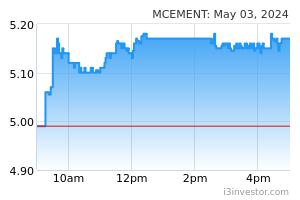

Malayan Cement Bhd (Trading Buy)

• A retracement from its recent high of RM2.95 in the second half of April this year has brought MCEMENT shares to close at RM2.20 yesterday, nearing a double-bottom reversal formation that was seen in late January 2021 and late February 2022 (when the stock had previously bounced off from a trough of RM1.97).

• With the appearance of a bullish hammer candlestick recently, as well as an ongoing unwinding from the oversold zone by both the stochastic and RSI indicators, the share price will probably show an upward bias ahead.

• On the way up, the stock could advance towards our resistance thresholds of RM2.47 (R1) and RM2.70 (R2), which represent upside potentials of 12% and 23%, respectively.

• Our stop loss price level is pegged at RM1.96 (or an 11% downside risk).

• Business-wise, as the largest cement manufacturer in Malaysia, MCEMENT offers exposure to the prevailing elevated cement selling prices, which have risen further by 12.2% YoY in May this year according to a report just released by the Department of Statistics Malaysia.

• On the back of its improved fundamentals, the group reported net profit of RM18.2m in 3QFY22 (up 402% YoY), taking 9MFY22’s bottomline to RM49.4m (compared with net loss of RM2.6m in 9MFY21).

• The strengthening financial performance is expected to continue with consensus forecasting MCEMENT to make net earnings of RM68.2m in FY June 2022 before soaring to RM129.6m in FY June 2023.

• In terms of valuation, based on its book value per share of RM4.38 as of end-March 2022, the stock is presently trading at a compelling Price/Book Value multiple of 0.50x (or near the minus 2SD level from its historical mean).

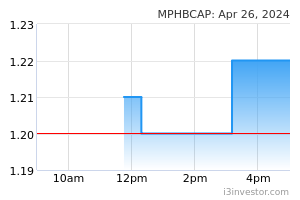

MPHB Capital Bhd (Trading Buy)

• After bouncing off from a recent trough of RM1.24 in end-January this year, the uptrend pattern is expected to persist as MPHBCAP’s share price remains above: (i) a positive sloping trendline that stretches back to late April 2020, (ii) the 50-day SMA support line, and (ii) a saucer reversal pattern.

• On the back of the emergence of a bullish hammer candlestick and with the MACD indicator also showing strengthening momentum, the upward trajectory could continue as the stock is on track to climb towards our resistance targets of RM1.63 (R1; 10% upside potential) and RM1.71 (R2; 16% upside potential).

• We have set our stop loss price level at RM1.33 (representing a downside risk of 10% from its last traded price of RM1.48).

• On the fundamental front, MPHBCAP – which is involved in the underwriting of general insurance business, provision of general loan financing services and property investment & management – saw its net loss narrowing to RM0.3m in 1QFY22 (from 1QFY21’s net loss of RM20.9m).

• Valuation-wise, based on its book value per share of RM2.60 as of end-March 2022, the shares are presently trading at Price/Book Value multiple of 0.57x (or marginally below the +1SD level from its historical mean).

• In terms of recent corporate development, MPHBCAP is in the midst of disposing of its entire general insurance business (held under MPI Generali) for RM508.2m cash. Post completion of the divestment exercise (which is expected to be in 3Q2022), MPHBCAP intends to reward its shareholders with a distribution of RM321.8m or 45.0 sen per share (via a capital reduction and repayment of RM286.0m and a dividend payment of RM35.8m).

Source: Kenanga Research - 22 Jun 2022