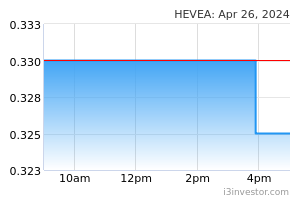

Heveaboard Bhd (Trading Buy)

• From a peak of RM0.815 in December 2020, HEVEA’s share price has formed lower lows and lower highs to trend downwards.

• However, following its rebound from a trough of RM0.42 in December 2021, the stock could be in the midst of a trend reversal after recently crossing above the mid-line of the Keltner Channel and the 50-day SMA (which previously acted as a resistance hurdle).

• The rising momentum is expected to persist following: (i) the DMI Plus trending above the DMI Minus, (ii) the 50-day SMA’s upward trend, and (iii) the stock hovering near the upper boundary of the Keltner Channel.

• With that, the stock could rise further to challenge our resistance levels of RM0.620 (R1; 12% upside potential) and RM0.675 (R2; 22% upside potential).

• We have pegged our stop loss at RM0.49, which represents a downside risk of 12%.

• Business-wise, the group is involved in the particleboard business focusing on the manufacturing, trading and distribution of a wide range of particleboard, ready-to-assemble (RTA) products and fungi cultivation.

• For FY21, the group’s revenue dropped by 5% YoY to RM370.9m in FY21 from RM388.6m in FY20 mainly due to a 15% drop in contribution from its RTA products segment as the Covid-19 lockdowns interrupted production. In line with the lower revenue and higher production costs, the group’s core net profit plunged from RM16.4m in FY20 to a core net loss of RM1.2m in FY21.

• Going forward, consensus is predicting the group to report a core net profit of RM26.8m in FY22 and RM34m in FY23 post the re-opening of the economy, which translate to forward PERs of 11.8x and 9.3x, respectively.

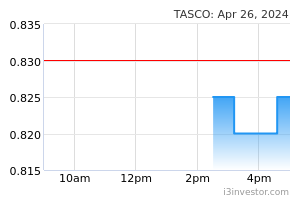

Tasco Bhd (Trading Buy)

• Chart-wise, after bottoming out in early March 2022 at RM0.925, TASCO’s share price has subsequently climbed 31% to close at RM1.21 yesterday.

• We believe the stock will likely strengthen further on the back of positive technical signals from: (i) the rising MACD histogram, (ii) the recent formation of a golden cross after the 20-day SMA crossed above the 50-day SMA, and (iii) the rising Parabolic SAR indicator.

• Thus, the stock could rise further and challenge our resistance levels of RM1.35 (R1; 12% upside potential) and RM1.45 (R2; 20% upside potential).

• On the downside, our stop loss price has been set at RM1.07, which translates to a downside risk of 12%.

• Business-wise, TASCO is a total logistics solutions provider. For its recent result, the group’s revenue rose by 63% from RM650.7m in 9MFY21 to RM1.1b in 9MFY22 thanks to higher contributions from the International Business Solutions segment (+116% YoY) and the Domestic Business Solutions segment (+102% YoY). In line with the higher revenue, the group’s core net profit rose by 62% to RM40.3m in 9MFY22 from RM24.9m in 9MFY21.

• Going forward, consensus is predicting the group to report a higher core net profit of RM63.8m in FY22 and RM67.4m in FY23, which translate to forward PERs of 15.3x and 14.4x, respectively.

Source: Kenanga Research - 14 Apr 2022