MARKET REVIEW

Asia/US. Tracking Wall Street's rally last Friday, Asian markets ended higher as investors welcomed the end of China's strict zero-Covid policy and the PBOC's optimistic remark that the country's economic growth would quickly rebound and return to its "normal" path as the government provided more financial assistance to households and private companies to help them recover from the Covid-induced slump. Lifted by slower US consumer inflation expectations for Dec to a 17M low at 5%, the Dow rose as much as 305 pts before falling - 113 pts to 33,517 following hawkish comments from two Fed officials, Raphael Bostic and Mary Daly, that interest rates should remain above 5% for some time to tame inflation. Meanwhile, investors are looking forward to Powell's upcoming speech (10 January) as well as the US December CPI print (12 Jan) for clues on the Fed's future course of action.

Malaysia. The KLCI rose 12.9 pts to 1,493.4, a tad above the 200D MA, alongside higher regional markets and expectations that Sabah's political turmoil would be resolved soon. Market breadth (gainers/losers ratio) jumped to 1.56 from 0.85 last Friday, while trading value soared 19% to RM1.92bn. Local institutions turned net buyers (RM51m, Jan: - RM73m) after net selling RM143m in three days, while local retailers (-RM46m, Jan: +RM5m) and foreign investors (-RM5m, Jan: +RM68m) emerged as net sellers on equities.

TECHNICAL OUTLOOK: KLCI

With KLCI still holding up above the uptrend channel, we reaffirm our view that the index’s near-term uptrend may continue. A successful close above 1,492 (or the 200 D MA) will lift the index higher towards 1,512–1,528 levels. Conversely, a decisive break below the support trend line near 1,470 now would set off a fall towards the 1,436–1,454 zones.

MARKET OUTLOOK

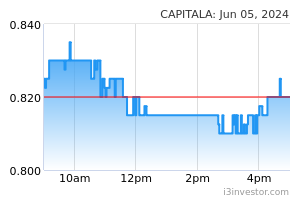

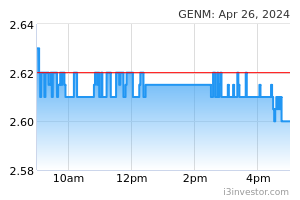

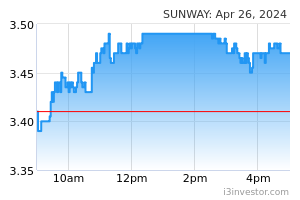

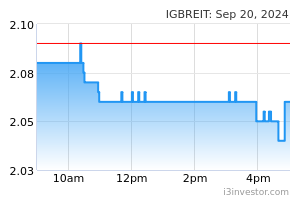

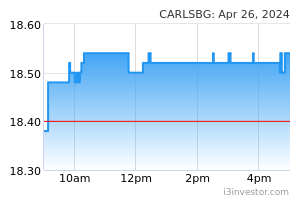

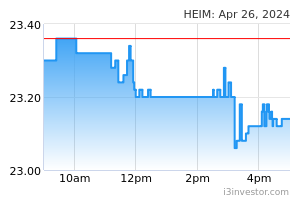

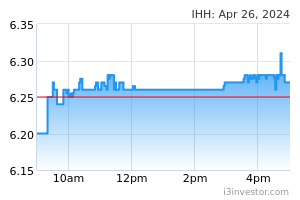

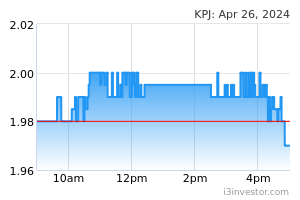

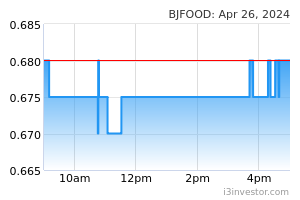

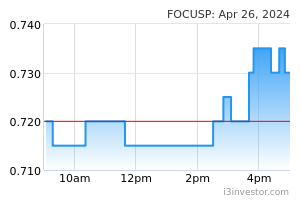

Barring a decisive break below the support trendline from the 2Y low of 1,373, we remain optimistic that the KLCI will post back-to-back gains in January (resistance: 1,512-1,528), supported by the benchmark's undemanding CY2023 valuation (12.4x P/E vs 10Y mean 17x), low foreign shareholding (Nov 2022: 20.7% vs all-time low of 20.1% in Aug), and more investors returning from year-end holidays. Given China’s border reopening on 8 Jan, we remain positive on tourism-related beneficiaries such as AIRPORT, CAPITALA, GENM, SUNWAY, IGBREIT, CARLBRG, HEIM, IHH, KPJ, BJFOOD and FOCUSP. Key events to watch in Jan: (1) FOMC meetings (31 Jan-1 Feb); (2) BNM OPR decision (19 Jan); (3) UMNO general assembly (11-14 Jan); and (4) the US 4Q22 results season (starting this Friday from US major banks).

Source: Hong Leong Investment Bank Research - 10 Jan 2023