Mestron Holdings Bhd (Trading Buy)

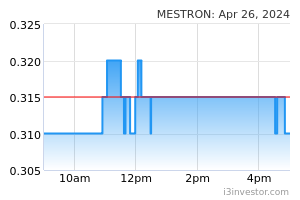

• Following a peak of RM0.46 in mid-May 2021, MESTRON’s share price proceeded to form lower highs before gapping down from RM0.39 to RM0.335 (-14%) in August 2021. Subsequently, after reaching a low of RM0.285 in March 2022, the share price then trended higher.

• With the ADX indicator rising steadily, this indicates the stock’s bullish momentum is intact.

• We believe the stock is poised to trend higher on the back of the positive technical signals arising from: (i) the rising MACD indicator, (ii) the stock trading above its key SMAs – 20-day SMA & 50-day SMA -, and (iii) the increasing ADX indicator.

• Thus, the stock could rise to challenge our resistance levels of RM0.39 (R1; 13% upside potential) and RM0.43 (R2; 25% upside potential).

• We have pegged our stop loss at RM0.31, which represents a downside risk of 10%.

• Business-wise, MESTRON is engaged in the pole business whereby the group offers various pole products such as street lighting pole, telecommunication monopole, traffic pole and many more.

• For its 1QFY22, the group’s revenue rose by 84% from RM11.6m in 1QFY21 to RM21.4m thanks to higher sales due to strong demand for standard poles and specialty poles for the telecommunication segment. Despite the jump in revenue, the group registered a lower core PATAMI of RM1.4m in 1QFY22 from RM1.5m in 1QFY21 (-8%) due to the group’s loss-making subsidiaries and fluctuations in the price of raw materials.

• Valuation-wise, based on its book value per share of RM0.10 as of end-March 2022, the stock is currently trading at a Price/Book Value multiple of 3.32x (or at 0.75SD above its 3-year historical mean).

Sunzen Biotect Bhd (Trading Buy)

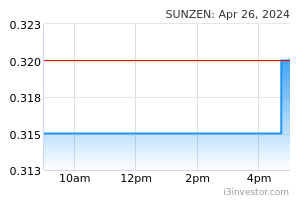

• Chart-wise, after a low of RM0.18 in November 2021, the stock climbed to a peak of RM0.31 (+72%) in February 2022 before sliding down to move in a consolidation.

• However, with the recent formation of a dragonfly doji the stock moved higher to close above the Keltner Channel’s mid-line which suggests a technical rebound is forthcoming.

• With the Parabolic SAR indicator shifting its direction to trend upwards, which coincides with the stock’s rebound and coupled with the rising MACD indicator, we believe that the stock will likely strengthen further to challenge our resistance levels of RM0.275 (R1; 12% upside potential) and RM0.305 (R2; 25% upside potential).

• On the downside, our stop loss price has been set at RM0.215, which translates to a downside risk of 12%.

• Business-wise, SUNZEN is engaged in the business of research and development of biotechnology and manufacturing and marketing of animal health products.

• For 1QFY22, the group registered a core PATAMI of RM0.7m, recovering from losses of RM0.2m in 1QFY21 as a result of higher earnings contributions from the traditional Chinese medicine (TCM) segment and money lending business.

• Valuation-wise, based on its book value per share of RM0.19 as of end-March 2022, the stock is currently trading at a Price/Book Value multiple of 1.26x (or at 0.5SD above its 3-year historical mean).

Source: Kenanga Research - 10 Jun 2022