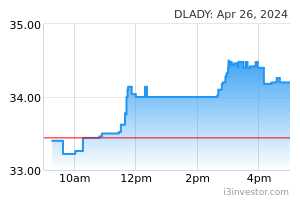

The easing diary prices globally recently will not have an immediate earnings impact to DLADY which typically holds six months’ worth of inventories. In any case, milk prices have started to climb again since Nov 2022. DLADY typically does not fully pass on higher input cost due to the B40 group constituting a huge proportion of its customers. We maintain our forecasts, TP of RM32.60 and MARKET PERFORM call.

We came away from DLADY’s analyst briefing feeling assured of its long-term prospects. The key takeaways are as follows:

1. YTD in the post-Covid era, DLADY claimed that Dutch Lady is still the preferred dairy brand for Malaysians with 60% of domestic households choosing it as their choice of liquid milk products. Not surprisingly, the 1-litre and 2-litre packs are best sellers. YTD, the demand for its milk products grew 2% YoY, supported by reformulation of dairy products by reducing sugar and increasing calcium, proteins, and vitamins. These innovative new products marketed under Banana Flavoured Milk and Juicy Milk Mango

were put onto the market during the festive season.

2. The easing dairy prices globally recently will not have an immediate impact on its earnings due to inventories acquired at high cost. DLADY typically holds six months’ worth of inventories. The data from Global Diary Trade (Nov 2022) even show that dairy milk prices have started to climb, confirming observations from other leading indicators that milk prices will indeed stay elevated well into 2023.

3. DLADY akin to its competitors has a moral obligation as well as ESG consideration to not excessively raise prices of its products. To maintain its resilient sales volume, the company will continue to focus on promotions and product innovations catering to local preferences while at the same mitigate elevated inputs costs. To promote operational efficiency and optimisation, it will source its milk powder from various strategically located branches of Friesland Campina, a Dutch multinational dairy cooperative, starting from May 2023.

4. Its Bandar Enstek manufacturing facility is expected to be fully operational by 2024. The installation and commissioning of the new site will take place in 2023 while the current manufacturing facility in Petaling Jaya will wind down commercial production. The new facility is 3x the size of the current one. In terms of production capacity, it is 2x the current one, expandable to 4x in the long term and can also be turned into a regional hub.

Forecasts. Maintained.

We like DLADY for: (i) it being the market leader in the dairy market in Malaysia, (ii) its earnings stability underpinned by the steady demand for staple food items despite the uncertain global economic outlook. However, its bottom line is vulnerable to erosion as it is unable to fully pass on the higher input cost given that the B40 group makes up a large proportion of its customer base.

We maintain our TP at RM32.60 based on an unchanged FY23F PER of 22x, which is consistent with the industry’s average forward PER. There is no adjustment to our TP based on ESG given a 3-star rating as appraised by us (see Page 4).

Risks to our call include: (i) volatile food commodity prices, and (ii) further weakening of the MYR resulting in higher cost of imported raw materials.

Source: Kenanga Research - 1 Dec 2022