BPPLAS is facing a slowdown in demand that is more significant than what we had initially thought, on the back of a slowing global economy. Nonetheless, its expansion plan is progressing as planned with the acquisition of a factory building which will be repurposed as a warehouse as well as to house its new machines. We cut our FY23F earnings by 13%, reduce our TP by 11% to RM1.23 (from RM1.38) and maintain our MARKET PERFORM call.

We came away from a recent engagement with BPPLAS feeling cautious on its near-term outlook. The key takeaways are as follows:

1. BPPLAS guided for moderate sales growth in 1HFY23 on the double whammy of weakening demand for its products on the back of the slowdown in the global economy and the lingering supply-chain disruptions at its customers’ end. The more generic products such as conventional stretch films (that typically makes up 25%-30% of its total stretch film production) will be hit the hardest as producers are generally price takers (more so, amidst a slowdown in demand).

2. On a brighter note, we understand that its margins may improve slightly from 4QFY22 as it has depleted its high-cost resin inventory, and as such, it would be able to start enjoying the softened resin prices.

3. BPPLAS is concluding the acquisition of a factory building on a 4- acre land near its existing plant in Batu Pahat for RM14.9m by Dec 2022. It will be repurposed as warehouse as well as to be used to house its new machines.

Forecasts. While maintaining FY22F net profit, we cut FY23F net profit forecast by 13% to reflect a flattish top line in FY23F (vs. +5%yoy we previously assumed) with a utilisation rate of 60% (vs. 60-65% we previously assumed) on the back of at least a subdued 1HFY23F amidst a slowing global economy. Recall, its utilisation averaged at 70-75% prior to the pandemic.

We like BPPLAS for: (i) its strong foothold in the South East Asia market that is expected to remain resilient despite the global economic downturn, (ii) its strong cash flow and balance sheet (net cash position) that will enable it to weather a downturn better, and (iii) its long-term capacity expansion in high-margin premium stretch film and blown film products, which will enable it to capitalise on the next upcycle. However, we are concerned over a significant decline in demand in the event of a sharp slowdown or recession in the global economy.

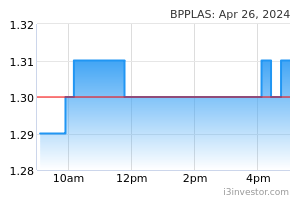

We reduce our TP by 11% to RM1.23 (from RM1.38) based on 9x FY23F PER, at a discount to the sector’s average historical forward PER of 13x largely to reflect BPPLAS’s relatively smaller market capitalisation and thin share liquidity. There is no adjustment to our TP based on ESG given a 3-star rating as appraised by us (see Page 4). Maintain MARKET PERFORM.

Risks to our call include: (i) sustained high resin cost, (ii) subdued demand for packaging materials in the event of a sharp slowdown in the global economy, and (iii) labour shortages.

Source: Kenanga Research - 8 Dec 2022