In Dec 2022, EU set up the Carbon Border Adjustment Mechanism (CBAM), which impose s a carbon tax to selected imported goods and is expected to take effect from 2026 onwards. According to a study from Commonwealth Secretariat, Malaysia exported USD769m of CBAM -related products to the EU in 2019, mainly for iron, steel and aluminium products. Local producers are expected to be hit either directly by the tax or indirectly through expected increased competition from trade diversion. We believe that while PMETAL (HOLD; TP: RM4.54) has a sizeable export to the EU and thus will inevitably be impacted by CBAM once implemented, it is nonetheless still relatively better positioned compared to its regional or global peers due to its low-carbon aluminium production process from its hydro-powered smelters.

EU introducing cross border carbon tax. In Dec 2022, EU reached a historic deal to set up the Carbon Border Adjustment Mechanism (CBAM), which imposes a carbon tax to selected imported goods. The price of the carbon tax imposed will mirror the carbon tax of the same goods in the EU Emission Trading Scheme (ETS). If the imported goods have paid a carbon price in another country, then the corresponding cost can be used to offset from the CBAM carbon tax. Currently, the goods proposed to be in the scope of the CBAM include iron and steel, cement, fe rtilizers, aluminium, electricity and hydrogen.

Timeline and rationale of CBAM. EU importers will start to collect and report embedded emissions in the CBAM products they import starting from 1 Oct 2023, while the carbon tax on imported CBAM products is expected to be implemented from 2026 onwards. This measure aims to level the playing field and protect EU’s carbon intensive industries which are forced to comply with the region’s increasingly stringent carbon rules. In addition, this will also prevent carbon leakage where companies in EU move their production base to a country with less stringent carbon policies.

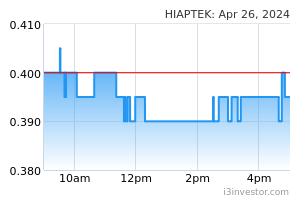

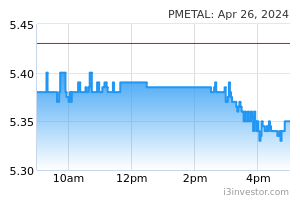

Implications to Malaysia. EU is Malaysia’s third largest trading partner comprising around 9.5% of Malaysia’s total trade in 2019 (pre-pandemic). According to a study from Commonwealth Secretariat, Malaysia exported USD769m of CBAM-related products to the EU in 2019, which is equivalent to c.3.5% of its USD22.1bn total export value. The composition of the exported CBAM-related products to the EU are: iron and steel (73.4%), aluminium (23.5%), fertilizers (1.9%) and cement (1.2%). Consequently, local exporters of these products to EU are expected to be hit by the CBAM in 2026. Under our coverage, steel maker HIAPTEK (BUY; TP: RM0.33) does not export its products to the EU, while aluminium producer PMETAL (HOLD; TP: RM4.54) exports an estimated 30% of its products to the region.

Possible trade diversion to regional market. Depending on the carbon price differential between the non-EU producers and EU, it may become cost-inefficient or unfeasible to export to the latter. As such, we reckon some of these non-EU producers may try to progressively divert some of their exports to other regions with lower or no cross border carbon tax. For example, China exports 3.2m tonnes or 4.8% of its steel products to the EU and UK region in 2021. For reference, China’s carbon price was USD8.2 per tonne on 6 Jan 2023 while EU carbon price was USD79.9 per tonne on the same date, indicating a steep price differential between the two regions.

Stickiness in supply. Having said that, we understand that for both steel and aluminium markets, there is some stickiness in the supply by producers to the different regions and consequently there will be some challenges in diverting the trades. For aluminium, this is due to (i) the modest growth in aluminium demand resulting in low absorption rate; and (ii) supply contracts to customers are typically locked in for many years. As for steel, this is due to logistical challenges as a result of the different distance and freight charges which impact the carbon footprint and cost of the products.

Introduction of VCM timely. Given this development, we view Bursa’s introduction of the Voluntary Carbon Market (VCM) to be timely as this allows market to put a price on carbon emissions. The price would serve as a benchmark for corporates to develop an internal carbon pricing mechanism to start considering and internalizing the cost of carbon in their businesses. Subsequently, when a compliance carbon pricing mechanism (either carbon tax or ETS) is introduced, the carbon price paid locally can be used to partially offset carbon tax paid under CBAM, thus mitigating its impact.

More countries may follow suit. We expect the EU CBAM will serve as a precedent and precursor for more regions to follow suit in implementing cross border carbon tax. Malaysia is a net exporting country with the value of its exports and total trade as a percentage of GDP at 68.8% and 130.6% in 2021, respectively. Given our country’s status as a trading nation, local exporters in the carbon intensive sectors are thus, vulnerable to the impact of the tax. Separately, given Malaysia’s policy direction is indicating a move towards introducing a carbon pricing mechanism, this will also create disincentive for FDIs from carbon intensive manufacturers to relocate their production bases to Malaysia.

Preparing for CBAM and carbon pricing. While CBAM is only expected to be implemented a few years down the road, we nonetheless note the steep carbon price differential between EU and Malaysia (carbon price is nil for Malaysia due to absence of carbon market). If corporates do not progressively internalize this cost in their operations, this will create a shock to operating costs once the tax kicks in. The operating environment is expected to become more competitive for local producers in the carbon intensive segment given (i) rising cost from both the cross border carbon tax as well as the impending local carbon pricing mechanism; and (ii) an expected increase in regional supply of steel and aluminium products as a result of trade diversion. We believe that while PMETAL (HOLD; TP: RM4.54) has a sizeable export to the EU and thus will inevitably be impacted by CBAM once implemented. Nonetheless, it is still relatively better positioned compared to its regional and global peers due to its low-carbon aluminium production process from its hydro-powered smelters.

Source: Hong Leong Investment Bank Research - 10 Jan 2023