KIMLUN’s 1HFY22 results met expectations. We expect a bumper 2H for KIMLUN with its RM780m Sabah-Sarawak Link Road project moving up the S-curve in terms of profit recognition. We like KIMLUN for its strong earnings visibility, underpinned by RM1.9b order backlogs. It is in a good position to garner a slice of action in the Johor Bahru – Singapore Rapid Transit System (RTS) project. We maintain our forecasts, TP of RM1.10 and OUTPERFORM call. Within our expectation. 1HFY22 CNP came in at only 10% of both our full-year forecast and the consensus full-year estimate. However, we consider the results within expectation as we expect a bumper 2H with its key project, i.e. the Sabah-Sarawak Link Road (RM780m), moving up the S-curve in terms of profit recognition (partly also assuming it gradually resolves the labour shortage issue). 1HFY22 revenue declined 15% YoY as most of its key jobs were still at initial stages (due to a gap in order-book replenishment a year ago). CNP dropped by a larger 76% due to poor overhead absorption on a decline in its turnover.

Outlook. YTD, KIMLUN has secured RM290m worth of new jobs (comprising RM200m construction jobs and RM90m orders for precast concrete products). We believe it is still premature to rule out the possibility of it meeting our full-year assumption of RM800m (as well as its guidance for RM600m-RM800m) contract replenishments. KIMLUN is in a good position to garner a slice of action in the Johor Bahru – Singapore RTS project, i.e. for the supply of precast concrete segments, given the proximity of its plant in Ulu Choh, Johor. Meanwhile, the company is also eyeing opportunities for Iskandar Bus Rapid Transit (BRT), Sarawak Autonomous Rapid Transit (ART) and Pan Borneo Highway Sarawak (Phase 2) but we understand that the tenders for these projects have yet to be called.

Forecasts and assumptions. We maintain our forecasts and FY22 order-book replenishment assumption of RM800m. As at end-June 2022, its outstanding order-book stood at RM1.9b (construction: c.RM1.57b; precast concrete products: RM0.34b), which is fairly close to the peak of RM2.4b during the last upcycle in FY17.

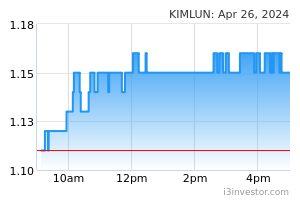

Maintain OUTPERFORM with an unchanged TP of RM1.10

based on 9x PER, at a 50% discount to the 18x we ascribed to market leader GAMUDA given KIMLUN’s much smaller size. There is no adjustment to TP based on ESG for which it is given a 3-star ESG rating as appraised by us (see Page 4). We like KIMLUN for: (i) the improved sentiment on construction stocks as the government is expected to expedite the rollout of public projects ahead of the GE15, (ii) KIMLUN’S geographically diversified earnings base with a strong presence in the precast concrete product segment in Singapore, and (iii) its strong earnings visibility backed by an outstanding order-book of RM1.9b which could keep it busy for the next two years.

Risks to our call include: (i) sustained weak flows of construction jobs from both public and private sectors, (ii) project cost overrun and liabilities arising from liquidated ascertained damages (LAD), and (iii) rising cost of building materials.

Source: Kenanga Research - 30 Aug 2022