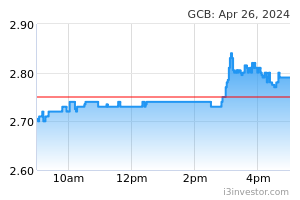

Guan Chong Bhd (Technical Buy)

• After retracing from a recent high of RM2.52 in mid-August to close at RM2.30 yesterday, GCB shares could bounce off from a positive sloping trendline that stretches back to mid-July this year.

• With the stochastic indicator showing the %K line cutting above the %D line in the oversold zone and the appearance of a bullish dragonfly doji candlestick recently, an upward shift in the share price is anticipated.

• Riding on the technical strength, the stock is expected to advance towards our resistance thresholds of RM2.52 (R1; 10% upside potential) and RM2.62 (R2; 14% upside potential).

• We have placed our stop loss price level at RM2.09 (representing a downside risk of 9%).

• A manufacturer of cocoa-derived food ingredients (namely cocoa mass, cocoa butter, cocoa cake and cocoa powder), GCB saw a jump in net profit to RM44.6m (+23% YoY) in 2QFY22, bringing 1HFY22 bottomline to RM97.9m (+39% YoY).

• Moving forward, consensus is forecasting GCB would make net earnings of RM215.7m for FY December 2022 and RM259.7m for FY December 2023. This translates to forward PERs of 12.0x this year and 9.9x next year, respectively with its 1-year forward rolling PER presently hovering slightly above the minus 1SD level from its historical mean.

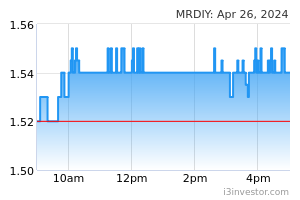

MR D.I.Y. Group (M) Bhd (Technical Buy)

• Yesterday’s 3.8% decline in MRDIY’s share price may present a timely opportunity for investors to position for an ensuing technical rebound.

• On the chart, continuing the price reversal from a recent low of RM1.91 in late June this year, MRDIY – which ended at RM2.03 yesterday – could extend the positive trajectory ahead.

• The upward shift will likely be backed by bullish technical signals arising from the share price crossing back above the lower Bollinger Band and the prevailing uptrend of the Parabolic SAR indicator.

• Hence, the stock is expected to make its way towards our resistance targets of RM2.23 (R1; 10% upside potential) and RM2.32 (R2; 14% upside potential).

• Our stop loss price level is set at RM1.84 (or a 9% downside risk).

• A home improvement retailer with 993 stores spread across Malaysia and Brunei, MRDIY reported net profit of RM135.2m (+65% YoY) in 2QFY22, taking its first half performance to RM235.7m (+14% YoY).

• According to consensus expectations, the group is projected to log net earnings of RM521.4m for FY December 2022 and RM630.6m for FY December 2023.

• In terms of valuation, this translates to forward PERs of 36.7x this year and 30.3x next year, respectively with its 1-year forward rolling PER currently trading at 1SD below its historical mean.

Source: Kenanga Research - 20 Sept 2022