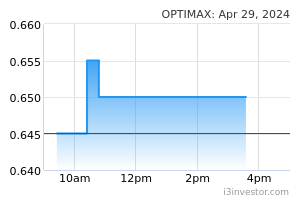

Optimax Holdings Bhd (Technical Buy)

• OPTIMAX’s share price is on the verge of staging a breakout from an immediate resistance line, a break of which might propel the stock to higher levels after moving sideways since early September 2022.

• Riding on the strengthening momentum, the stock will likely extend its upward bias backed by: (i) the positive Parabolic SAR trend, (ii) the MACD still hovering above its signal line, and (iii) the RSI crossing above the MA line.

• Hence, stock could climb to challenge our resistance thresholds of RM0.90 (R1; 11% upside potential) and RM0.98 (R2; 21% upside potential).

• We have set our stop loss price at RM0.72 (translating to an 11% downside risk from yesterday’s closing price of RM0.81).

• A healthcare service provider that specializes in eye care services, OPTIMAX posted lower net profit of RM3.7m (-19% QoQ) in 3QFY22, which lifted its 9MFY22’s earnings to RM10.9m (+25% YoY).

• Moving forward, consensus is projecting that OPTIMAX would report net profit of RM14.7m for FY December 2022 and RM16.6m for FY December 2023, which translate to forward PERs of 29.7x this year and 26.3x next year, respectively.

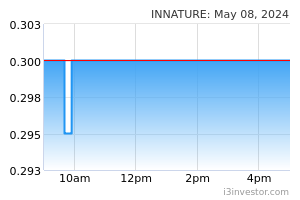

InNature Bhd (Technical Buy)

• Since our Technical Buy call made on 8 November 2022, INNATURE’s share price has appreciated 15.1% to close at RM0.61 yesterday. Continuing from where it left off, the stock will likely climb further ahead following its breakout from the descending trendline on 12 December.

• Chart-wise, the price uptrend is strengthening with the Ichimoku Cloud’s Span A line crossing above Span B line while the Chaikin Oscillator’s rise above zero is indicating net buying momentum.

• That said, the stock could advance to reach our resistance targets of RM0.68 (R1; 11% upside potential) and RM0.72 (R2; 18% upside potential).

• Our stop loss price level is pegged at RM0.54 (or an 11% downside risk).

• Fundamentally, INNATURE – which is a leading regional retailer of cosmetics and personal care products serving customers across Malaysia, Vietnam and Cambodia - offers exposure to the robust retail sales. This comes as the Malaysia Retail Industry Report has forecasted retail sales in Malaysia (which saw a 39.2% YoY jump in 1HCY22) to accelerate by 61.7% YoY in 3QCY22 with the personal care segment anticipated to show an annual growth of 102.2% in the third quarter.

• Reflecting the strong industry sales momentum, the group registered a higher net profit of RM4.6m (+537% YoY) in 3QFY22, which then brought its 9MFY22 bottomline to RM14.7m (+104% YoY).

• From a valuation standpoint, consensus is estimating INNATURE to make net earnings of RM21.3m in FY December 2022 before increasing further to RM24.2m in FY December 2023, which translate to forward PERs of 20.2x and 17.8x, respectively.

Source: Kenanga Research - 16 Dec 2022