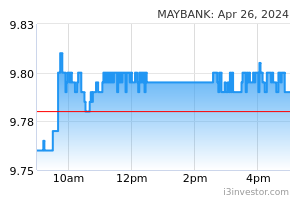

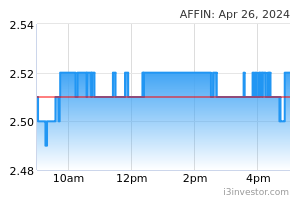

Aligned with our in-house expectations, BNM raised the OPR by another 25 bps to 2.25% yesterday. We believe there will be two additional 25 bps hikes in the subsequent September and November 2022 MPC meetings. As global macros continue to be stirred by inflationary concerns from rising commodities prices and looming restrictions, tighter monetary policies are usually called for to keep inflation in check. That said, this will be a boon for the banks as higher rates would alleviate funding cost pressures from tightening competition for CASA. In line with corporate guidances, our annualised NIM assumptions are raised by 2-4 bps which translates to net earnings upgrades of 2-3% (save for MBSB which is expected to see compression due to its unfavourable fixed-rate loans mix). We keep our OVERWEIGHT call on the sector with an emphasis on dividend counters as a shelter against recession-pulled sentiment. Our top picks are MAYBANK (OP; TP: RM11.05) which is our highlighted dividend champion (7-8% yield) while still defending its leading market share in loans and deposits. We favour AFFIN (OP; TP: RM2.45) as a tactical pick as possible special dividends post-AHAM and AXA disposals could spur market interest while boosting its more than decent 5-6% dividend yield.

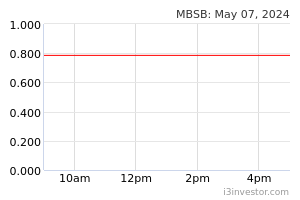

Another bump to earnings. As expected and guided by corporate guidances, another round of 2-4 bps increment to NIMs is enjoyed by the banks. As with our previous May 2022 OPR hike update, we reflect the impact of this 25 bps increase to our earnings assumptions which translates to EPS gains of up to 3%. We highlight the exception of MBSB which had an unfortunately higher proportion of fixed-rate financing accounts relative to its deposits over the previous years, reversing what would otherwise be similarly higher earnings for the group.

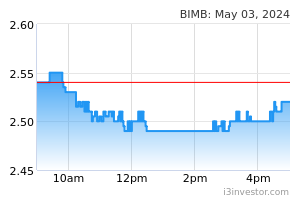

Following our earnings adjustments, several of our GGM-derived TPs were changed (refer to the overleaf for details of our new TP and calls). Notably, we upgraded BIMB to OP (from MP) as we believe its risk-to-reward ratio is fairer at current price levels while the scarcity of Shariah-compliant financiers could draw investors seeking exposure. Meanwhile, MBSB saw a slight drop in its TP which warranted us to maintain our UP call.

Maintain OVERWEIGHT on the Banking Sector. We continue to find strong value in the banking space as leverage against inflationary pressure as we opine the demand for loans will only improve as economic activity picks up post-pandemic. Additionally, given stringent cost controls, we do not foresee any significant deviation in the operating structure of banks amidst widescale macro developments. As for our Top Picks, we still like MAYBANK (OP; TP: RM11.05) which we highlight for stellar dividend returns (7-8%) paired by its commendable asset quality readings (GIL: <1.9%, below listed peers’ average of 2.0%) despite being the leader in loans and deposits share. For the smaller cap banks, we believe AFFIN (OP; TP: RM2.45) presents opportunities with the return in earnings growth prospects, thanks to its AIM22 initiatives. With the disposal of AHAM and AXA Affin to be completed in 3QCY22, we do not discount special payouts which could bump up an already decent expected yield of 5-6%.

Source: Kenanga Research - 7 Jul 2022