We cut our average CPO price assumption in 2023 by 5% to RM3,800 from RM4,000 per MT. Also, the production cost is looking higher and structurally stickier, dampening future margins further. As such we are downgrading the sector from overweight to NEUTRAL from OVERWEIGHT. The sector’s asset-rich NTA, Shariah compliance (9.6% of FBM Shariah Index, 9.4% of FBMKLCI) and 1.1x PBV suggest a defensive sector with much negative news already priced. Therefore, the downgrade is more about a poorer environment for a strong upside catalyst to develop over the next 6-12 months. Sector consolidation is one potential upside but pricing this in at this juncture seems premature. KLK (OP; TP: RM25.50) remains our sector pick though.

We project CPO prices to stay elevated at an average at RM3,800 per MT in 2023 (although 5% lower than RM4,000 we previously assumed) on the back of: (i) edible oils such as palm oil are basic consumables needed for day-to-day living (ii) resumption to more normalised growth in the 2023 edible oil market after staying flattish since 2020; (iii) anticipated supply improvement into 2023 is likely to serve recovering demand rather than lifting inventory significantly; while (iv) firm existing fossil fuel prices are supportive of biofuel offtake.

A sluggish 2023 economic outlook may dampen demand for edible oil but we suspect otherwise due to the following factors.

1. About 70% of edible oil ends up in the global food chain with another 20% as biofuels, in short, edible oil is essential to consumers and industries world over. Key demand drivers for edible oil are thus very fundamental forces such as growing demographic, rising affluence and wider use of biofuels. Past economic slowdown such as the 1997 Asian financial crises or 2008 financial crisis did not hamper demand from growing 3-4% a year before, during or even after the crises.

2. However, the unprecedented spread of Covid and its impact on the global economy as well as supply chain dampened edible oil demand, which stayed flattish since 2020. Nonetheless, as some countries started to reopen their economies in late 2021 with more during 2022, demand for edible oil should revert back to the more normal 3-4% annual increment in demand over 2023 and 2024. Even China, a big market, could be starting to revert to a new post Covid normal.

3. Prices of edible oils have also eased by over 30% since mid-2022 which have drawn more interests and purchases since. At the same time, fossil fuel prices are still firm despite current weakness, prompting countries such as Indonesia to consider raising its biodiesel blend from B30 (30% palm oil) to B35 in 2023 whilst keeping the B40 target in place. Brazil may also be revising its soyabean oil biodiesel from 10% back to 14% in 2023.

Supply is recovering but fragile. Despite the disruption caused by the Ukraine conflict on sunflower output, overall edible oil supply should still inch up by 1-2% in 2022. Palm oil output is also expected to grow despite labour shortages constraining Malaysia output to levels achieved in 2021, ie flat YoY. Some supply recovery of 3-4% YoY is expected though in 2023 but as global demand is also likely to pick up at comparable pace, the net supply-demand scenario looks quite even handed for 2023 and, potentially, for 2024 as well. As such, pronounced swings in prices can be expected but firm average CPO price of RM4,500 per MT for 2022 and RM3,800 for 2023 are still expected.

Cost inflation is more structural and stickier. Higher operating cost – from labour, fertiliser to transportation costs - was a key reason for the poorer than expected recent 3Q 2022 results across the plantation sector. For the rest of 2022 and beyond in 2023, fertiliser and fuel costs have eased but staying high. Wages, the single largest category of operating cost, are flattening after 1 May 2022 but the longer-term trajectory is still upwards as minimum wages are periodically adjusted to partly reflect underlying rising inflationary pressures. As such, higher productivity is key to ensure unit production cost remained competitive hence the push to replant with higher yielding planting materials, mechanisation and adding value especially downstream.

Net zero journey has started. Supporting oil palm’s competitiveness and environmental credential thus far has been its high oil yield. This translates to the much smaller environmental footprint when compared to other oil crops. It also allows the sector to stay profitable and invest in various ESG initiatives including projects to move the sector towards net zero. For one, development of higher yielding planting materials is already underway with some planters aiming for 6 MT of CPO per Ha, possibly more. This would make oil palm 10x more productive than other oil crops. Meanwhile, 30% of palm oil mills in Malaysia (10% in Indonesia) already capture bio-gas emitted from mill effluent, significantly reducing the amount of GHG released during operation. IOI is investing into a plant to repurpose matured oil palm trunks into timber. If successful, palm wood can potentially turn oil palm into net negative as a lot of carbon is stored within each trunk. Already, about 16m MT of palm oil is now certified to meet some of the highest ESG requirements for agriculture produce around the world.

Defensive with undemanding ratings. Poorer FY23 CPO prices and earnings are largely priced. Yet the sector’s balance sheet is asset rich, not highly geared, Shariah compliant (9.6% of FBM Shariah Index, 9.4% of FBMKLCI) and palm oil is used worldwide as food or fuel. The sector’s defensive qualities are thus highly attractive amidst uncertain economic outlook. However, there is no strong upside catalyst taking shape as 2023 approaches even though the sector is highly defensive and ratings are far from demanding. Sector consolidation is one possible upside but such consideration is better assessed on a case-by-case basis.

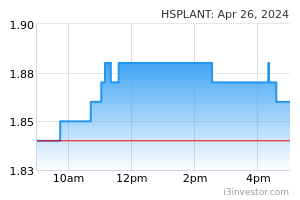

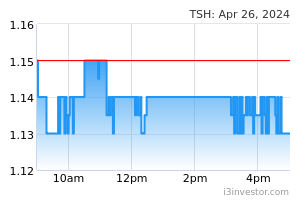

Downgrade the sector to NEUTRAL (from overweight) but keeping KLK (OP, TP RM25.50) as our sector pick given its track record, efficient upstream operations and strong regional presence. TSH (OP; TP: RM1.35) is ready to expand its planted area from 40K Ha to 60-65K Ha after paring net debt from RM816m in FY21 to RM151m (7% net gearing) by 3QFY22. HSPLANT (OP; TP: RM2.50) offers pure upstream exposure with strong net cash holdings and attractive dividend yields.

Source: Kenanga Research - 14 Dec 2022