REIT’s FY22 results saw earnings jump 31.2% YoY, primarily led by retail and industrial REITs. Overall, there were 6 results within estimates and 2 below. Looking ahead, we believe retail’s bottom line still has legs to go due to promising rental reversion outlook and sustained footfall supported by foreign tourists arrival. Similarly, industrial REIT remainsfavourable given broadening expansion and acquisitions plans. Whereas, the office market will continue to be flooded by new supplies, which aggravates the glut in Klang Valley. We adjust our MAG10YR yield assumption to 4.0% (from 4.5%) and rollover the yield spread input for respective REITs. Maintain our NEUTRAL stance on the REIT sector, with top picks Axis REIT, Sunway REIT and Pavilion REIT.

4Q22 results mostly inline. Sector results were largely inline with 6 out of 8 REITs under our coverage delivered core net profit that met our forecasts (Axis REIT, IGB REIT, KLCC REIT, Pavilion REIT, Sunway REIT and UOA REIT) while the remaining 2 were below (IGB Commercial REIT – dragged by continued rising opex and Sentral REIT – hampered by lower rental revenue and higher finance costs).

Dividends. Referring to Figure#2, dividends declarded by retail REITs (IGB REIT, Sunway REIT, Pavilion REIT) staged a remarkable recovery for CY22. Meanwhile, dividends from industrial REIT (Axis REIT) grew steadily at 3%. Save for IGBCR (with only 6 months accounted for CY21), the rest of the office REITs had mixed divvy showing, ranging from -8% to +13%.

Retail still have legs to go. Retail malls experienced upsurge in footfall and retail sales as well as significant decline in rental assistance, which contributed to retail REITs’ stellar showing. We believe retail still has room to grow on the back of anticipated positive mid-single digit rental reversion for prime shopping malls (guided by managments), sustained elevated footfall supported by foreign tourists given the reopening of international borders (especially malls that have meaningful exposure to foreign tourists pre-pandenmic, i.e. Pavilion KL and Suria KLCC). Also, the return of Chinese patronage is set to support retail performance while cushioning some downside risks arising from economic slowdown from the West.

Dismal showing for office. As the office market is grappling with pressured rental and occupancy rates amid growing supplies of office space which is outpacing its demand, pure office REITs (Sentral REIT, IGBCR, UOA REIT) logged muted performance in FY22 (Figure #1). We expect the ordeals to persist given the high impending office supply (5.1m sqft) expected in 2023, that is on top of 113.9m sf cumulative office space as at 2H22 in Klang Valley (Knight Frank Research). As such, rental reversions will likely be in the negative territory due to intense competition with the completions of multiple new Grade A office buildings, in our view.

Execution year ahead for Axis REIT. A proxy to industrial assets, Axis REIT continued its steady growth, stemming from contribution of newly acquired properties and positive rental reversion in FY22. Major enhancement works for Axis Facility 2@Bukit Raja and Bukit Raja Distribution Centre 2 are slated for completion and ready for tenancy in 1Q23 and 3Q23 with improved rental rates. Management has also embarked on the phase 2 development of Axis Mega Distribution Centre with an estimate RM130m construction cost to be completed in 1Q24. Coupled with the RM120m acquisition targets in 2023, we think this year will be another growth year for the REIT when these expansion plans come into fruition.

Tail end of OPR upcycle. Following the unexpected pause of OPR hike in Jan-23 MPC meeting, our economics team anticipates BNM to raise OPR by 25bps in 2023 to bring the policy rate to 3.00% from 2.75% as headline and core inflation are projected to moderate over the course of the year. In light of that, we think the OPR is at the tail end of its upcycle with limited room for rate increases moving forward. To note, there were 4x25bps hikes in 2022 vs the forecasted 1x25bps hike in 2023. We believe the costs of debt for REITs will remain elevated, at least in 2023 given the full year impact of past rate hikes will be felt this year, especially for REITs who have relatively high composition of floating rate debts such as Axis REIT (53%), Sunway REIT (69%), Pavilion REIT (65%), Sentral REIT (66%). However, upside for finance costs should be capped moving forward, not to mention the fact the previous rate hikes did not materially dent their bottom line. Also, increasing the composition of fixed rate loans at the height of the upcycle, in our view, is not ideal.

Back to equilibrium. With the interest rate upcycle nearing its end, the MAG10YR yield has dropped substantially from the peak of 4.6% at end-Oct 2022 to 3.8% at early-Feb 2023. In tandem, the yield spread between MAG10YR and our REITs coverage has returned to its 5-year mean at c.170bps (from 80bps at mid-May). We believe the MAG10YR yield should hover at current level as future rate hike have largely been priced in. In view of the decreasing MAG10YR yield (now trading at 3.8%), we adjust our assumption to 4.0% (from 4.5%) for all REITs under our coverage and rollover the 5-year average yield spread input for respective REITs to end-2022. New TPs are shown in Figure#8.

Maintain NEUTRAL. There are some positives to be excited about for the sector: (i) OPR approaching the end of its upcyle, (ii) positive earnings and divvy outlook of prime retail owners supported by the return of foreign tourists (i.e mainland Chinese), (iii) gradual revival of tourism sector to lift hospitality assets and (iv) sustained demand for industrial assets despite external headwinds. That said, the risk and reward profile of the REIT sector is reasonably balanced at this juncture as we opine these positives have been largely priced in, as reflected by their recent run up of KLREI index. As a result, the yield spread between REITs and MAG10YR yield has swiftly returned to its 5-year mean from +1SD in end-2022, capping upside for the sector. On balance, we maintain NEUTRAL rating on REIT sector rating while being selective on asset classes that benefit from the tailwinds aforementioned.

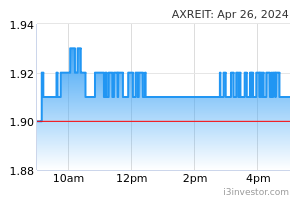

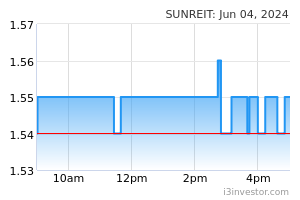

We advise investors to be exercise extra caution on office REITs as office owners are grappling with dwindling occupancy and rental rates due to the oversupply woes. Meanwhile, we are sanguine on Sunway REIT (TP:RM1.68) due to its strategically located prime malls, hospitality assets to ride on the revival of tourism sector as well as diversified exposure to various asset classes. We also favour Pavilion REIT (TP: RM1.47) for Pavilion KL’s promising rental reversion outlook and sizable foreign tourists footfall. We also like Axis REIT (TP: RM2.23) for its robust track record, occupant tenancy in its diversified portfolio and broadening expansion and acquisition pipeline.

Source: Hong Leong Investment Bank Research - 15 Feb 2023