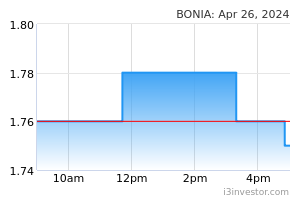

Bonia Corp Bhd (Technical Buy)

• After a retracement from a recent high of RM2.54 on 26 August to close at RM1.96 yesterday following its intermediate support at RM1.90 last week, BONIA could bounce off from a positive sloping trendline that stretches back to mid-March this year.

• With the stochastic indicator likely to climb out from oversold zone and the appearance of a bullish dragonfly doji candlestick recently, an upward shift in the share price is anticipated.

• Riding on the technical strength, the stock is expected to challenge our target thresholds of RM2.25 (R1; 15% upside potential) and RM2.40 (R2; 22% upside potential).

• We have pegged our stop loss price level at RM1.70 (representing a downside risk of 13%).

• Business-wise, Bonia is involved in the design, manufacturing, retailing, and wholesale of leatherwear, footwear, men’s apparel and accessories.

• Fundamental-wise, BONIA posted a net profit of RM17.9m in 4QFY22 (+43.2% QoQ) which brought full-year FY June 22 net profit to RM45m (+223% YoY), on the back of strong consumer spending after the global lockdown.

• Based on consensus forecasts, the group is expected to report a net profit of RM43.5m in FY June 2023 and RM 45.7m in FY June 2024, translating to forward PERs of 9.1x and 8.5x, respectively.

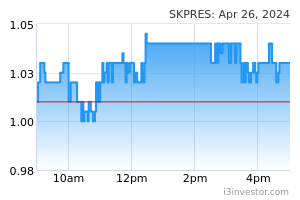

SKP Resources Bhd (Technical Buy)

• A decline of 2.3% in SKPRES’s share price may signal a timely opportunity for investors to position for an ensuing technical rebound.

• On the chart, continuing the price reversal from a recent low of RM1.43 on 7 July this year, SKPRES – which ended at RM1.70 yesterday after a reversal from Fibonacci Retracement principle’s 38.2% level – could extend the positive trajectory ahead within the upward channel.

• The upward shift will likely be backed by bullish technical signals arising from the prevailing uptrend of the Parabolic SAR indicator and probable shift of %K line direction from bottom of stochastic.

• Thus, the stock is anticipated to climb further and challenge our resistance targets of RM1.92 (R1; 13% upside potential) and RM2.04 (R2; 20% upside potential).

• Our stop loss price level is set at RM1.50 (or a 12% downside risk).

• SKPRES – which is predominately engaged in manufacturing of plastic products and moulds at its plant in Malaysia reported a net profit of RM37.2m in 1QFY23 (+14% YoY).

• Going forward, consensus is forecasting SKPRES to report higher net profit of RM184.6m in FY March 2023 and RM212.4m in FY March 2024, which translate to forward PERs of 14.2x and 12.5x, respectively.

Source: Kenanga Research - 27 Sept 2022