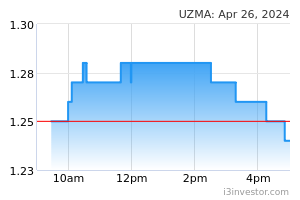

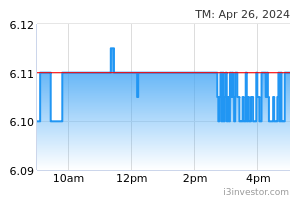

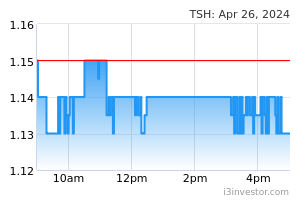

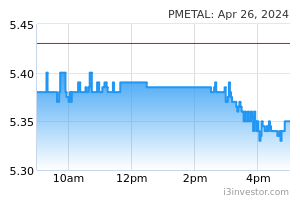

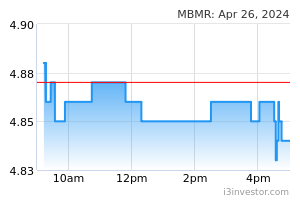

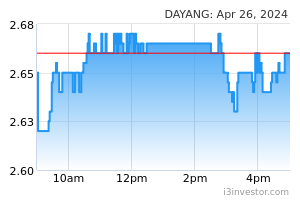

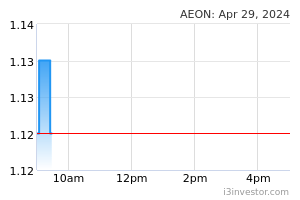

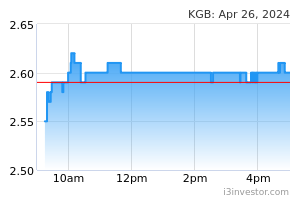

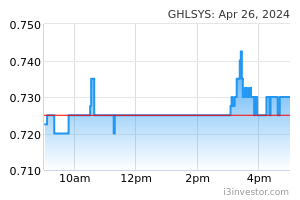

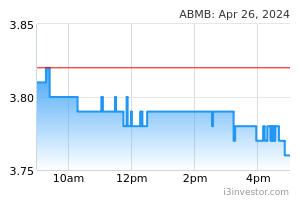

The just concluded 4QCY21 results season saw decent and stronger set of results, generally leading to slight earnings and target upgrades. Expectation-wise, out of the 129 stocks that reported results, 40 of them (31%) came in “above”, 55 (42.6%) “within”, and 34 (26.4%) “below”. Sector wise, underdogs like Automotive and Media sectors saw an overwhelming 2/3 of stock coverage surpassing expectations. The other three sectors that exhibited positive tone were Healthcare, Plantations and Banks. On the flipside, sectors leading the misses were Building Materials and Gaming. At the same time, Packaging and Property sectors experienced some headwinds as well. An earnings review led us to upgrade the FBMKLCI’s FY22E/FY23E earnings growth to - 0.3%/12.2% from -8.1%/11.2%. The big earnings upgrades came generally from Plantations as well Oil & Gas sectors. As such, we tweak our FBMKLCI Target slightly higher to 1,670 (from 1,654). Our Index Target implies a FY22E PER of 15.0x, which is not excessive in our view. Our revised Top Pick list comprise: ABMB (OP, TP: RM3.85), GHLSYS (OP, TP: RM1.90), KGB (OP, TP: RM1.90), PADINI (OP, TP: RM3.80), RHBBANK (OP, TP: RM6.70), AEON (OP, TP: RM1.70), DAYANG (OP, TP: RM1.00), MBMR (OP, TP: RM3.50), PMETAL (OP, TP: RM8.63), TSH (OP, TP: RM1.80), TM (OP, TP: RM7.00) and UZMA (OP, TP: RM0.68).

