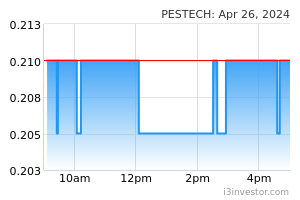

Pestech International Bhd (Technical Buy)

• PESTECH’s share price has fallen 72% since November 2021 from its 52-week high of RM1.02 to close at RM0.285 yesterday. With the share price currently fluctuating near its 52-week low of RM0.275, a technical rebound from an oversold position is anticipated.

• Chart-wise, we believe the share price will shift upward as: (i) both the Stochastic and RSI indicators are set to climb out from the oversold zone, and (ii) the stock price has crossed back above the lower Bollinger Band.

• Hence, we expect the stock to move higher towards our key resistance levels of RM0.32 (R1; 12% upside potential) and RM0.34 (R2; 19% upside potential).

• Conversely, our stop loss price has been identified at RM0.25 (representing a 12% downside risk).

• Business-wise, PESTECH is an integrated electrical power technology company with core businesses in electrical system, transmission line & power cables, infrastructure asset management, power generation, rail electrification & signalling and power distribution & smart grid.

• The group recorded a net loss of RM13.8m in 4QFY22 mainly due to project cost overrun and delays in the shipment of equipment from China to Malaysia on the back of the intermittent lockdowns in China. This took its full-year net profit to RM13.7m (versus FY21’s net profit of RM66.4m).

• Based on consensus forecasts, PESTECH’s net earnings is projected to come in at RM33.7m in FY June 2023 and RM44.5m in FY June 2024, which translate to forward PERs of 8.3x this year and 6.3x next year, respectively.

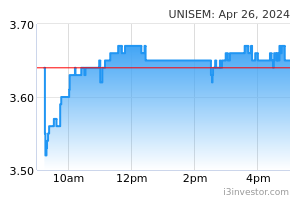

Unisem (M) Bhd (Technical Buy)

• The share price of UNISEM has been sold down since January 2021 from RM4.08 to as low as RM2.07 (a 52-week low) in July 2022 before closing at RM2.59 yesterday.

• On the chart, the share price is expected to stage a technical rebound soon as the stochastic and RSI indicators are in the midst of reversing from the oversold area.

• Riding on the upward momentum, the stock could rise to challenge our resistance levels of RM2.86 (R1; 10% upside potential) and RM3.05 (R2; 18% upside potential).

• Our stop loss level is pegged at RM2.32 (representing a 10% downside risk).

• Fundamentally speaking, UNISEM provides semiconductor assembly and test services which include wafer bumping, wafer probing, wafer grinding, leadframe and substrate integrated circuits packaging, wafer level chipscale packaging as well as radio frequency, analog, digital and mixed-signal test services.

• Earnings-wise, the group reported a net profit of RM70.4m (+39% QoQ, 29% YoY) in 2QFY22, which brought 6MFY22 bottomline to RM121.1m (+21% YoY).

• Based on consensus forecasts, UNISEM’s net earnings is projected to come in at RM242.4m in FY December 2022 and RM271.7m in FY December 2023, which translate to forward PERs of 17.2x this year and 15.4x next year, respectively.

Source: Kenanga Research - 9 Sept 2022