Aurelius Technologies Bhd (Trading Buy)

• From a low of RM1.40 on 26 July, ATECH shares have staged a subsequent rebound to plot an upward sloping price channel pattern before closing at RM1.65 yesterday.

• Riding on the positive momentum, the stock is anticipated to continue its upward bias as the stochastic indicator’s %K line has crossed above the %D line in the oversold area while the share price has bounced off from the lower Bollinger Band.

• This will likely propel the share price to climb towards our resistance thresholds of RM1.88 (R1) and RM2.04 (R2), which represent upside potentials of 14% and 24%, respectively.

• Our stop loss level is pegged at RM1.47 (or an 11% downside risk).

• As an Electronics Manufacturing Services (EMS) player, ATECH is principally involved in the manufacturing of industrial electronic products as well as semiconductor components.

• The group reported net profit of RM7.1m (+42% QoQ) in 2QFY23 amid an improved global supply chain and logistics backdrop. This brought its cumulative net earnings to RM12.1m (+18% YoY) in 1HFY23.

• Moving forward, consensus is forecasting that ATECH would report a net profit of RM31.7m in FY Jan 2023 and RM46.6m in FY Jan 2024, which translate to forward PERs of 18.6x and 13x, respectively.

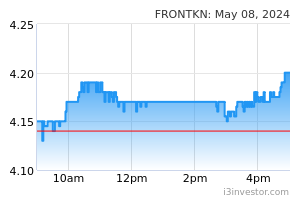

Frontken Corporation Bhd (Trading Buy)

• In tandem with the broad market sell-off, FRONTKN’s share price tumbled to as low as RM2.40 on 11 October before closing at RM2.47 yesterday as it found an intermediate support at the 61.8% Fibonacci Retracement level.

• On the chart, the stock is expected to extend its technical rebound ahead backed by the following positive signals: (i) the stochastic indicator is climbing out from the oversold zone, and (ii) the share price has crossed back above the lower Bollinger Band.

• On the way up, the stock could advance towards our resistance targets of RM2.80 (R1) and RM3.05 (R2), which represent upside potentials of 13% and 23%, respectively.

• Our stop loss level is pegged at RM2.18 (or a 12% downside risk).

• Business-wise, FRONTKN is involved in the provision of surface and mechanical engineering solutions to a variety of heavy industries clientele in the oil and gas, power generation, semiconductors and marine sectors.

• Recently, FRONTKN reported a net profit of RM32.2m in 2QFY22 (+21.5% QoQ), which brought its 1HFY22 bottomline to RM58.7m (+23% YoY).

• The robust YTD financial performance suggests that the group is on track to meet consensus expectations for FRONTKN to make net profit of RM127.2m in FY December 2022 before rising further to RM155.5m in FY December 2023. This translates to forward PERs of 30.5x and 25x, respectively.

Source: Kenanga Research - 20 Oct 2022