Inari Amertron Bhd (Trading Buy)

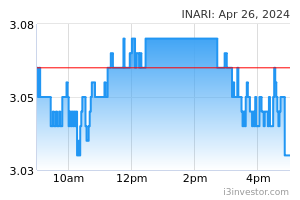

• The share price of INARI – which has trended downwards from a peak of RM4.30 in late November 2021 – may extend its technical rebound after bouncing off from a trough of RM2.36 in July this year.

• Technically speaking, the stock price is expected to continue its upward bias as the DMI Plus has cut above the DMI Minus and the MACD has crossed over the signal line.

• Thus, we believe that INARI’s share price will rise further to challenge our resistance levels of RM2.94 (R1; 10% upside potential) and RM3.05 (R2; 14% upside potential).

• On the downside, our stop loss level has been identified at RM2.40 (representing a 10% downside risk).

• Fundamental-wise, INARI is involved in the electronics manufacturing services (EMS) industry, providing Outsourced Semiconductor Assembly and Test (OSAT) niche services in Radio Frequency (RF) System in Package (SiP) for smart mobile devices, fiber-optic transceivers and other electronics manufacturing services.

• INARI has announced revenue of RM360.3m (a 5% YoY increase) and net profit of RM90.5m (a 10% YoY increase) in 3QFY22 thanks to higher contributions from all business segments. This took the group’s 9MFY22 bottomline to RM302m (+28% YoY).

• Based on consensus estimates, INARI’s net earnings is projected to come in at RM393.9m in FY June 2022 and RM447.1m in FY June 2023, which translate to forward PERs of 25x and 22.1x, respectively.

Magni-Tech Industries Bhd (Trading Buy)

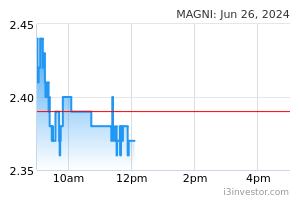

• MAGNI’s share price has been trending down since early December 2020 from RM2.66 to close at RM1.85 yesterday. With the share price currently fluctuating near its 52-week low, further downside risk may be cushioned by a short-term support line at the RM1.83 level.

• On the chart, a technical rebound could be forthcoming as both the stochastic and RSI indicators are set to climb out from the oversold area.

• With that, we expect the stock to shift higher and test our resistance thresholds of RM2.03 (R1; 10% upside potential) and RM2.13 (R2; 15% upside potential).

• Conversely, our stop loss level is pegged at RM1.67 (representing a 10% downside risk).

• MAGNI is involved in the manufacturing and sales of: (i) garments, and (ii) flexible plastic packaging goods and corrugated cartons (focusing on consumables, food and beverage, pharmaceuticals and healthcare related products).

• The group reported net profit of RM26. 9m (-12.1% YoY) in 4QFY22 as revenue declined due to lower sales orders from both the garments and packaging segments, bringing full-year FY22 net earnings to RM91.7m (-27. 9% YoY).

• Based on consensus forecasts, MAGNI’s net earnings is projected to come in at RM110.0m in FY April 2023 and RM129.0m in FY April 2024, which translate to forward PERs of 7.3x this year and 6.2x next year, respectively.

Source: Kenanga Research - 21 Jul 2022