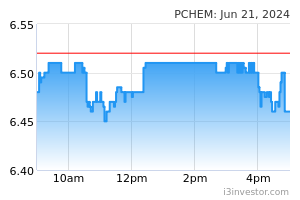

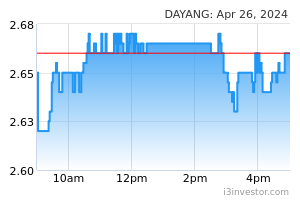

We maintain OVERWEIGHT on the oil & gas sector. The recently concluded 2QCY22 reporting season saw a marked improvement (against expectations) from the last quarter. While larger players were hit by project cost overrun, the smaller names did better due to rising activity levels on the back of the buoyant oil prices. We expect national oil company Petronas to ramp up capex in 2HCY22, as the amount spent in 1HCY22 is still significantly trailing its full-year guidance of RM60b. This should spur activities in the industry. We maintain our average Brent crude oil price assumption of USD100-110/barrel in 2022-23. Our top picks are PCHEM (OP; TP: RM11.00) and DAYANG (OP; TP: RM1.30).

A decent reporting season. The recently concluded 2QCY22 reporting season saw a marked improvement (against expectations) from the last quarter. Out of a total of 11 companies under our coverage, the percentage that disappointed dropped to 27% (vs. 45% in 1QCY22). On an even more encouraging note, 36% beat expectations (vs. nil in the last quarter).

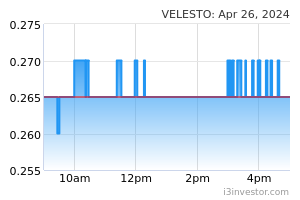

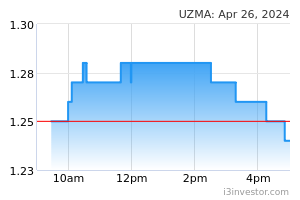

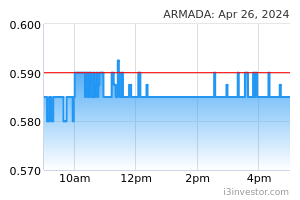

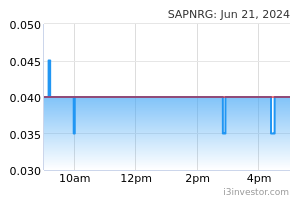

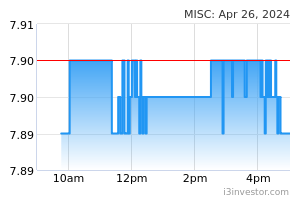

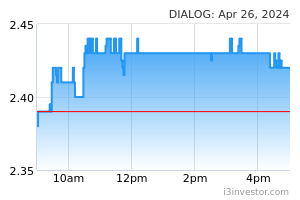

Two big boys disappointed, smaller players generally did well. Two FBMKLCI constituent stocks within the sector missed expectations, namely, DIALOG (on higher downstream project costs) and MISC (due to cost escalation its Mero-3 FPSO conversion works in China), both being hit by cost inflation. Conversely, smaller names, mostly local contractors such as DAYANG, SAPNRG and UZMA did well driven by a recovery of activity levels amidst strong oil prices. VELESTO lagged behind its peers as its rig utilisation remained lack-lustre in 1HCY22. Meanwhile, FPSO-player ARMADA surprised to the upside thanks to reduced finance cost after having actively pared down its borrowings to a much more manageable level.

We expect national oil company Petronas to ramp up capex in 2HCY22, as the amount spent of RM18.9b in 1HCY22 (+49% YoY) is still significantly trailing its full-year guidance of RM60b (which almost doubled from 2021). This will benefit DAYANG (from higher demand for offshore maintenance, construction and modification (MCM), and hook-up and commissioning (HUC) works), UZMA (on higher activities in the brownfield segment such as well services, oil production enhancement and optimisation, as well as late-life operation and maintenance) and VELESTO (from improved demand for jack-up rigs).

There are concerns over Petronas’s capex plans being jeopardised by the doubling of its dividend commitment to the government of RM50b in 2022 (from RM25b in 2021). We are unperturbed as Petronas is set to post strong FY2022 earnings (barring a major crash in oil prices in 2HCY22) and it has a strong cash buffer of RM103b, which is the highest since 2018.

We maintain OVERWEIGHT on the sector underpinned by sustained firm oil prices, spurring capex and hence activity levels in the oil & gas industry. We maintain our average Brent crude oil price assumption of USD100- 110/barrel in 2022-23. Comparatively, Petronas projects Brent crude oil price to range between USD90-95/barrel in 2HCY22, with a downside bias in 2023. Top picks for the sector remain PCHEM and DAYANG.

We like PCHEM given: (i) its favourable feed-cost structure against peers – i.e. most of PCHEM’s gas feed stock can be procured from Petronas at a fixed pre-agreed price, while others may be hampered by the volatile input cost environment, and (ii) its dominant market share regionally, which will be further cemented by the start-up of its Pengerang complex in 2HCY22 - increasing its capacity by ~15%). We like DAYANG because it is the market leader within the MCM and HUC space.

Source: Kenanga Research - 12 Sept 2022