SPToto reported 2QFY23 core PATAMI of RM56.7m, bringing 1HFY23’s sum to RM130.9m (+1.7x YoY). The results were within ours but above consensus expectation. The group’s NFO segment continued to show steady performance, while its vehicle dealership segment recorded a softer performance this quarter due to (i) a temporary sales gap as customers await for new car model launches in upcoming quarters; (ii) rising interest cost; and (iii) rising operating cost from increase in wages. Maintain forecasts and our BUY call with TP RM2.27 based on DCF valuation with WACC of 9% and TG of 1.5%. The stock currently provides an attractive projected dividend yield of 9.3% for FY23.

Within ours but above consensus. SPToto reported 2QFY23 core net profit of RM56.7m (-23.5% QoQ; -5.9% YoY) which brought 1HFY23’s sum to RM130.9m (+1.7x YoY). The results were within ours (50.7%) but above consensus (57%) full year forecast. 1HFY23 core PATAMI was arrived at after excluding net EIs of +RM5.4m mainly from FV gain on investments (+RM13.4m) and provision for inventories write-down (-RM4.9m).

Dividend. 2.5 sen, ex-date: 4 Apr 2023 (2QFY22: 1 sen). 1HFY23: 4.5 sen (1HFY22: 2 sen).

QoQ. Revenue was flat at -0.8% (NFO: +7.9%; vehicle dealership: -10.1%). NFO revenue increased due to (i) higher number of draws (48 draws vs. 46 draws in 1QFY23); and (ii) higher accumulated jackpot prizes. The lower revenue from vehicle dealership was due to (i) delay in some of the car models supply; and (ii) lower sales as customers await new car model launches in coming quarters. Core PATAMI declined by -9.3% due to (i) higher prize payout from NFO; and (ii) lower sales from vehicle dealership segment.

YoY. Revenue increased by +13.1% (NFO: +28.4%; vehicle dealership: -2.6%). NFO revenue increase was due to softer sales SPLY during the initial resumption of operations after a long period of operations shutdown (3.5 months). Revenue decline in vehicle dealership was due to weaker GBP compared to SPLY. This segment however recorded a pre-tax loss of -RM0.8m (vs. RM14.9m SPLY) as a result of (i) higher operating cost due to inflationary pressure; (ii) higher finance cost due to interest rate hike; and (iii) lower profit margin in the used car segment compared to SPLY as there was a supply shortage in previous year which driven up selling price. Consequently, core PATAMI declined by -5.9% mainly dragged by the vehicle dealership segment.

YTD. Revenue increased by +38.4% (NFO: +1.2x; vehicle dealership: -2.4%). NFO improvement was due to low base effect from operation shutdown of 2.5 months in SPLY. Vehicle dealership revenue decline was due to weaker GBP compared to SPLY. The segment recorded a wider pre-tax profit decline of 72.8% to RM10.9m due to the same reasons as highlighted in the YoY paragraph above. Subsequently, core PATAMI increased by +1.7x due to the improvement in NFO segment which more than offset the decline from vehicle dealership.

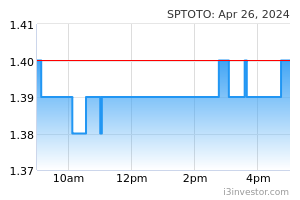

Outlook. The group’s NFO segment continued to show steady performance, while its vehicle dealership segment recorded a softer quarter due to (i) a temporary sales gap as customers await for new car model launches in upcoming quarters; (ii) rising interest cost; and (iii) rising operating cost from increase in wages. The stock witnessed recent share price weakness dampened by the negative sentiment following several developments including (i) reduction in special draws for 2023 to eight (vs. 22 in 2022); and (ii) ban of NFOs in Kedah. We reiterate our view that the reduction in special draws have minimal earnings impact given that compared to normal draws, special draws have lower sales and margin. On the ban of Kedah NFOs, we highlight that while the business licenses for the Kedah NFOs were not renewed, its gaming licenses however were renewed and as such, SPToto should be able to relocate its Kedah outlets to more strategic locations in other states subject to MoF approval. Upcoming key events to look out for include (i) Budget 2023 to be re tabled on 24 Feb; and (ii) the impending six state elections.

Forecast. Unchanged.

Maintain BUY, TP: RM2.27 based on DCF valuation with WACC of 9% and TG of 1.5%. While we are wary of the downside risks and sentiment surrounding the stock as highlighted above, we nonetheless continue to see value in the stock. The group’s NFO business should continue to provide stable cash flow for the group, while its luxury car dealership segment should drive the growth for the group moving forward. The stock currently provides an attractive projected dividend yield of 9.3% for FY23.

Source: Hong Leong Investment Bank Research - 22 Feb 2023