Selangor Dredging Bhd (Trading Buy)

• SDRED is a proxy to climbing iron ore price, which has rebounded by 79% from a trough of USD80/t in mid-November last year to USD143/t currently (after previously falling from as high as USD239/t on 10 May 2021) as global output has been disrupted by the ongoing conflict between Ukraine and Russia, two key iron ore producers in the world.

• While the group’s main business focus is on property development activities in Malaysia and Singapore, it is also involved in the mining of iron ore (an essential ingredient for steel production) in Terengganu via 31%-owned Singapore-listed Fortress Minerals Ltd (FML) and the hospitality business (which owns the Maya Hotel in Kuala Lumpur).

• Interestingly, FML’s existing share price of SGD0.50 – which jumped 7.5% amid high trading interest yesterday to lift its cumulative gain to 33% since mid-November last year – implies a current market value of SGD250m (or c.RM780m) for FML. This means SDRED’s 31% stake in FML is now worth RM242m, which is more than its own entire market cap of RM230m.

• Earnings-wise, SDRED made net profit of RM9.8m in 9MFY22 (versus 9MFY21’s net loss of RM5.5m), driven mainly by earnings contributions from property sales in Singapore (RM19.0m) and the iron ore mining segment (RM17.2m). Prior to this, FML contributed RM23.7m in net profit in FY March 2021 amid the high iron ore prices during the period.

• In terms of valuation, based on its book value per share of RM2.01 as of end-December 2021, the shares are presently trading at a Price/Book Value multiple of 0.27x (or at 0.5 SD below its historical mean).

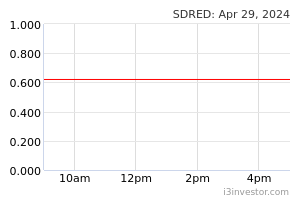

• From a technical perspective, following a price pullback from a peak of RM1.04 in May last year to RM0.54 on Monday, SDRED shares could swing higher ahead in view of a bullish stochastic divergence (which plotted rising bottoms while the share price was drifting listlessly) and the accelerating Parabolic SAR trend.

• An uptrend reversal will be forthcoming when the 50-day SMA crosses above the 100-day SMA, which in turn will probably lead the stock to reach our resistance targets of RM0.61 (R1; 13% upside potential) and RM0.68 (R2; 26% upside potential).

• We have pegged our stop loss price level at RM0.48 (representing an 11% downside risk).

OKA Corporation Bhd (Trading Buy)

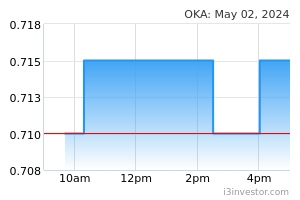

• OKA’s share price has been climbing since end-March 2020, charting higher lows along the way to plot an ascending trendline.

• The upward trajectory will likely extend based on the positive technical signals arising from: (i) a recent golden crossover by the 50-day SMA above the 100-day SMA, (ii) the accelerating trend in the Parabolic SAR, and (iii) the strengthening MACD signal.

• With that, the stock could advance towards our resistance thresholds of RM0.95 (R1; 13% upside potential) and RM1.03 (R2; 23% upside potential).

• Our stop loss price level is set at RM0.73 (or a 13% downside risk from Monday’s close of RM0.84).

• Fundamental-wise, OKA is involved in the manufacturing and sale of pre-cast concrete products and trading of ready-mixed concrete.

• For the quarter ended December 2021, the group made net profit of RM3.7m (-10% YoY), bringing 9MFY22’s bottomline to RM11.1m (+5% YoY) as its underlying performance was lifted mainly by lower operating expenses incurred.

• Financially sound, OKA’s debt-free balance sheet is backed by cash holdings of RM49.0m (translating to 20.0 sen per share or nearly a quarter of its current share price) as of end-December 2021.

Source: Kenanga Research - 20 Apr 2022