A stronger quarter. The just concluded 4QCY21 results season saw decent and stronger set of results, generally leading to slight earnings upgrades. Of the 134 stocks in our research universe, 129 of them have turned in their quarterly report cards, out of which 40 of them (31%) came in “above”, 55 (42.6%) “within”, and 34 (26.4%) “below”, our expectations. Compared to 3QCY21, 4QCY21 fared better in that the percentage of outperformers against our in house estimates is higher at 31% versus 27%, while the misses were less at 26% versus 37% previously.

Sector-wise, underdogs like Automotive and Media sectors saw an overwhelming 2/3 of stock coverage surpassing expectations. The other three sectors that exhibited positive tone were Healthcare, Plantations and Banks.

Automotive (NEUTRAL ↔): Results accelerated strongly, recovering from 3QCY21 lockdown quarter, and further boosted by year-end promotional sales. For 4QCY21 reporting season, almost all stocks under our coverage performed above expectation (DRBHCOM, MBMR, TCHONG, UMW), with only BAUTO and SIME coming in within expectation as we already had factored sufficient estimates in our earlier review reports. However, 1QCY22 is expected to drive slower on lower inventory and after the floods in December 2021 which disrupted certain suppliers’ operations.

Media (OVERWEIGHT ↔): Results were mainly above expectations with only ASTRO performing below expectations due to the continued high content costs airing major sporting events in 2QFY22 and 3QFY22, which affected EBITDA margin. As advertising expense is highly correlated to the health of the economy, the reopening of the economy in 4QCY22 resulted in the Omnia segment of MEDIA jumping 40% QoQ / 79% YoY whereas the Malaysian market of MEDIAC improved by 28% QoQ / 2.4% YoY. Going forward, we expect 1QCY22 to continue with the renewed optimism encouraging advertisers to increase adex alongside with the reopening of the economy. (in-house GDP growth expectations at 5.5%-6.0%).

Healthcare (NEUTRAL ↔): During the quarter, IHH and Pharmaniaga performed above expectations. IHH’s earnings came in above expectation due to better-than-expected performance in Acibadem alongside with stronger bottom-line performance in India. On the other hand, Pharmaniaga came in above expectation due to better-than expected volume sales. However, KPJ underperformed due to lower-than-expected number of patients and longer than-expected gestation periods for some of its new hospitals.

Plantations (NEUTRAL ↔): This is the best quarters for the plantation sector boosted by record CPO prices, as none of them disappointed and half of the stock universe under coverage exceeded forecasts. Looking ahead, we expect the plantation sector to enjoy another stellar quarter in 1QCY22 and increasingly for 2QCY22 as well.

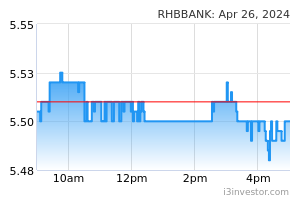

➢ Banks (OVERWEIGHT ↑): During this reporting season, 4 banks performed above expectations (ABMB, AFFIN, AMBAK, and HLBANK). We observed all banks demonstrating similar trends where they enjoyed loans growth mixed with higher sequential NIMs being the beneficiary of re-pricing of assets. As the economy continues to recover without disruption, demand for loans is expected to pick up and its growth may mitigate any NIM erosion from the ongoing competition of deposits. Most banks anticipate at least one OPR hike in 2HCY22 and this should translate to slight bump to annualised NIMs thereafter. We anticipate NOII to stabilise from the industry-wide decline in CY21 as we operate in a more normalised trading and investing landscape. Dividend payments are also mostly back to pre-Covid levels, indicating that soundness in capital management has recovered. Going forward, earnings surprises may be seen when the banks eventually write back their provisions and overlays.

On the flipside, sectors leading the misses were Building Materials and Gaming. At the same time, Packaging, Manufacturing and Property sectors experienced some headwinds as well. Other sectors’ performances were generally mixed. Nonetheless, with the strong commodities prices, sectors such as Oil & Gas may be worth monitoring.(Please refer to detailed sector commentaries in Appendix 2.)

