Impact POSITIVE

Measures

• RM1.1b for upgrading and maintenance of public schools.

• RM1.2b to improve dilapidated school infrastructures in Sabah and Sarawak.

• RM430m to build 5 new schools in Sabah, Sarawak, Terengganu and Selangor.

• RM420m to improve dilapidated hospitals and clinics with priority given to rural areas in Sabah and Sarawak.

• RM1.8b for construction of new hospitals and clinics i.e. Hospital Maran, Women and kids block at Hospital Melaka, 5 new clinics in Linggi, Negeri Sembilan; Penampang, Sabah; and Sepupok, Sarawak.

• RM118m to maintain Rumah Keluarga Angkatan Tentera

• RM42m to upgrade and improve PDRM quarters. RM28m provision to proceed with 3 quarters construction under the Prison Department.

• Commit RM15b flood mitigation measures up until 2030. RM700m will be mobilised in 2023 to kickstart the following projects:

- Sabo Dam (RM500m),

- Dual function reservoir along Sungai Rasau and Sungai Klang (RM2b) and,

- ontegrated river basin project in Golok River, Kelantan (RM500m).

• To launch new Public Private Partnership (PPP) Master Plan 2023-2032 which will drive infrastructure project implementation through user pay mechanism (like toll roads) or in-kind payment such as land swaps.

• Establish RM250m infrastructure fund to support the implementation of high impact PPP projects.

• EPF to invest RM3b in Kwasa Damansara up until 2025.

• Highway network at Pengerang to be upgraded through the construction of a new lane with direct access to Senai Desaru Expressway.

• RM510m to upgrade the Senai Utara-Pandan section of the North-South highway to 6 lanes (from 4 lanes).

• RM145m to maintain, upgrade and construct sporting facilities in the whole country.

• RM16.5b allocated for the transport sector i.e. (i) Pan Borneo Highway, (ii) Gemas JB Double Track, (iii) ECRL, (iv) RTS, and (v) Central Spine Road.

• RM11.4b earmarked for the maintenance and repairs of federal roads and government buildings.

• RM3.3b allocated for MRT3 in the year 2023. MRT3 total project cost is estimated to be RM50.2b.

• RM2.55b for rural infrastructure focusing on Sabah and Sarawak. Among these are:

- RM1.5b for 500km worth of rural roads.

- RM472m for rural electrification.

- RM381m for rural water infrastructure.

- RM123m for 6,800 street lights.

- RM54m for 85 new bridges

• RM5.2b allocated for state road maintenance under MARRIS.

• RM11.7b allocated for Sarawak and Sabah infrastructures relating to water, electricity roads etc.

• RM1.4b for the five economic corridors. Among these are:

- RM80m for dairy farm in Chuping, Perlis.

- RM80m for Johor Bus Rapid Transit.

- RM250m for the expansion of Sepangar Bay Container Port.

- RM100m for Samalaju Water Supply Infrastructure Project Phase 3.

• RM150m to develop cities bordering Thailand and Kalimantan, Indonesia i.e. (i) Bukit Kayu Hitam in Kedah, (ii) Selabakan in Sabah, and (iii) Tebedu and Bakelalan in Sarawak.

• RM3.7b for small and medium sized projects, of which RM500m is for contractors between grade G1 and G4.

Comments

• We are positive on the high development expenditure of RM95b in the budget – a 32% increase from the estimated amount in 2022. The outsized amount reinforces our view that domestic consumption (in the form of massive infrastructure spending) is needed to shield our local economy from the external uncertainties – which would benefit local contractors in general.

• Meanwhile, with the establishment of the new Public Private Partnership Masterplan 2022-2032, we anticipate more concessions to be awarded. In more recent times, the government has approved 3 new toll concessions i.e. PJD Link, KL NODE Highway, and Bangi Putrajaya Highway.

Beneficiaries

• Infrastructure contractors will greatly benefit from the higher expenditure allocation that would help replenish their order-books.

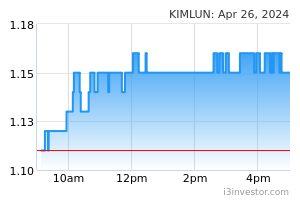

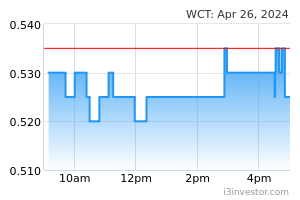

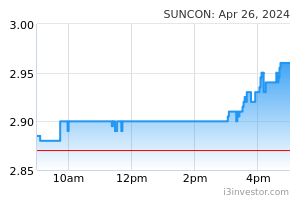

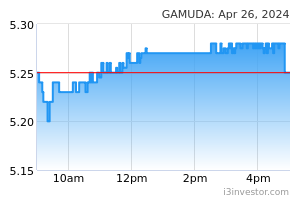

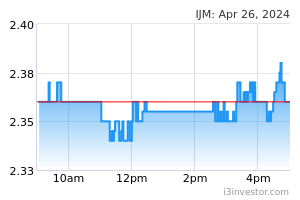

• Under our coverage, GAMUDA (OP; TP: RM5.15), IJM (MP; TP: RM1.75) and SUNCON (MP; TP: RM1.60) could benefit from the flood mitigation measures, Pan Borneo, ECRL and MRT3 projects. WCT (MP; TP: RM0.43) will benefit from MRT3, road related works, and the continuous expansion of Sepangar Bay Container Port which they are currently in the midst of constructing the first phase of the expansion. Meanwhile, KIMLUN (OP; TP: RM1.10) will potentially benefit from Central Spine Road, RTS, Johor BRT, Pan Borneo and road related upgrade works.

Source: Kenanga Research - 8 Oct 2022