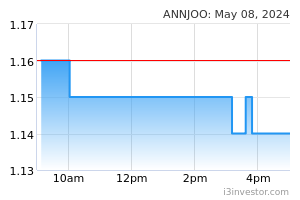

Ann Joo Resources Bhd (Technical Buy)

• Following the formation of a bullish cup-and-handle chart pattern in mid-July, ANNJOO’s share price – which has subsequently retraced to RM1.03 yesterday – may find intermediate support at the Fibonacci retracement level of 78.6%.

• With the stochastic indicator reaching the oversold zone and the %K line on the verge of crossing above the %D line, the stock may stage a technical rebound anytime soon.

• On the chart, an upward shift is anticipated as the stock price has crossed back above the lower Bollinger Band.

• Following which, the stock will probably advance towards our resistance targets of RM1.20 (R1; 17% upside potential) and RM1.33 (R2; 29% upside potential).

• We have pegged our stop loss price level at RM0.89 (representing an 14% downside risk).

• A manufacturer of steel and hardware products catering to the building and construction industry, ANNJOO reported a net profit of RM34.1m (-3% QoQ) in 2QFY22, bringing its cumulative bottomline to RM69.1m (-58% YoY) in 1HFY22, dragged mainly by a decline in steel prices.

• Going forward, consensus is projecting the group would post net profit of RM133.3m for FY December 2022 and RM107m for FY December 2023, which translate to forward PERs of 4.5x and 5.6x, respectively

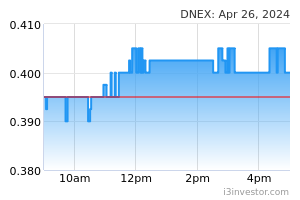

Dagang Nexchange Bhd (Technical Buy)

• After rising from a low of RM0.715 in mid-July to a high of RM0.935 on 15 August, DNEX’s share price has retraced to RM0.82 yesterday, probably finding support at the Fibonacci retracement level of 50%.

• A resumption of the upward momentum is expected when the stochastic indicator reverses from the oversold zone and the share price moves back above the lower Bollinger Band.

• In that case, an ensuing upward shift could propel the stock to challenge our resistance targets of RM0.94 (R1; 15% upside potential) and RM1.00 (R2; 22% upside potential).

• Our stop loss price level is set at RM0.72 (or a 12% downside risk).

• Earnings-wise, DNEX – a conglomerate that is involved in IT solutions, e-services for trade facilitation, semiconductor and energy sectors – posted a net profit of RM550m for FY June 2022 (+410% YoY), mainly contributed by its semiconductor and energy businesses.

• Based on consensus estimates, DNEX is projected to make net earnings of RM231.5m for FY23 and RM278m for FY24, which translate to forward PERs of 11.5x and 9.2x, respectively.

Source: Kenanga Research - 2 Sept 2022