➢ Oil & Gas (OVERWEIGHT↔): A largely improved results season this quarter, with most of the stocks within our sector coverage reporting results that were at least within expectations or better. Considering the geopolitical tension and shortage in supply, we have raised our 2022 average Brent crude oil price assumption to USD90/barrel (from USD65 previously). As such, activity levels are expected to recover in 2022. In fact, we have highlighted the offshore maintenance, construction and modification (MCM) and hook-up and commissioning (HUC) as beneficiaries given the planned increase in demand – benefitting contractors like DAYANG. Meanwhile, the high oil prices could also translate to more works for brownfield players such as UZMA, given the increased incentive for oil producers for increase production and well enhancements. PCHEM is also a good proxy for the high prices.

Raised earnings estimates and Index Target. Post the latest results season and coupled with analysts’ earnings revisions, our FBMKLCI FY22E/FY23E earnings growths are revised from -8.1%/11.2% to -0.3%/12.2%. The big upgrades came generally from Plantations as well Oil & Gas sectors. As such, we tweak our FBMKLCI Target slightly higher to 1,670 (from 1,654), implying an FY22E PER of 15.0x, which is not excessive in our view.

1QCY22 Top Picks Review. In line with the earnings and target price revisions post results, and coupled with recent stocks and commodities prices movement, we have reviewed our 1QCY22 Top Picks. After taking the aforementioned factors into consideration, we decided to take out some defensive names but to include some laggards and commodities price sensitive names.

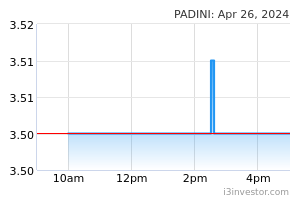

We continue to like ABMB (OP, TP: RM3.85), GHLSYS (OP, TP: RM1.90), KGB (OP, TP: RM1.90), PADINI (OP, TP: RM3.80) and RHBBANK (OP, TP: RM6.70).

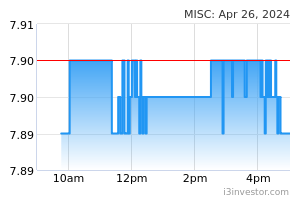

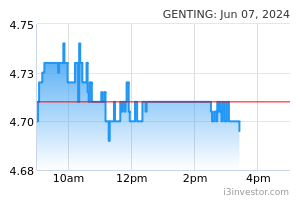

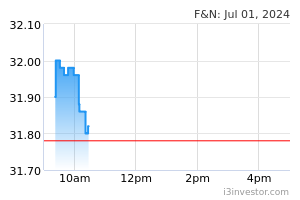

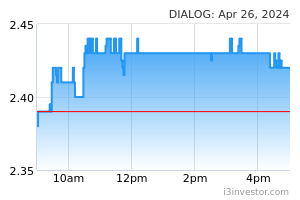

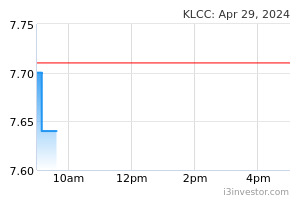

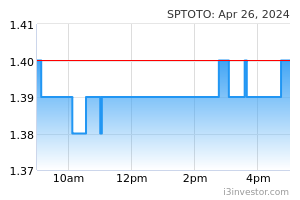

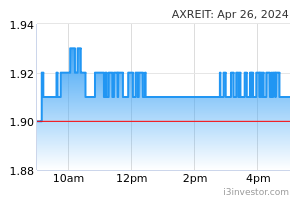

However, we have replaced AXREIT (OP, TP: RM2.05), BJTOTO (OP, TP: RM2.22), KLCC (OP, TP;RM7.35), DIALOG (OP, TP: RM3.30), F&N (OP, TP: RM34.25), GENTING (OP, TP: RM6.12), MISC (OP, TP: RM7.90) with AEON (OP, TP: RM1.70), DAYANG (OP, TP: RM1.00), MBMR (OP, TP: RM3.50), PMETAL (OP, TP: RM8.63), TSH (OP, TP: RM1.80), TM (OP, TP: RM7.00) and UZMA (OP, TP: RM0.68).

Source: Kenanga Research - 3 Mar 2022