profit of RM34.1m previously).

• Based on consensus forecasts, SENHENG’s net earnings are projected to come in at RM67.2m in FY December 2022 and RM62.1m in FY December 2023, which translate to forward PERs of 14x this year and 15.1x next year, respectively.

Source: Kenanga Research - 22 Dec 2022