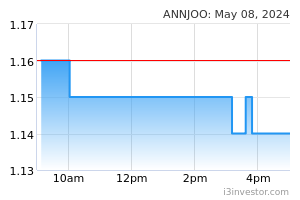

Ann Joo Resources Bhd (Trading Buy)

• After bouncing off from a recent low of RM1.64 in early March, which coincided with a previous trough in late December last year, a short-term trend reversal could be underway for ANNJOO shares.

• An extended climb by the share price may be on the horizon based on the bullish crossover by the DMI Plus above the DMI Minus and the strengthening MACD signal.

• With that, the stock could be on its way to challenge our resistance targets of RM2.09 (R1; 15% upside potential) and RM2.24 (R2; 23% upside potential).

• We have pegged our stop loss price level at RM1.56 (or a 14% downside risk).

• ANNJOO – which is primarily involved in the manufacturing and trading of steel and steel related products – registered net profit of RM16.5m (+166% YoY) in 4QFY21. This brought full-year’s net earnings to RM242.9m for FY21 (versus FY20’s net loss of RM100.0m).

• Following the buoyant results, the company declared a dividend payment of 6.0 sen per share (with ex-dividend date set on 28 April and payment date on 27 May), implying a dividend yield of 3.3%.

• Going forward, consensus is projecting that the group will make net profit of RM198.3m for FY December 2022 and RM180.3m for FY December 2023, which translate to forward PERs of 5.1x this year and 5.6x next year, respectively.

• The steady earnings expectations will likely be supported by an anticipated recovery in construction and property development activities post the Covid-19 pandemic as well as elevated selling prices.

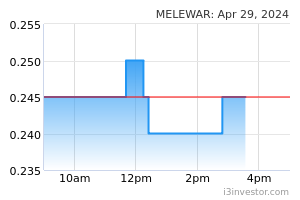

Melewar Industrial Group Bhd (Trading Buy)

• MELEWAR’s share price – which saw active trading before closing 10.3% higher yesterday – is poised to break away from a consolidation pattern that stretches back to early December last year.

• Riding on the strengthening momentum that is backed by: (i) the bullish crossover by the 50-day SMA above the 100-day SMA, (ii) the accelerating Parabolic SAR trend, and (iii) the DMI Plus overcoming the DMI Minus, an upward shift in the shares is now anticipated.

• On the way up, the stock could advance towards our resistance thresholds of RM0.50 (R1; 16% upside potential) and RM0.55 (R2; 28% upside potential).

• Our stop loss price level is set at RM0.36 (representing a 16% downside risk from its last traded price of RM0.43).

• Via its 74.1%-owned Mycron Steel (which is listed on Bursa Malaysia), MELEWAR is involved in the mid-stream segment of the steel industry, focusing mainly on the manufacturing of: (i) cold rolled coil steel sheets, and (ii) steel tubes & pipes. Its other businesses are in the supply of industrialised building system (IBS) to niche markets and the trading of food products.

• Profit-wise, the group posted net earnings of RM16.3m (+42% YoY) in 2QFY22, taking its 1HFY22’s bottomline to RM22.3m (+18% YoY).

• Forward earnings momentum will likely be underpinned by a pick-up in construction and property development activities post the Covid-19 pandemic as well as the lagged effect on margins amid rising steel prices.

• Based on its book value per share of RM1.09 as of end-December 2021, the stock is currently trading at a Price/Book Value multiple of 0.39x (or at 0.5 SD above its historical mean).

• Interestingly, following yesterday’s share price jump of 23.5% to RM0.605, Mycron Steel is now valued at a market cap of RM197.9m. This implies that MELEWAR’s 74.1% equity stake in Mycron Steel is currently worth RM146.6m, accounting for 95% of MELEWAR’s existing overall market cap of RM154.5m.

Source: Kenanga Research - 13 Apr 2022