2023 TIV started at a slow pace of only 49.5k units for Jan (-34.0% MoM) due to lower inventory available during the period (post accelerated deliveries in Dec 2022) and current shorter working month. The growth +17.4% YoY was due to low base effect resulted from supply chain disruption SPLY. Note that Jan 2023 statistics lacks data from BMW, Mini and Mercedes for proper comparison. We maintain our 2023 TIV expectation at 630.0k units (-12.6% YoY) at current juncture, as we expect pent up deliveries toward 2Q23, driven by the high order backlogs of over 300k units, but slowdown in 2H23. We reaffirm our NEUTRAL call on the automotive sector with top picks: DRB (BUY; RM2.24) and MBMR (BUY; TP: RM5.00).

Malaysian Automotive Association (MAA) reported a slow start to the year 2023 at only 49.5k units, a MoM drop -34.0%, attributed to the accelerated deliveries in Dec 2022 (resulting to lower inventory for Jan 2022) and lower working days during the month (due to CNY festive period). Nevertheless, it was still a growth of +17.4% YoY due to low base effect as SPLY was affected by flood in Shah Alam and supply chain shortage. At current juncture, we are maintaining our TIV expectation of 630k units for 2023, a drop of -12.6% YoY, as we expect slower sales towards 2H23 as OEMs fulfil the huge pent-up orders in 1H23.

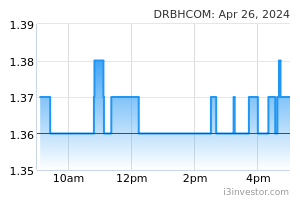

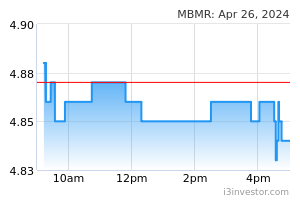

Despite the expected strong TIV until mid-2023, we still maintain our NEUTRAL rating on the sector, as we expect TIV to drop post the fulfilment of the current huge backlog orders of 300k units. Nevertheless, we advise investors to accumulate MBMR (BUY; TP: RM5.00) and DRB (BUY; TP: RM2.24), as we expect national OEMs to triumph over the longer term with potential growth from new export markets.

Note that no data was provided for the following:

1) Monthly sales for BMW, Mini and Mercedes for Jan 2023.

2) Monthly sales for Kia and Peugeot for Jan 2022 to Jan 2023.

Perodua (UMW and MBMR) recorded sales of 21.4k units (-31.3% MoM; +23.0% YoY), with a market share of 43.4% in Jan 2023. Management has recently revealed its 2023 sales target at 314.0k units, indicating a targeted growth of +11.3% YoY, after achieving a record high of 282.0k units in 2022. The high target is backed by healthy order backlogs of 220k units and increase in planned production for the year to 330.0k units (vs. 289.1k units in 2022). Perodua has recently launched all new Axia replacement model for RM38.6-49.5k in mid-Feb with over 20.1k bookings recorded. We expect another 2 models update for 2023. Management also guided a new leasing business program to be introduced during the year after getting positive feedbacks from Ativa HEV leasing program. However, a new HEV will only be introduced in 2024, likely to be a variant of the new Bezza model.

Proton (DRB) recorded sales of 11.5k units, -19.9% MoM, mainly due to accelerated deliveries in prior month. The growth of +166.6% YoY was driven by supply chain shortage caused by the floods SPLY. Including export volume, it was 11.7k units (-20.8% MoM; +162.3% YoY). While there is no official sales target for 2023 being announced, Proton deputy CEO Roslan Abdullah is confident of another year of growth for Proton in 2023 after achieving 141.4k units in 2022 (including export volume), indicating a growth of +23.3% YoY, banking on continued strong domestic demand, new launches and new export markets. Proton is expected to launch a new large X90 SUV with potential option of mild hybrid variant (MHEV) in 2023. Management has guided Proton to only launch its own EV model by 2027, while at the mean time it will be introducing MHEV and PHEV variants during the transitioning period.

Toyota (UMW) registered sales of 6.8k units (-34.7% MoM; -9.9% YoY) in Jan 2023 which underperformed the market trend, mainly due to accelerated deliveries in prior month and shorter current working month. While there is no official 2023 sales target being revealed yet, management has guided sales will likely to sustain in 2023 driven by high order backlogs of 50k units and new models launch, after achieving a high of 100.0k units in 2022. Toyota has recently launched GR variants for 5 existing models, while management has guided 5 new models launches in 2023.

Honda (DRB) registered sales of 3.5k units (-54.9% MoM; -10.0% YoY), similar to Toyota. Recent Honda sales CNY campaign indicates no more carry over inventory from 2022 and is only available for limited models – City, City Hatchback and Accord – with minor discounted offer. We expect Honda to launch new replacement model for CR-V and BR-V and all new Z-RV in 2023.

Nissan (TCM) sales remained disappointing in Jan 2023, at only 0.7k units (-33.7% MoM; -40.3% YoY), mainly due to lack of attractive models and stiff market competition. Nissan is expected to maintain its strategy to avoid stiff pricing competition, while leveraging onto its core models: Almera, Serena and Navara. On a hopeful side, we expect Nissan to introduce new models for X-Trail and Kicks in 2023 to boost sales volume.

Mazda (BAuto) recorded 1.2k units (-29.8 MoM; +43.6% YoY), sustaining above Nissan for consecutive past 6 months. Mazda’s order backlogs remain healthy at 8-9k units. Mazda is expected to launch its new CX-30 CKD in 2023, which will likely to sustain the marque’s sales volume.

Source: Hong Leong Investment Bank Research - 21 Feb 2023