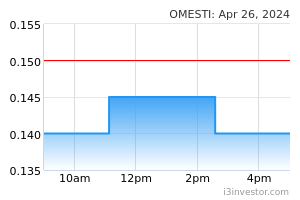

Omesti Bhd (Trading Buy)

• A rounding bottom formation could be in the making as OMESTI shares gradually turn up after oscillating in a sideways pattern since mid-March this year.

• On the chart, after overcoming the 100-day SMA and with the Parabolic SAR indicator signalling an uptrend, the share price is expected to advance towards our resistance thresholds of RM0.43 (R1) and RM0.47 (R2), which offer upside potentials of 13% and 24%, respectively.

• Our stop loss price level is pegged at RM0.33 (representing a downside risk of 13% from yesterday’s closing price of RM0.38).

• Comprising a grouping of ICT companies, OMESTI’s business focus is to assist clients achieve their digital transformation strategies via the provision of information technology services in terms of hardware, software, consultancy and maintenance mostly to the telecommunication, oil & gas and government sectors.

• The group’s performance – which saw net loss of RM20.2m in FY March 2022 (versus net loss of RM1.2m previously) – has been hit mainly by the impact of the COVID-19 pandemic as well as rising costs and supply chain disruptions. Nonetheless, the worst may probably be over as economic activities gather pace going forward.

• In terms of valuations, based on its book value per share of RM0.36 as of end-March 2022, the stock is currently trading at Price/Book Value multiple of 1.06x (or just below the minus 1 SD level from its historical mean).

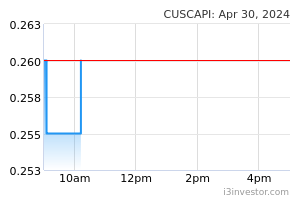

Cuscapi Bhd (Trading Buy)

• After bouncing off from a recent low of RM0.215, which is near a key support line that stretches back to the beginning of March last year, CUSCAPI’s share price may attempt to plot a trend reversal ahead.

• Following the recent appearance of bullish dragonfly doji candlesticks and on the back of the strengthening MACD signal, the stock could be on its way to challenge our resistance targets of RM0.28 (R1; 17% upside potential) and RM0.32 (R2; 33% upside potential).

• We have placed our stop loss price level at RM0.20 (or a 17% downside risk from its last traded price of RM0.24).

• CUSCAPI is primarily involved in the provision of: (i) restaurant management solutions, offering a comprehensive range of integrated services such as outlet management solutions, information technology security solutions, IT consulting services and contact centre outsourcing services, and (ii) IT solutions to businesses across various industries, including retail, hospitality and automotive.

• The group saw a reduction in net loss to RM1.2m in 3QFY22 (from RM3.7m in 3QFY21), thus narrowing its 9MFY22 net loss to RM2.5m (versus -RM10.0m previously).

• Financially stable, CUSCAPI’s debt-free balance sheet is backed by cash holdings of RM17.2m (or 1.8 sen per share) as of end-March 2022.

• Based on its book value per share of RM0.087 as of end-March 2022, the stock is presently trading at Price/Book Value multiple of 2.76x (or around its historical mean).

Source: Kenanga Research - 16 Aug 2022