Results

- Meeting expectations– LBS Bina Group (LBS) performed within our estimates, accounting for 96.2%/98.5% of our total full-year net profit and revenue forecast. QoQ wise has experienced a decline due to overall lower revenue recorded while margins remain firm, revenue in 4Q22 was -29.5% QoQ and -15.6% YoY.

- Record Year for LBS – The Group has recorded an impressive revenue growth of 26.1% YoY (FY22: RM1.7b) which helped them achieve their highest revenue in a year to date due to repeated strong demand for their existing properties. This revenue growth has also supported the Group’s downline to increase by 32.8% YoY (FY22: RM126.3m) in core earnings. Margins however took a slight beating with EBIT (-1.8% YoY) and PBT (-1.1% YoY).

- Outperforming sales during tough times – LBS has exceptionally attained RM2b in property sales in FY22 with bookings on hand worth RM195m as of Feb 14, which surpassed 26.9% of its previous year’s sales target of RM1.6b. In 2022, the sales contribution from Klang Valley projects takes the biggest pie at 90%, followed by Pahang (5%), Johor (3%), and Perak (2%). The Group has set an identical sales target of RM2b for FY23 and so far achieved 5% of that target as of Feb 14. Unbilled sales have also achieved a record high of RM2.5b which is an improvement of 6.7% YoY which paves the way for clear earnings visibility for the next two to three years.

- 12 New Projects Launches for 2023 – In order to support the goal of hitting RM2b in sales once again, the Group has prepared 12 project planned launches in 2023 with a total GDV of RM2.1b with most of the projects planned to be launched in 2Q23, ongoing developments have a GDV of RM5.7b with an 80% take-up rate. The planned projects such as KITA@Cybersouth, Bayu Hills Genting, and Zenit Molek takes up more than RM1.3b of the total planned GDV combined. We remain positive about the outcome of these launches while we continue to observe the behaviour of the market.

- Non-core businesses to offset growth. Other revenue segments such as management and investment, and motor racing circuit may continue to drag the Group’s top and bottom line and we continue to observe that these segment’s losses may grow further. On the bright side, the hotel business is on the way to profit to capitalise on the improving demand for domestic tourism and the reopening of international borders.

Earnings Outlook/Revision

- Forecast lifted – We are raising our revenue and EPS forecasts for FY23 by 18.1% and 3.5% respectively while estimates for FY24 are 7.2% and 8.0% higher respectively from FY23 after increasing our progress billings on current projects and upcoming launches in FY23.

Valuation & Recommendation

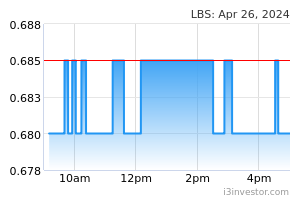

- Maintain BUY with a lower target price of RM0.61 (from RM0.62) following our adjustments. Our revised target price is pegged at a 7.0x PE (previously 8.5x PE) multiple to the Group’s 2023F diluted EPS which is the -1 Standard Deviation of its 5-year historical mean PE due to our overall less rosy outlook of the sector caused by higher interest rates which could dampen demand.

Source: JF Apex Securities Research - 22 Feb 2023